State Tax Master

Introduction/Purpose:

The State Tax Master Module in the Transport Management System (TMS) acts as a centralized repository for managing state-specific tax details essential for financial transactions related to transport operations. This module serves as an integral part of the TMS, allowing transport managers and finance teams to maintain accurate and comprehensive state tax information that is essential for ensuring smooth and compliant trip-related processes.

This module is designed to streamline the configuration of state taxes, enabling users to pre-define tax rates and types applicable to different states. With the State Tax Master in place, the TMS automatically applies the relevant taxes to transactions during trip operations, thereby reducing manual input and potential errors. This preemptive setup ensures adherence to state tax laws and facilitates accurate financial reporting, contributing to enhanced operational efficiency.

Additionally, the module provides users with functionalities to add, modify, or update tax data, encompassing details such as state, tax type, tax group, and service provider. This capability empowers organizations to maintain up-to-date tax information, adapt to changes in tax regulations, and oversee all tax-related data effectively within their transport operations.

Dependency for State Tax Master :

The State Tax Master Module in the Transport Management System (TMS) has essential dependencies that ensure its efficient operation and integration with other systems. Below are the key dependencies:

- Tax Type: The State Tax Master is dependent on pre-defined tax types, which are crucial for classifying and applying taxes accurately. These tax types are typically configured within the finance system and integrated with the TMS. This integration ensures consistency and compliance in tax application across all transport operations. Depending on client requirements, tax types can also be configured from the backend to accommodate specific operational needs.

- Tax Group: Another critical dependency is the tax group configuration. This classification groups related tax rates and helps streamline the application of multiple taxes during transport transactions. Similar to tax types, tax groups are usually managed within the finance system and synced with the TMS to maintain alignment. Backend configuration of tax groups is also possible, providing flexibility for custom client setups.

By maintaining accurate and synchronized tax type and tax group data through integration with the finance system, or configuring them from the backend as needed, the State Tax Master Module supports precise tax management and ensures compliance within transport operations.

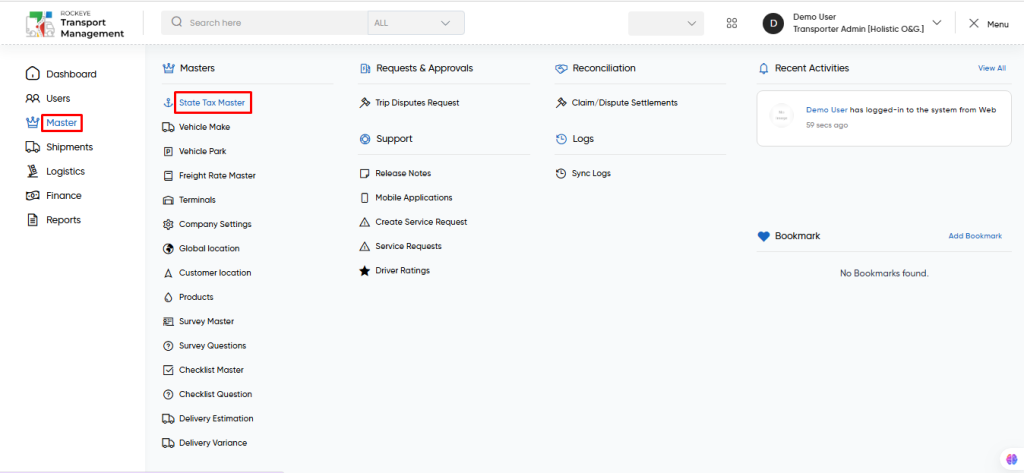

How To Navigate To State Tax Master :

The navigation includes the following steps for viewing the state tax masters in the transporter management system

- Click on the Master tab: The master can be accessed by clicking on the Master tab on the side menu.

- Click on state tax master: The state tax master can be accessed by clicking it from the master section.

