Credit Line Request

Purpose

Credit Line Request is to allow businesses to request an extension or adjustment of a customer’s credit limit within the sales process. This feature enables sales executives to formally initiate requests for additional credit, ensuring that transactions can continue without disruption if a customer’s available credit needs to be increased.

The Credit Line Request feature in a sales and payment system may have several dependencies that ensure proper functionality and data integrity. These dependencies include:

- Customer Module: The credit line request is tied to a specific customer. This means the customer must be created and available in the system before initiating any credit line request.

- Sales Orders: The credit line request may depend on the sales order history and any outstanding payments or past transactions. These help assess the customer’s creditworthiness and determine the appropriate credit line.

- Admin or User Roles: Only users with specific roles, such as an admin or finance team member, may have the authority to approve or decline credit line requests. The roles and permissions need to be properly configured.

- Payment and Billing System: The approval or modification of a credit line might affect the payment terms, invoice handling, and billing processes, creating a dependency between the credit line request and other parts of the payment system.

Navigation Path

To reach the Credit Line Request in the system, follow these steps:

- Go to the Sales Module: From the main menu, locate and select the Sales module.

- Navigate to Payment: Within the Sales module, find and click on the Payment section.

- Click on Credit Line Request: Under the Payment section, you will see the Credit Line Request option. Click on it to access the feature.

Listing

Users can view a list of all credit line requests added in the system. The listing provides detailed information about each request for better management and tracking.

- In the Credit Line Request Listing, you will find the following details for each request:

- Request Code: A unique identifier for the credit line request.

- Customer: The customer associated with the credit line request.

- Credit Line: The amount of credit being requested by the customer.

- Added By: The user who added the credit line request to the system.

- Add Date: The date when the credit line request was added.

- Modify Date: The date when the credit line request was last modified.

- Status: The current status of the credit line request (e.g., Pending, Approved, Declined).

- Action (Approve/Decline): Options to approve or decline the credit line request.

- When a user clicks on a particular credit line request, the system navigates to this detailed page. The page displays key information like Customer ,currency and Credit line amount details.

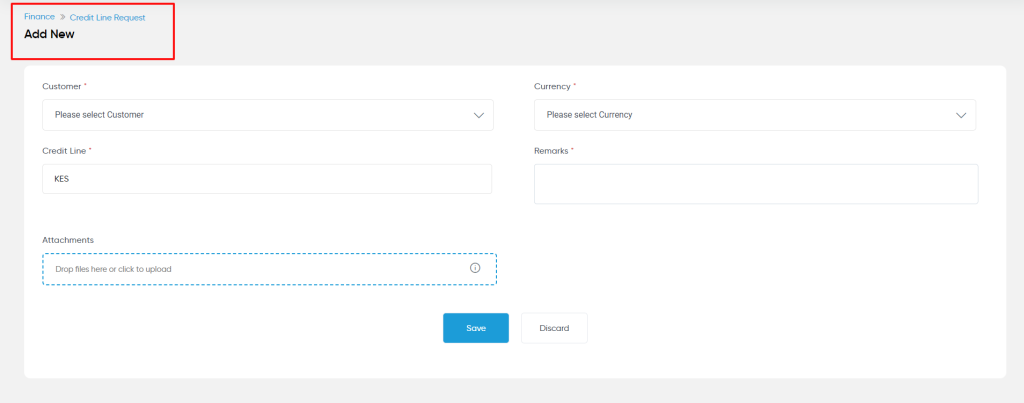

Add/Edit

When adding or editing a credit line request, users need to input the following information:

- Customer (Required)

- Select the customer for whom the credit line request needs to be assigned

- Currency (Required)

- Need to select the currency from the dropdown

- Credit Line (Required)

- Remarks

- Attachments (Optional)

Note : The credit line request needs to be Approved by the admin (company admin) user to get the necessary effect on the customer’s credit.

Action Button :

In the Credit Line Request module, the following actions are available:

- Save: Allows users to save the current credit line request for future reference or modification. This option saves all entered details without finalizing the request. Users can return to edit or approve the request later.

- Discard: If the user decides not to proceed with the request or has entered incorrect information, they can choose to discard the changes. This action will remove all unsaved details and prevent the request from being added to the system.

Once the details are added this Credit line request will be viewed in the listing page.