Debit Note

Debit Note Purpose

The Debit Note feature in our system allows businesses to issue formal documents to customers or suppliers, typically used to increase the amount owed in a previously issued invoice. Debit notes are used when additional charges or corrections need to be applied, such as price adjustments or extra services provided. This feature helps maintain accurate records of financial transactions and ensures proper account reconciliation.

In our system, the Debit Note functionality is seamlessly integrated with invoicing and financial management modules, enabling users to create, track, and manage debit notes efficiently. The system ensures that all related transactions are accurately reflected, providing clear visibility into adjustments and supporting better financial oversight.

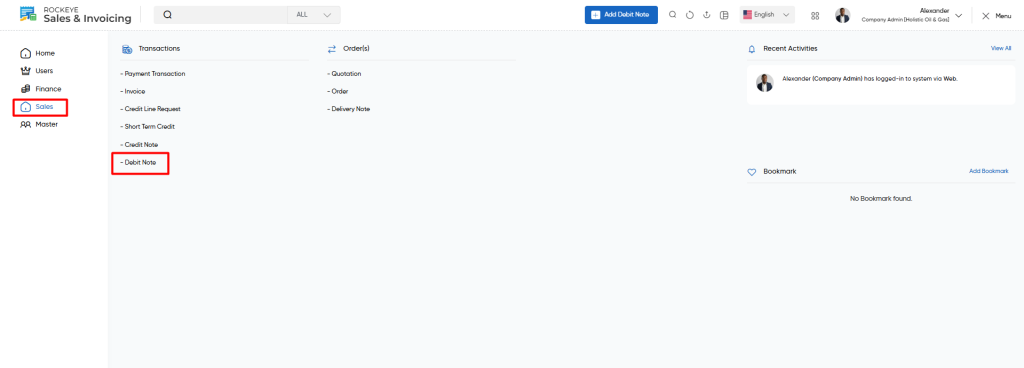

Navigation Path

To access and manage debit notes related to invoices in the system, follow these steps:

- Navigate to the Main Menu

- Click on the main navigation icon in the top-right corner of the system’s interface to open the menu.

- Select ‘Sales’

- From the navigation options, choose the Sales section to access modules related to sales transactions.

- Open ‘Invoices’

- Within the Sales section, click on the Invoices option to view and manage all invoice-related activities.

- Go to ‘Debit Note’

- In the Invoices section, select Debit Note to access the list of debit notes associated with sales invoices. From here, you can view, create, or manage debit notes as needed.

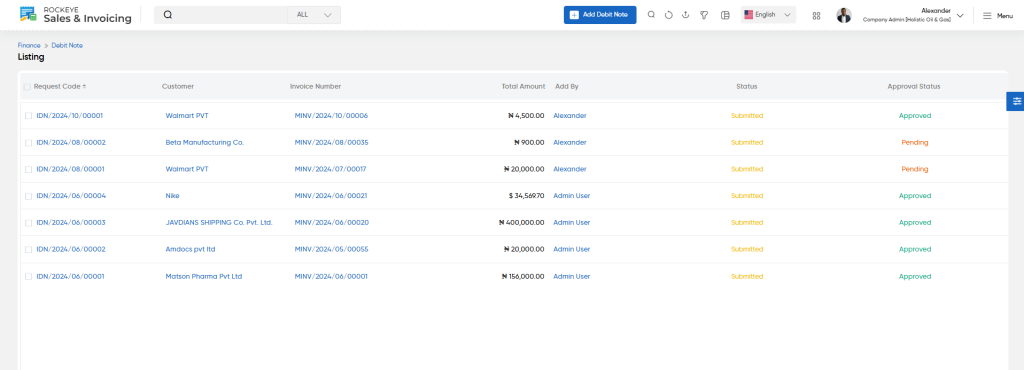

Listing

Users can view a comprehensive list of all debit notes added to the system, enabling efficient management and tracking of financial adjustments. The listing includes detailed information for each debit note, ensuring transparency and streamlined record-keeping.

The following details are available in the Debit Note Listing:

- Request Code: The unique identifier assigned to the debit note.

- Customer: The name of the customer associated with the debit note.

