Payment Transactions

Purpose

The Payment Transaction Listing provides a comprehensive overview of all payment transactions processed within the system. Users can easily access and manage transaction details, facilitating effective tracking and reconciliation of payments. This listing ensures that users have complete visibility of each transaction’s status and helps streamline financial reporting.

In our system, the Payment Transaction Summary offers a quick and detailed view of transaction activity, including a total count of all transactions. It categorizes transactions into approved, pending, canceled, or failed statuses, enabling efficient monitoring and management of payment processes. This helps users maintain a smooth workflow and ensures that payment status is updated in real time, aiding in faster decision-making and transaction processing.

Dependency

The Payment Transaction dependent on several key components in the system to ensure accurate and effective tracking of payment activities. These dependencies include:

- Sales and Invoicing Module: The transactions are linked to invoices and sales orders processed in the system. This ensures that payments are accurately associated with specific sales transactions.

- User Roles and Permissions: Access to payment transactions and their details is controlled by the user roles and permissions set within the system. Only authorized users, such as finance or accounting teams, can view or manage payment transactions.

- Account Management System: The payment transactions are linked to the company’s financial accounts and general ledger (GL) accounts. Proper mapping is required to ensure the transactions are reflected in the correct financial accounts.

- Payment Methods and Gateways: The system supports different payment methods (credit card, bank transfer, etc.) and gateways, which may affect how transactions are processed, tracked, and reported.

- Transaction Validation Rules: Payment transactions may be subject to validation rules to ensure they meet the required criteria for approval, which could include checks for duplicates, errors, or compliance with payment terms.

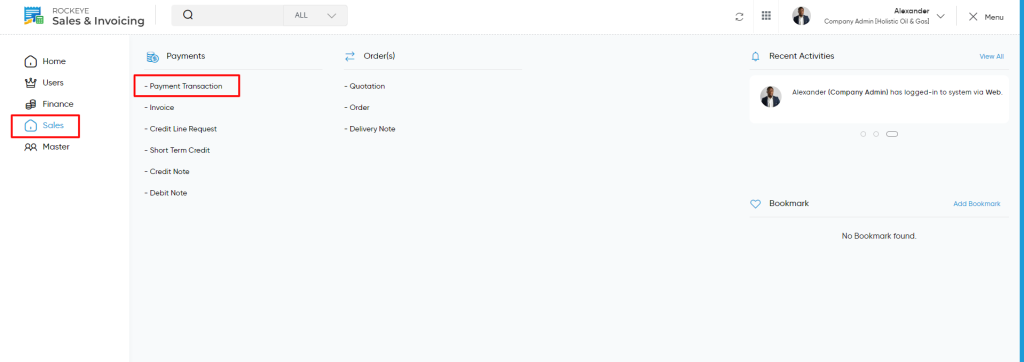

Navigation Path

To access and manage the Payment Transaction module within the system, follow these steps:

- Navigate to the Main Menu:

Click on the main navigation icon located in the top-right corner of the screen to access the system’s menu. - Select ‘Sales’:

From the main navigation menu, choose the Sales section. - Open ‘Payments’:

Within the Sales section, click on Payments to explore options related to payment processing. - Click on ‘Payment Transaction’:

In the Payments section, select Payment Transaction to access a detailed view of all payment transactions processed within the system. This will take you to the page where you can view, manage, and reconcile payment transactions.

