Loan & Advance

Introduction/Purpose

The Loan and Advance feature in Employee Self-Service (ESS) enables employees to request and manage financial assistance such as loans and salary advances. It streamlines the process through automation and ensures transparency, making it easier for employees to access funds during urgent or personal financial needs.

The purpose of the loan and advance feature is to offer financial support to employees who need it during critical situations or for personal reasons. By integrating this feature into ESS, organizations aim to simplify the loan or advance application process, automate approvals, and ensure transparency in financial transactions.

Process Flow:

How to Navigate:

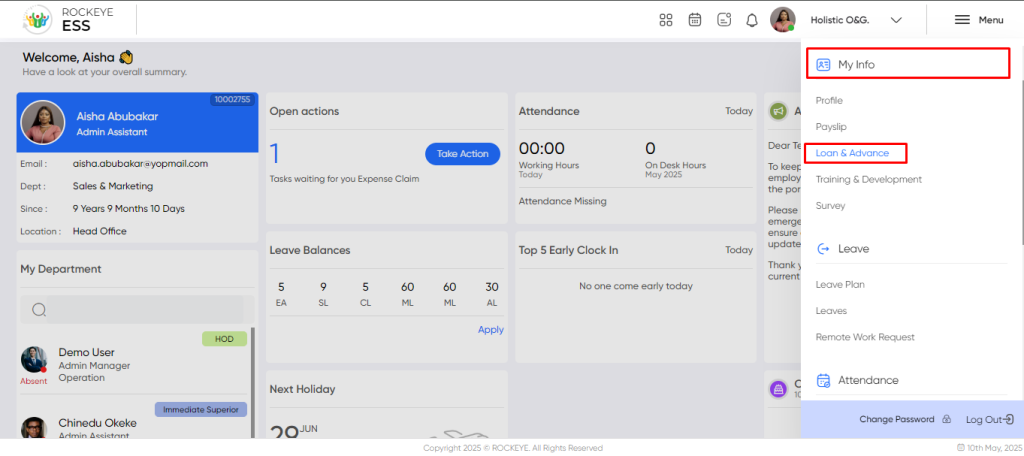

To access the Loan and Advance module in ESS:

- Click the menu icon in the top-right corner.

- Navigate to My Info > Loan and Advance.

- The page will display a list of previously submitted requests with their statuses.

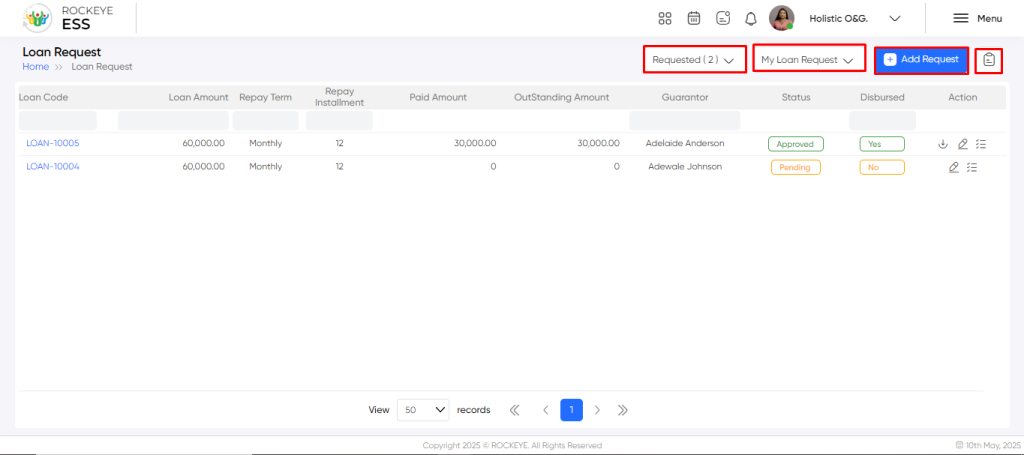

Listing & Filters

- My Request Filters:

- Requested: Displays submitted loan/advance requests that are yet to be reviewed.

Pending: Lists requests under review or awaiting approval. - Approved: Shows requests that have been authorized and are pending processing.

