Short Terms Credit

Purpose

The Short Term Credit Request feature in our system provides businesses with the ability to extend temporary credit to customers for specific transactions. This feature is used when a customer needs a short-term increase in their credit limit, allowing them to complete transactions without affecting their long-term credit line. It ensures smooth business operations by offering a flexible solution to manage temporary financial requirements, particularly for customers who may face short-term liquidity issues or need additional credit for larger purchases. This functionality enhances customer service and allows businesses to maintain sales continuity while managing credit risk effectively.

Navigation Path

To access the Short Term Credit Request feature in the system, follow these steps:

- Navigate to the Sales Module

- On the main menu, locate and click on the Sales module, which handles all sales-related activities.

- Access the Payment Section:

- Under the Sales module, find and select the Payment section. This section includes all functionalities related to managing customer payments, including credit requests.

- Select Short Term Credit Request:

- Within the Payment section, click on Short Term Credit Request. This will take you to the page where you can view, create, and manage short-term credit requests for customers.

Listing

Users can view a list of all short term credit requests added in the system. The listing provides detailed information about each request.

The Short Term Credit Request Listing displays the following details:

- Request Code: A unique identifier assigned to each credit request for tracking purposes.

- Customer: The name of the customer requesting the short-term credit.

- Short Term Credit Amount: The temporary credit limit being requested by the customer.

- Added By: The name of the user who created the short-term credit request.

- Add Date: The date the credit request was created.

- Modify Date: The date the credit request was last updated, if applicable.

- Status: The current status of the credit request (e.g., Pending, Approved, Declined).

- Action (Approve/Decline): The action that can be taken on the request, allowing the user to approve or decline the credit request.

When a user clicks on any short-term credit in the listing, a side drawer opens with an option for More Details. Clicking on More Details displays a detailed page showing an overall summary of that short-term credit.

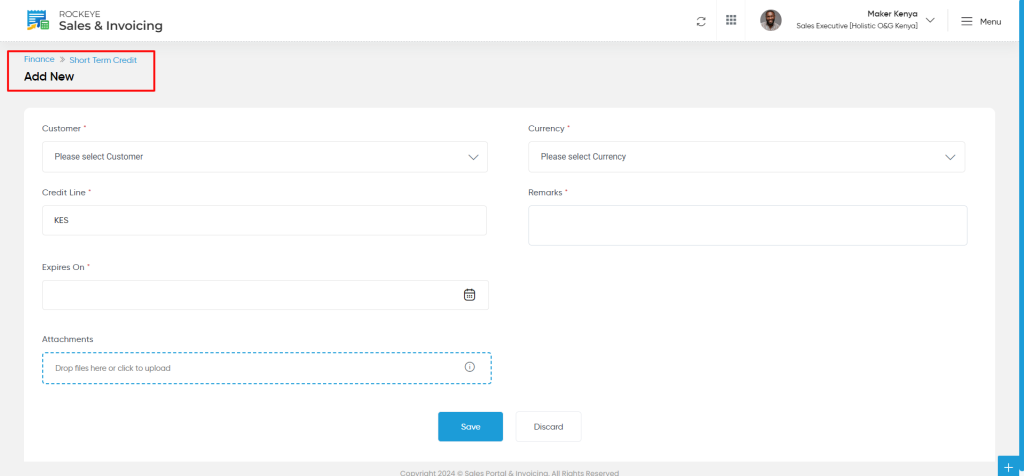

Add/Edit

Add/Edit(The Sale Executive will be able to add the Short term credit request)

When adding or editing a short term credit request, users need to input the following information:

- Customer (Required)

- Select the customer for whom the short term credit request needs to be assigned.

- Currency (Required)

- Select the currency from the dropdown list.

- Credit Line Amount (Required)

- Specify the amount of credit being requested for short-term use.

- Expires On(Required) :

- Select the date on which the short term credit will get expire

- Remarks

- Additional notes or comments related to the request.

- Attachments

- Upload any relevant documents supporting the credit request.

Actions:

- Save as Draft: Allows users to save the Short Credit for later editing.

- Submit: Finalize and submit the short term credit for processing.

- Discard: Discard the current entry.

Once the details are added this Short Term Credit will be viewed in the listing page.