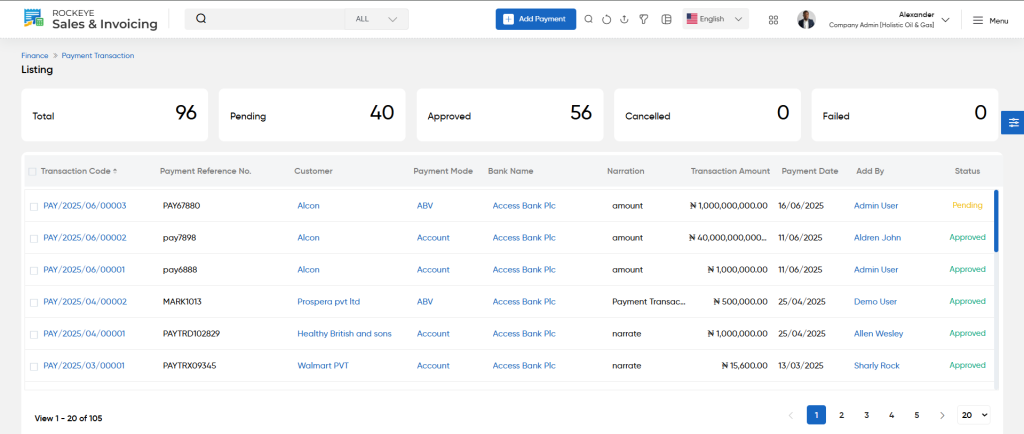

Listing

Users can view a comprehensive list of all payment transactions added in the system. The listing provides detailed information about each transaction for better management and tracking.

- In the Payment Transaction Listing, users can view the following details for each payment transaction:

- Transaction Code: A unique identifier for the payment transaction.

- Payment Reference No.: The reference number associated with the payment for tracking and reconciliation purposes.

- Customer: The name of the customer associated with the payment transaction.

- Payment Mode: The method used to process the payment (e.g., bank transfer, credit card, cash).

- Bank Name: The name of the bank through which the payment was processed.

- Narration: A brief description or comment related to the payment transaction.

- Transaction Amount: The total amount paid in the transaction.

- Payment Date: The date when the payment was processed.

- Added By: The user who added or recorded the payment transaction.

- Status: The current status of the payment (e.g., Pending, Approved).

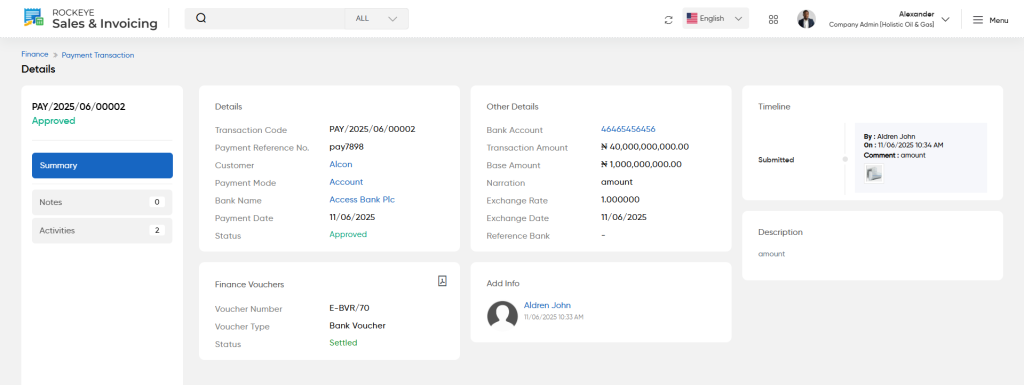

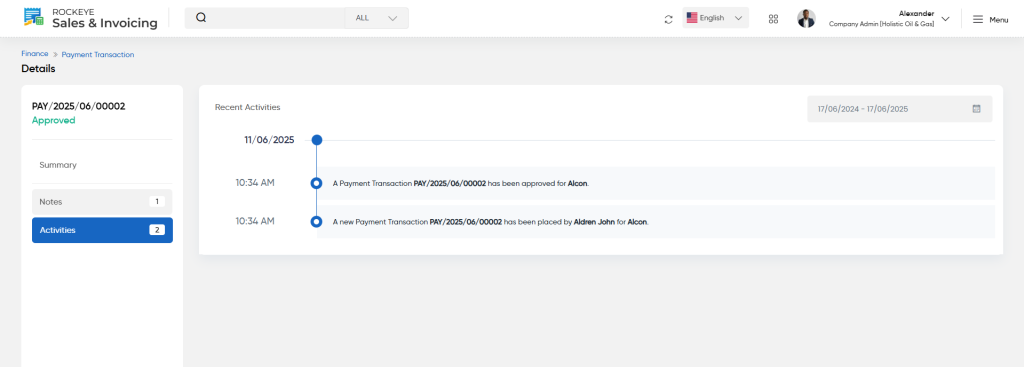

In the detail page user will be able to view below sections

- View Summary: The Summary will display the details of the particular transaction.