- Declined: Lists requests that have been rejected.

- Requested: Displays submitted loan/advance requests that are yet to be reviewed.

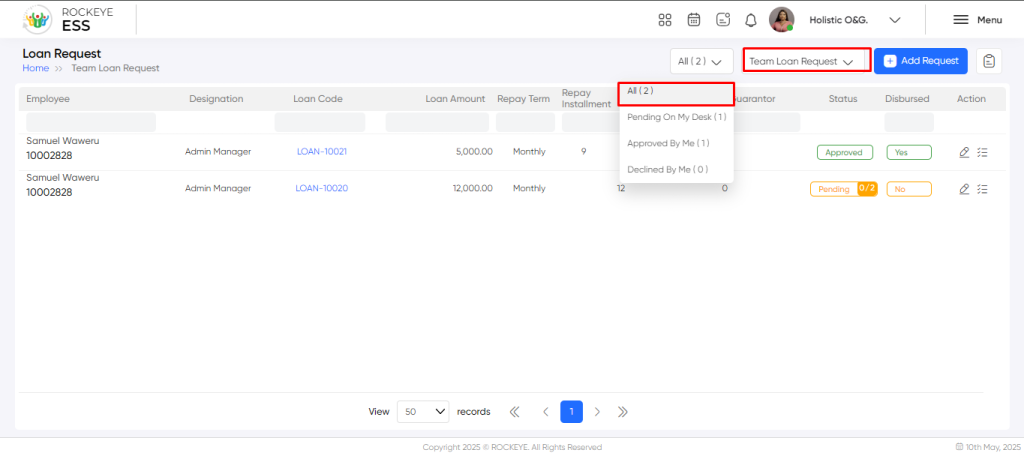

- Team Request Filters: (visible only to managers with approval rights)

- All: Shows all loan/advance requests from team members.

- Pending on My Desk: Requests awaiting the user’s approval.

- Approved By Me: Requests approved by the user.

- Declined By Me: Requests declined by the user.

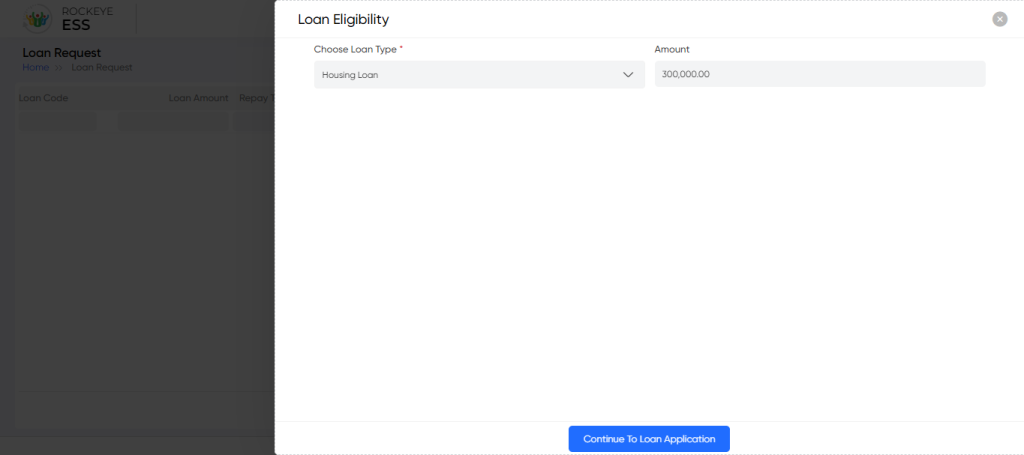

Eligible Loan Amount: Employees can proceed with their application by clicking Continue to Loan Application.

By default, the page will display the employee’s eligible loan details, including:

- Loan Name

- Eligible Loan Amount

The employee has the option to proceed with the loan request. Upon clicking the “Continue to Loan Application” button, they will be redirected to the Loan Request Form.

