Asset Revalution

Introduction/Purpose

Asset Revaluation allows organizations to adjust the book value of fixed assets to reflect current fair market value. This process helps maintain accurate asset records in financial reports, particularly when there’s a significant change in an asset’s value due to market conditions, improvements, or impairment. Revaluation impacts depreciation and financial forecasting, ensuring transparency and compliance with accounting standards.

Users can add an asset revaluation entry by selecting the asset and entering the updated valuation details. The system will automatically calculate the surplus value resulting from the revaluation.

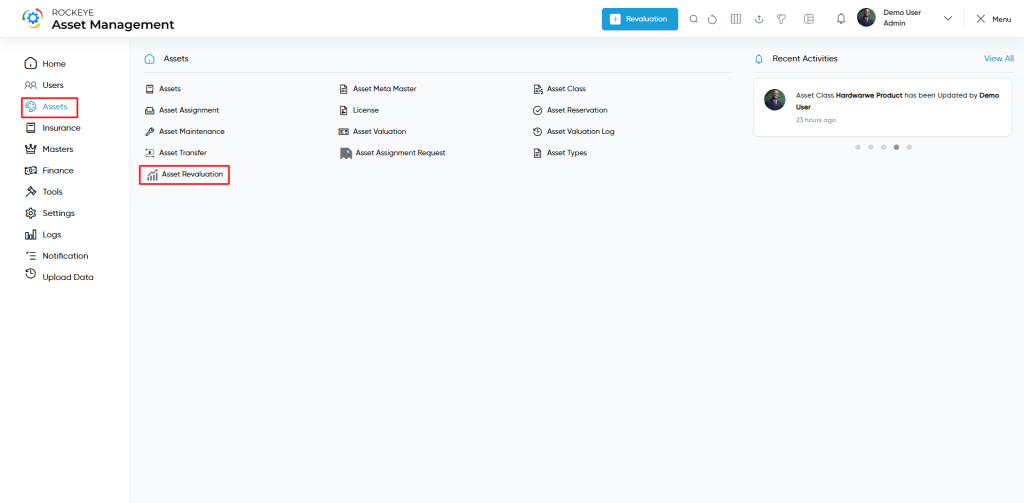

How To Navigate

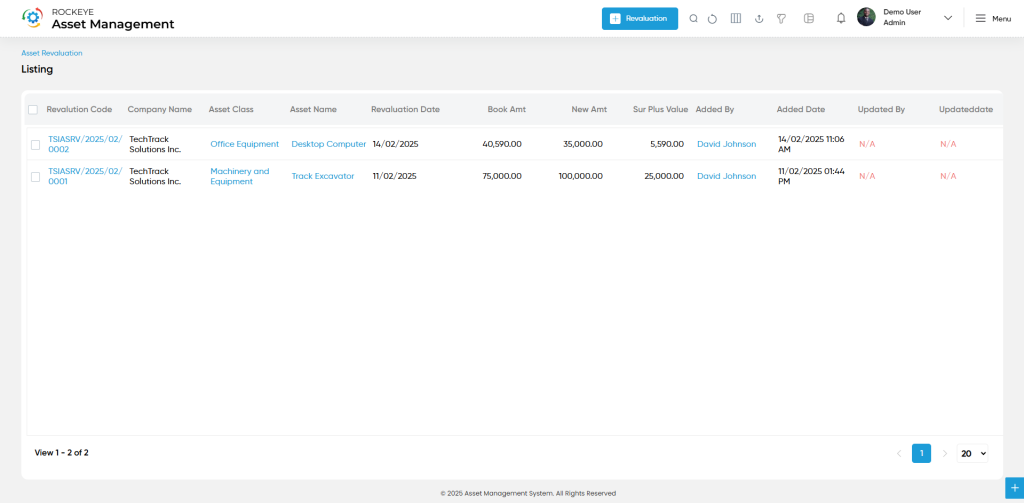

Click the menu button in the top-left corner, then select the Asset module. Under it, choose the ‘Asset Revaluation’ sub-module to view a list of all previously performed asset revaluations.

Listing

To Add Asset Revalution

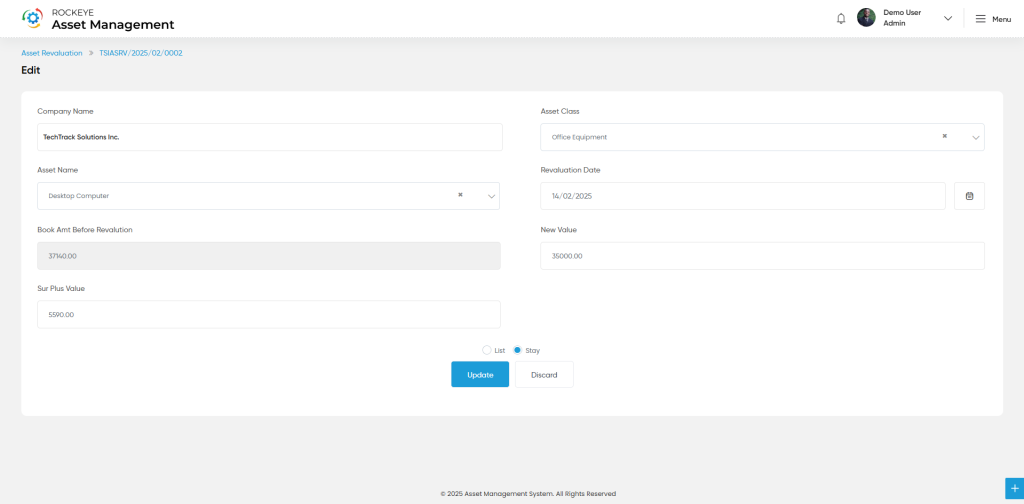

Click the ‘Add’ button in the header section to open the Asset Revaluation form. Fill in the following details to save the asset revaluation

- Company Name: The company to which the asset belongs.

- Asset Class: The category or classification of the asset (e.g., IT Equipment, Vehicles).

- Asset Name: Specific asset selected for revaluation.

- Revaluation Date: The date on which the revaluation is performed.

- Book Amount Before Revaluation: The asset’s original or current book value before revaluation.

- New Value: The revised market or fair value of the asset after revaluation.

- Surplus Value: The difference between the new value and the previous book amount (auto-calculated).

- Submit: This option allows the user to submit the employee record.

- Discard: This option allows the user to discard the transaction, which will remove all changes done (if any) in the module.