- This data is fetched from the inventory

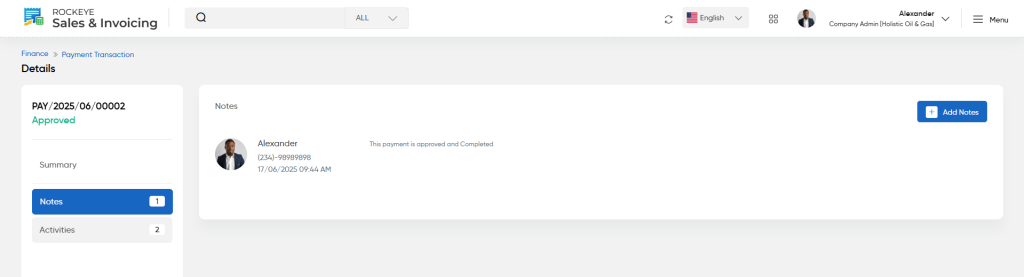

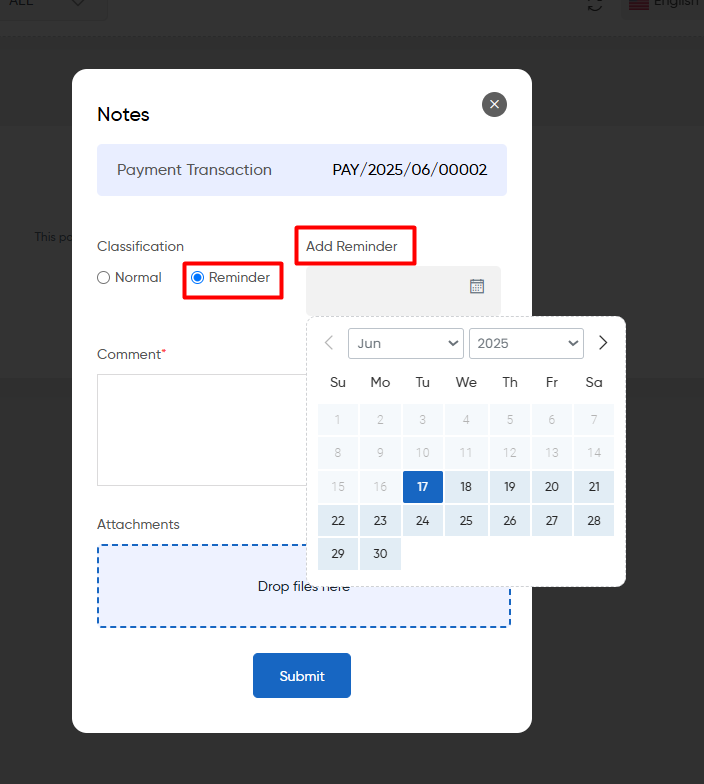

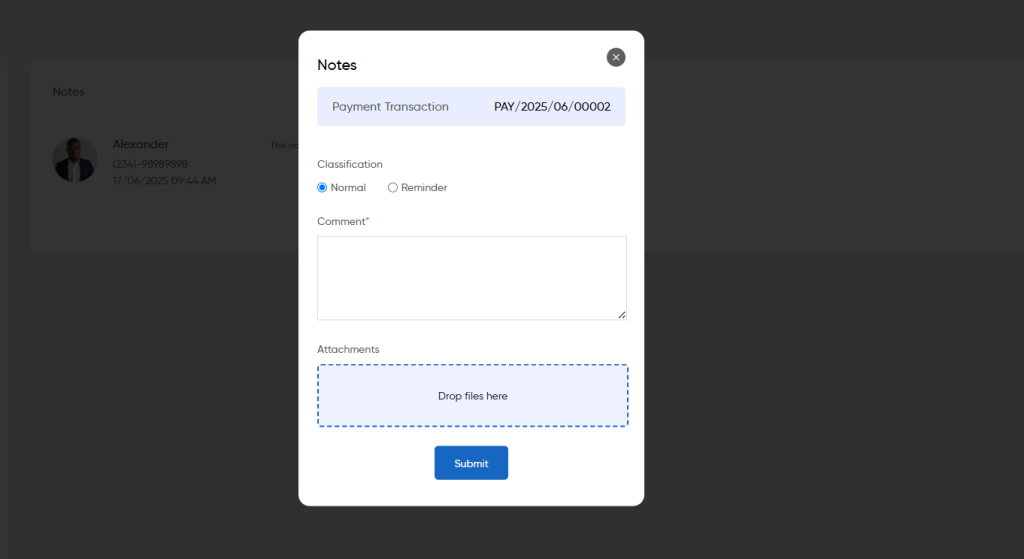

- View Notes: On clicking the notes tab user will be able to view and add the notes for the specific Transaction

- Add Reminder : On cliciking the reminder option user will be able to choose the dates on which you want to put the reminder

To add notes for a payment transaction or any related entry, users will need to provide the following details:

- Classification: The category or type of note being added (e.g., general remark, issue, inquiry).

