Asset Management

Depricitaion Method

Introduction/Purpose

The Depreciation Method Submodule is used to define and manage different depreciation strategies applicable to assets. These methods determine how an asset’s value is reduced over time for accounting and compliance purposes. This master allows organizations to standardize depreciation calculations across asset classes and ensure accurate financial reporting.

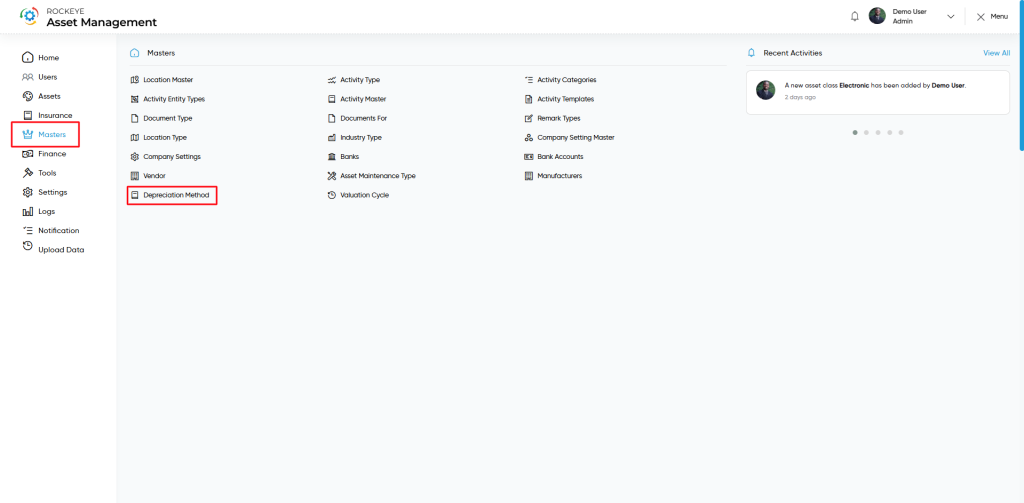

How To Navigate

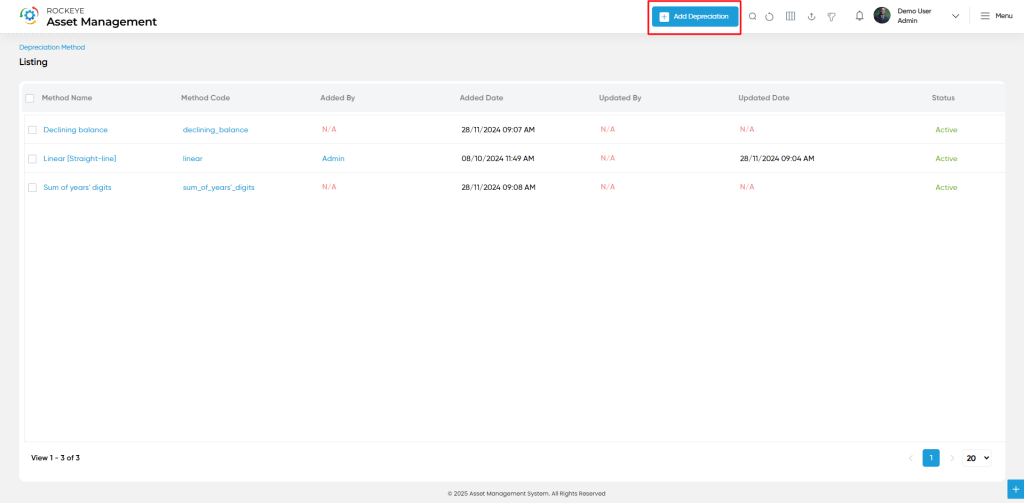

Click the menu button in the top-left corner, then select the Master module. Under it, choose the ‘Depricitaion Method’ sub-module to view a list of all previously added Depricitaion Method

How To Add Depricitaion Method

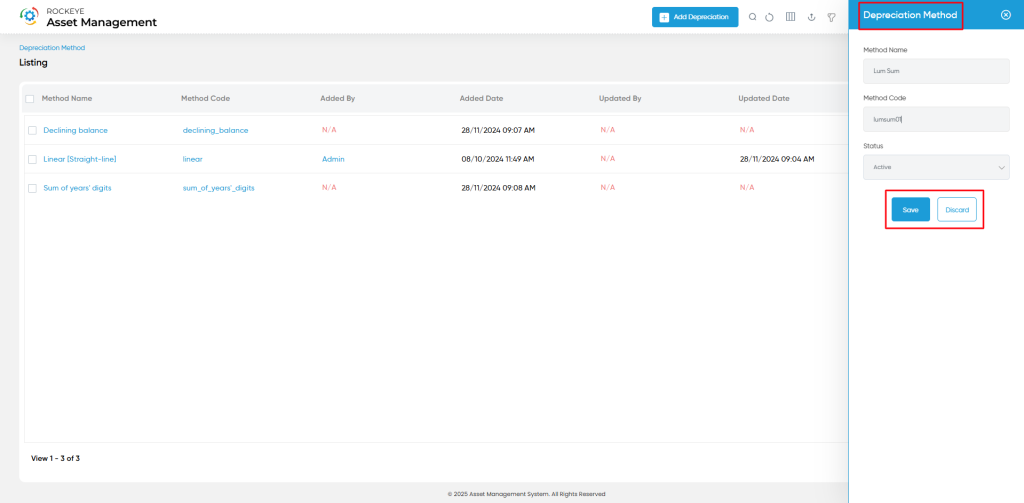

Click the ‘Add’ button in the header section to open the Depriciation Method form. Fill in the following details to save the depriction method

- Method Name: The name of the depreciation method (e.g., Straight-Line, Declining Balance).

- Method Code: A short unique identifier or code for the depreciation method.

- Status: Indicates whether the method is currently Active or Inactive in the system.

- Submit: This option allows the user to submit the employee record.

- Discard: This option allows the user to discard the transaction, which will remove all changes done (if any) in the module.