Asset Valuation

Purpose

The Asset Valuation module is designed to determine the financial worth of an organization’s assets over time, ensuring accurate representation in financial records. It enables the calculation of depreciation or appreciation using various methods, such as Straight-Line or Percentage-based depreciation, allowing businesses to track asset value throughout their lifecycle. This process supports accurate financial reporting, informed decision-making regarding maintenance or replacement, and compliance with accounting standards. By recording key details such as purchase amount, current book value, and expected lifespan, the module provides transparency and precision in financial planning, budgeting, and regulatory adherence.

How to Navigate

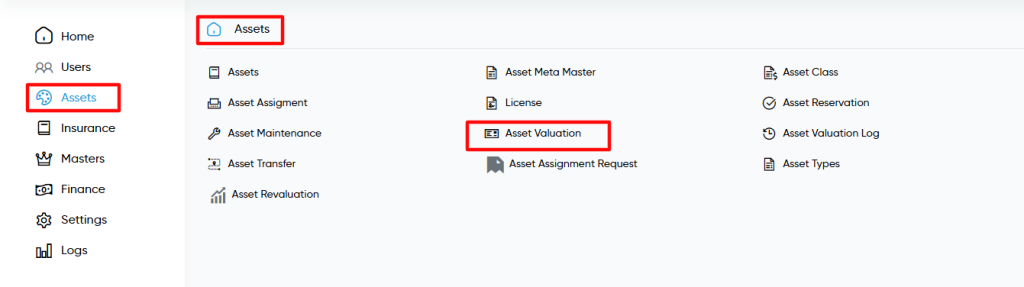

The navigation to record a Asset Valuation Module in the Asset Management system typically involves the following steps:

Click on the main navigation icon: The main navigation icon may be located in the top right corner of the screen. Clicking on this icon will open the navigation menu, which typically includes links to various sections of the Asset Management system.

Click on the Asset section: The Asset section located under the left section of the screen clicking on this section will display a list of transactions related to assets.

Find the Asset Valuation section: The Asset section located in the list of transactions under the Asset section. Clicking on this section will display a listing screen of assets valuation.

Click on the Asset valuation link: The Asset valuation link located under the Asset section, after clicking on this link you can navigate Asset valuation listing and from that you can easily add Asset valuation.

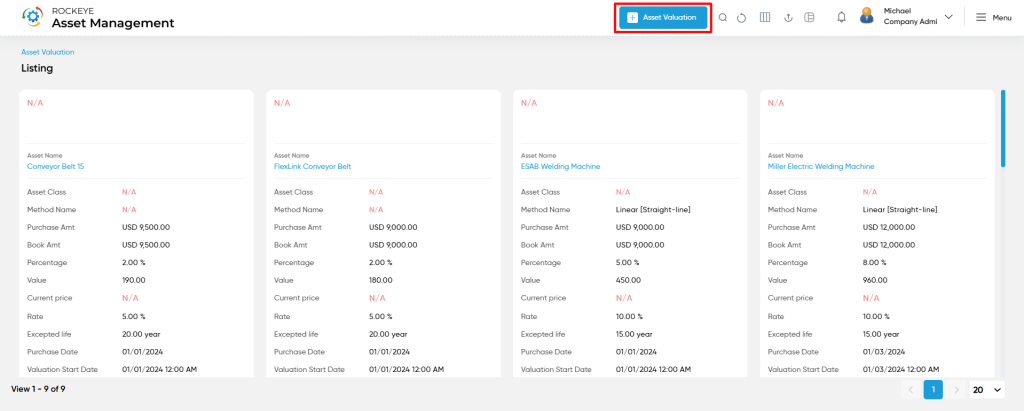

Listing

The Listing Screen is a fundamental interface used for viewing, managing, and interacting with data records in a tabular format. It serves as a central hub for displaying structured content, enabling users to perform actions on individual or multiple records efficiently.

Add Asset Valuation

The Add Asset Valuation Screen is designed to allow users to easily input and manage the valuation details of assets within the system. The key features of this screen include:

- Company Selection: Users can select the company to which the asset valuation belongs, ensuring proper categorization.

- Asset Mode and Selection: The user can specify the asset mode (whether depreciating or non-depreciating) and choose the asset being valued from the system’s asset list.

- Purchase Information: Fields for the purchase date and purchase amount (in local currency, NGN) are available, providing the historical acquisition cost for the asset.

- Valuation Percentage: This field allows users to define the valuation percentage, which will be used in calculating the asset’s current value.

- Book Amount: This field captures the book value of the asset in NGN, reflecting the asset’s value as recorded in the company’s accounting records.

- Valuation Start Date: Users can specify the date from which the asset’s valuation starts, marking the beginning of its depreciation cycle or financial assessment.

- Valuation Value: The current value of the asset based on the valuation process, which will be updated in real-time.

- Valuation Cycle: This field defines the duration for the valuation, such as yearly or monthly, to ensure periodic assessments are consistent.

- Expected Life: The expected lifespan of the asset is recorded, allowing for accurate depreciation calculations over its useful life.

- Valuation Rate: This field defines the rate at which the asset will depreciate or appreciate, critical for determining the asset’s value over time.

- Depreciation Methods: Users can select the appropriate depreciation method, such as straight-line or declining balance, based on the company’s accounting practices.

The Next, List, and Stay buttons provide users with the option to either proceed to the next step, return to the asset valuation listing screen, or save and stay on the current screen for further input.

In summary, the Add Asset Valuation screen simplifies the process of recording asset valuations, making it easier for users to manage financial data, track asset values over time, and apply the correct depreciation methods for accurate reporting.