- Comment: A detailed description or explanation related to the note, providing context or additional information.

- Upload Image: The option to attach an image, such as a screenshot, document, or relevant image, to support the note.

- View Activities:

- By selecting the ‘Activities’ tab, users can access a detailed log of all activities related to a specific payment transaction. This log tracks actions such as updates, changes in status, or other significant events associated with the transaction, providing transparency and a clear audit trail for the payment process.

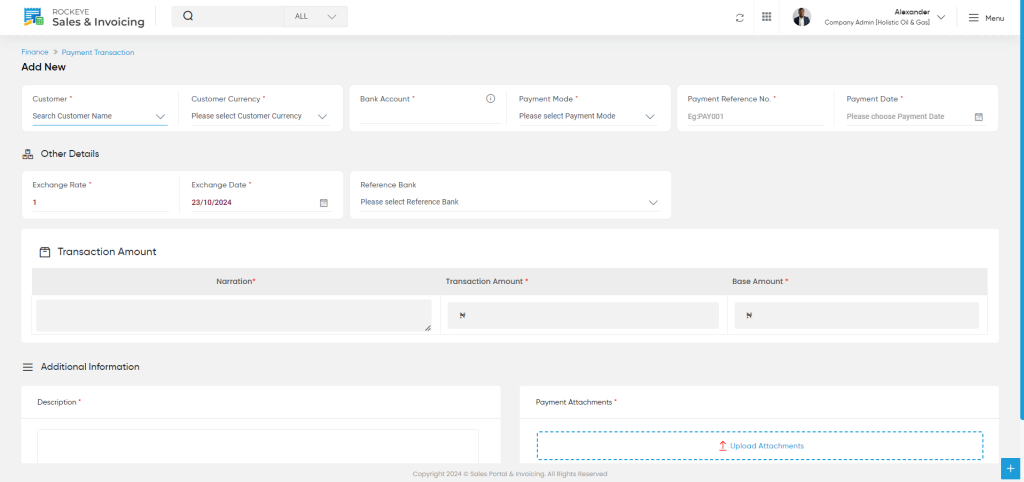

Add/Edit Payment Transaction

Users can add or edit payment transactions using the following fields:

- Customer (Required):

- Select the customer involved in the transaction.

- Customer Currency (Required):

- Choose the currency in which the transaction will be processed.

- Bank Account (Required):

- Select the bank account from which the payment will be made.

- Payment Mode (Required):

- Specify the method of payment (e.g., credit card, bank transfer, etc.).

- Payment Reference No. (Required):

- Enter the payment reference number (e.g., PAY001) for tracking purposes.

- Payment Date (Required):

- Choose the date when the payment is processed.

- Other Details:

- Provide any additional information related to the transaction.

- Exchange Rate:

- Based on the system currency automatically exchange rate will be calculated but it can be edited in the run time by the user as well.

- Exchange Date:

- Enter the date for the exchange rate (e.g., 07/10/2024).

- Reference Bank:

- Include any reference information related to the bank.

- Exchange Rate:

- Provide any additional information related to the transaction.

- Transaction Amount

- Enter the total amount Information involved in the payment transaction.

- Narration (Required):

- Provide a brief description or notes related to the transaction.

- Transaction Amount (Required):

- Enter the total amount involved in the transaction.

- Base Amount:

- Base amount will always be auto calculated based on the exchange rate.

- Additional Information (Required):

- Provide any additional details or comments.

- Payment Attachments (Required):

- Upload any relevant documents or files related to the payment transaction

Save: This button allows the user to save the note along with the details entered (classification, comment, and any uploaded image) to the system.

Discard: This button allows the user to cancel the action of adding a note, clearing any entered information without saving it.

Once the details are added this Payment transaction will be viewed in listing page