- Invoice Number: The invoice linked to the debit note

- GL: The General Ledger account impacted by the debit note.

- Total Amount: The total value of the debit note before adjustments.

- Final Amount: The adjusted amount after any applicable changes.

- Added By: The user who created the debit note.

- Status: The current state of the debit note (e.g., Active, Inactive).

- Approval Status: Indicates whether the debit note has been approved, rejected, or is pending approval.

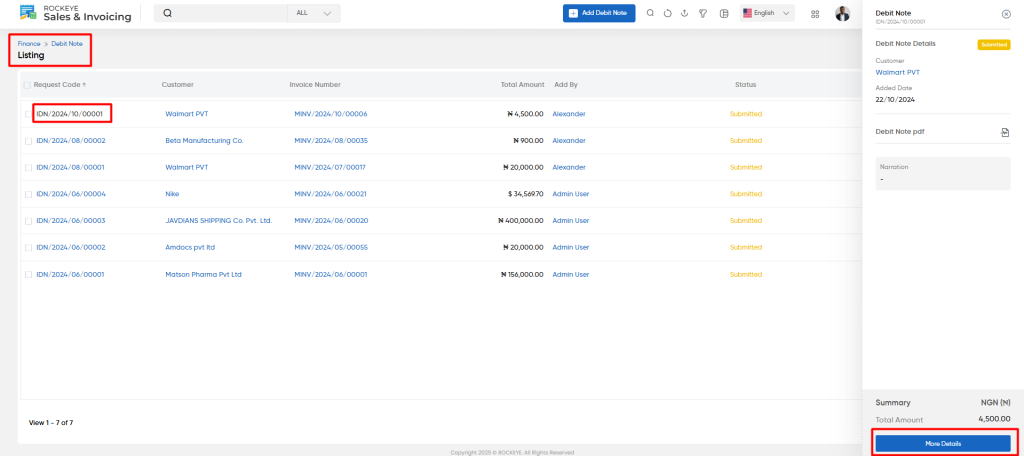

When a user clicks on any Debit Note in the listing, a side drawer opens with an option for More Details. Clicking on More Details displays a detailed page showing an overall summary of that Debit Note.

Add/Edit

When adding or editing a debit note, users need to input the following information:

- Customer (Required): Select the customer or supplier for whom the debit note is being issued.

- Invoice (Required): Choose the relevant invoice associated with the debit note.

- Exchange Rate: Set the applicable exchange rate.

- GL (Required): Specify the General Ledger code related to the transaction.

- VAT Withheld?: Option to indicate if VAT is withheld.

- Item:

- Add item details including:

- Description (Required): A detailed description of the item or service being included in the debit note.

- Item GL: The General Ledger account associated with the item.

- Quantity (Required): The number of units of the item.

- Unit Price: The cost per unit of the item.

- Amount: The total value of the item before taxes, calculated as Quantity × Unit Price.

- Tax Calculation: Defines how the tax is calculated for the item (e.g., percentage or flat.rate).

- Tax Group: The tax group or category applicable to the item (e.g., VAT, GST).

- Tax Amount: The calculated tax based on the item’s taxable amount.

- Taxable Amount: The amount eligible for taxation after applying adjustments, if any.

- Final Amount (Required): The total amount including taxes and adjustments.

- WHT Tax: The withholding tax applicable to the item, if any.

- WHT Amount: The amount deducted as withholding tax.

- Add item details including:

- Remarks: Add any additional notes or remarks.

- Attachment: Option to attach relevant documents.

Summary

Before saving or submitting a debit note, the system provides a detailed summary of all the entered information. This summary offers users a comprehensive overview, allowing them to review and verify the accuracy of the details before finalizing the document. Additionally, it presents a detailed breakdown of all items added, highlighting their descriptions, quantities, unit prices, and calculated amounts.

Tax-related information is also displayed, covering details like tax amounts, tax groups, taxable amounts, and any applicable withholding tax. Furthermore, the summary provides financial totals, including the total amount, final amount, and any adjustments applied.

Actions

- Save as Draft: Allows users to save the debit note for later editing.

- Submit: Finalize and submit the debit note for approval.

- Discard: Discard the current entry.

Once the details are added, this Debit Note will be viewed in the listing page.