Human Resource

-

Basic Guide

-

Employee Self Service

-

HR Analytical Dashboard

-

HR Operation

-

Time & Attendance

-

Leave Management

-

Loan & Advance

-

Payroll

-

Core Masters

-

- Articles coming soon

-

Training & Survey

-

Assets

-

Report

-

- Missed Punch In Report

- Employee Demographics Report

- Employee Exit Report

- Employee Joining Report

- Employee Anniversary Report

- All Employee Salary Projection Reports

- Employee Birthday Report

- Employee Birthday Message Report

- New Hires Report

- Employee Generic Reports

- Employee Attendance Configuration Missing

- Employee Bank Account

-

- Casual Employee Payrun

- Casual Employee Pay Projection

- Variable Earning Report

- Payee Schedule

- Pension Schedule Report Vendor Wise

- Pension Schedule Report

- Employee Payee

- Employee Payout

- Contract Employee Payrun

- Permanent Employee Payrun

- Employee Payrun

- Permanent Employee Pay Projection

- All Employee Pay Projection

- Employee Salary Report

- Contract Employee Pay Projection

- Variable Deducation Report

- Employee Pay Run Summary

- Employee Accrual Lender

- Contract Employee Pay Projection

- Show Remaining Articles (4) Collapse Articles

< All Topics

Print

Loan Categories

PostedAugust 11, 2023

UpdatedApril 1, 2024

ByKalpesh Patel

Introduction/Purpose:

The Loan Categories Master module in HRMS (Human Resource Management System) serves as a centralised database to manage and categorise various types of loans offered within an organisation. The purpose of the loan categories is to add the various types of loan categories to the HRMS system like personal loan, car loan and home loan.

How To Navigate:

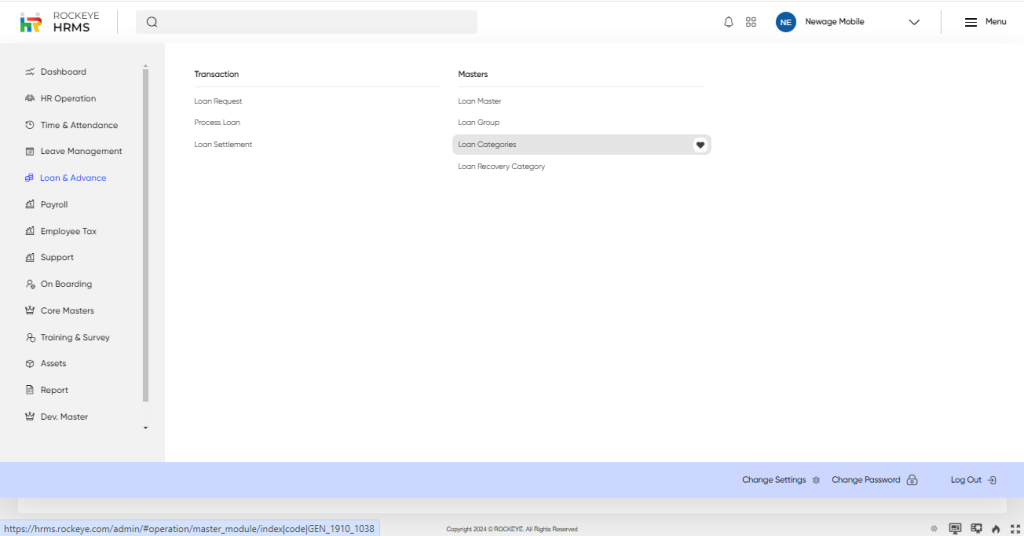

The navigation to a Loan Categories in a HRMS typically involves the following steps:

- Click on the main navigation icon: The main navigation icon located in the top right corner of the screen. Clicking on this icon will open the navigation menu, which typically includes links to various sections of the HRMS system.

- Click on the Loan & Advance section: The Loan Categories is located under the transaction section. By clicking on the loan categories, it will display a loan category, code, added by, added date, approval status, status and action.

Listing:

- Quick Search: By using this feature, users can quickly search for specific records within a listing. By using the filter search based on the respective column details.

- Export: By using this feature, the user can extract data from the system and save it in a compatible format like Excel, CSV, or PDF (only PDF supports landscape and portable formats).

- Hide and Show Column: By using this feature, the user can customize the display of columns in a listing. Users can select the column name and show specific columns based on their preferences.

- Show all listing records: By using this feature, the user can refresh the listing records within the system.

- Advanced Search: By using this feature, the user can use the advanced filter option to find the listing records within the system.

- Delete Row: By using this feature, the user can remove a specific record from a listing.

- Pagination: By using this feature, the user can view the records of the various pages and also increase or decrease the listing rows in a page.

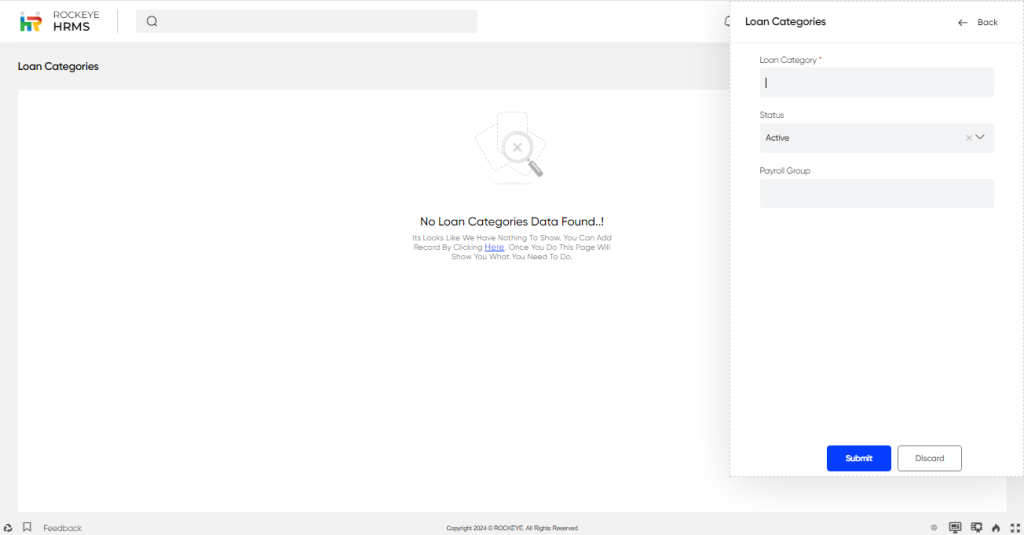

Recording & Update:

The loan categories in HRMS typically include:

- Loan Category*: The loan category field identifies the specific category or type of loan to which the loan group belongs, enabling effective classification and management.

- Status: The status field represents the current state of the loan group.

- Note: “*” represents the mandatory fields to be entered by the user.

- The user can perform the following actions in this section:

- Discard: This option allows the user to discard the changes before saving it.

- Submit: This option allows the user to add the Loan categories in the system.

Table of Contents