Recording & Update

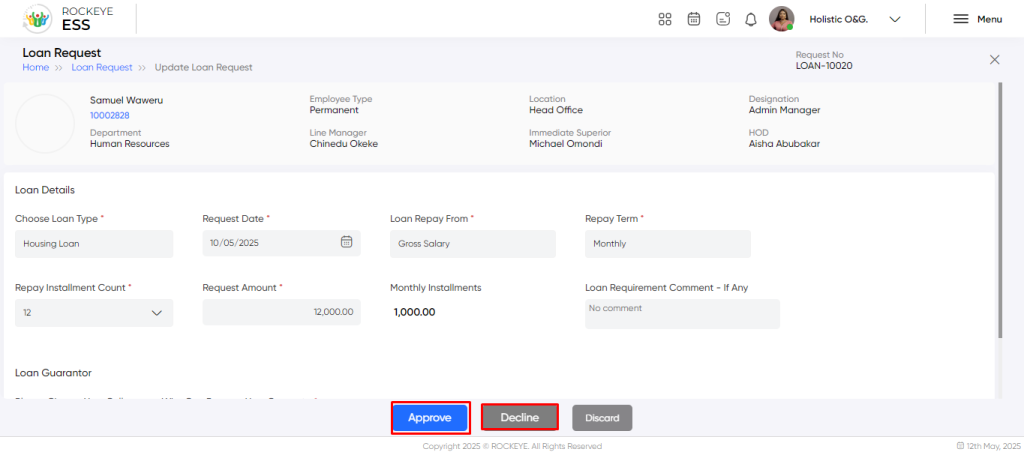

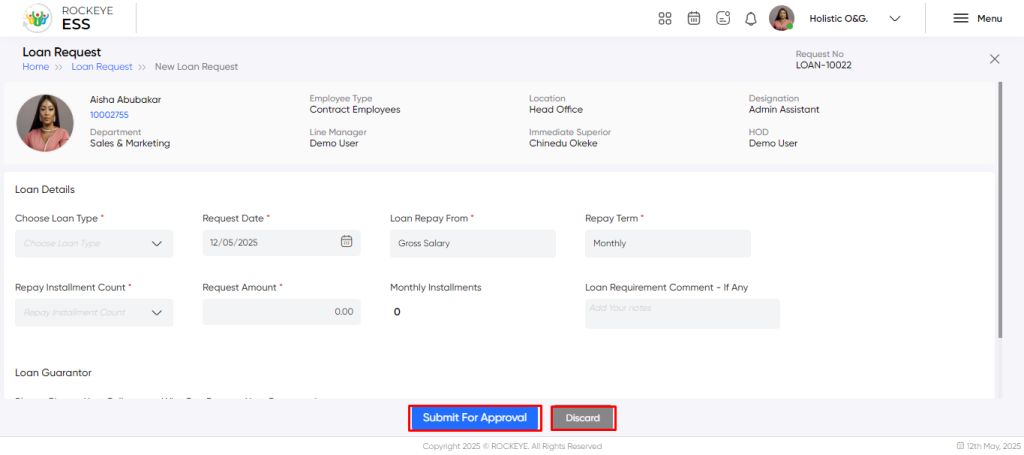

Employees are required to fill out the loan application form with the following details:

Note: The requested amount limit (for HRA, the maximum limit is HA * 12) and rules and conditions are configured by the organization.

- Loan Type*: Select from available loan types (e.g., Personal, Home, Car, Business).

- Request Date*: The submission date of the request.

- Request Amount*: The total loan amount requested.

- Repayment Installment Count*: Number of installments to repay the loan.

- Loan Repayment Source*: Choose between salary deduction or manual payment.

- Repayment Term*: Select frequency—monthly, quarterly, annually, etc.

- Monthly Installment: Automatically calculated based on amount and term.

- Loan Guarantor: Select an employee as a guarantor (if applicable).

- Comments: Optional remarks explaining the loan requirement.

Note: Fields marked with “*” are mandatory. Loan limits and conditions are defined by the organization.

Employees can:

- Submit for Approval

- Discard Draft

Managers or reporting authorities can:

- Approve or Decline the request.

- Discard to return to the dashboard.

Note: Once approved, the loan request cannot be modified.