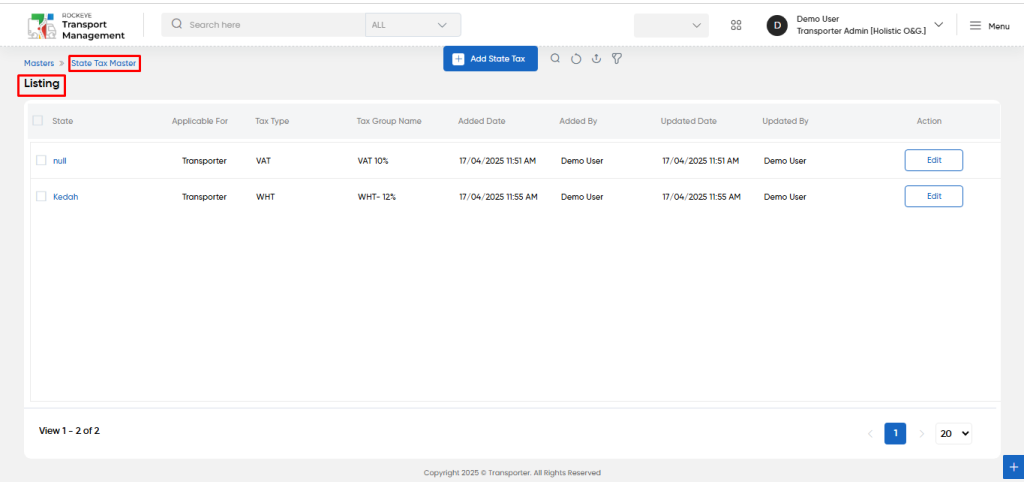

State Tax Master Tab Listing:

A state tax master listing in a transporter management system is a feature that provides a list of all state tax masters.

- Users can view the following information in the state tax master listing page

- State

- Applicable for

- Tax type

- Tax group name

- Added date

- Added by

- Updated date

- Updated By

- Action

- Edit

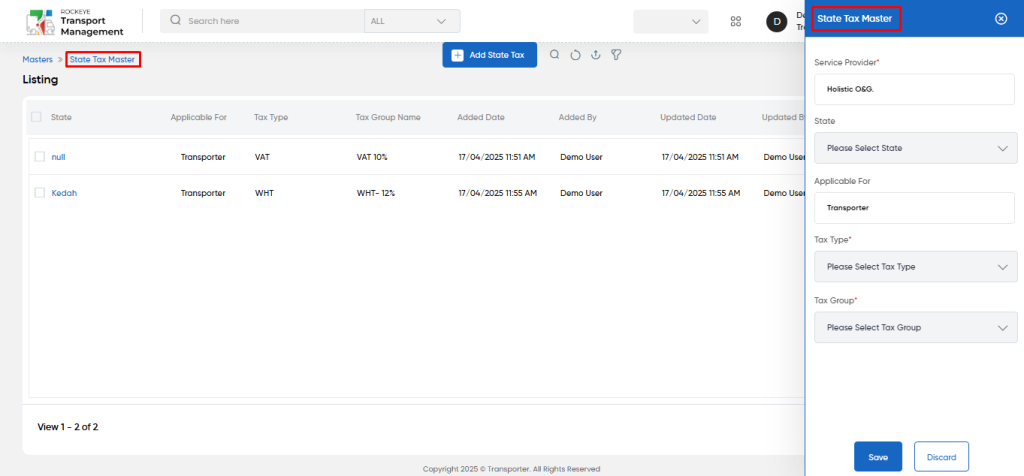

State Tax Master – Add new:

- The “Add new” function allows you to create and add new state tax masters to the system as shown in the below screen.

- User will be able to add the state tax master with the following fields

- Service Provider

- This is specifying the service provider for the state tax master.

- State

- This is specifying to choose the state for the state tax master.

- Applicable For

- This is specifying to choose the “applicable for” as transporter.

- Tax Type

- This is specifying to choose the tax type for the state tax master.

- Tax Group

- This is specifying to choose the tax group for the transporter.

- Service Provider

User can perform the following actions

- Advanced Search : The “Advanced Search” function enables searching using multiple field names with multiple conditions to find specific data. The “Search” function allows the user to look for a specific entry within the available data and presents results that match the search parameters.

- Show all listing records: This functions like a refresh icon, retrieving and displaying all records in the listing.

- Export: The “Export” feature allows users to export selected or all data in CSV or PDF format.

- Filter: The “Filter” function in the state tax master allows users to customize their view of state tax based on specific criteria.

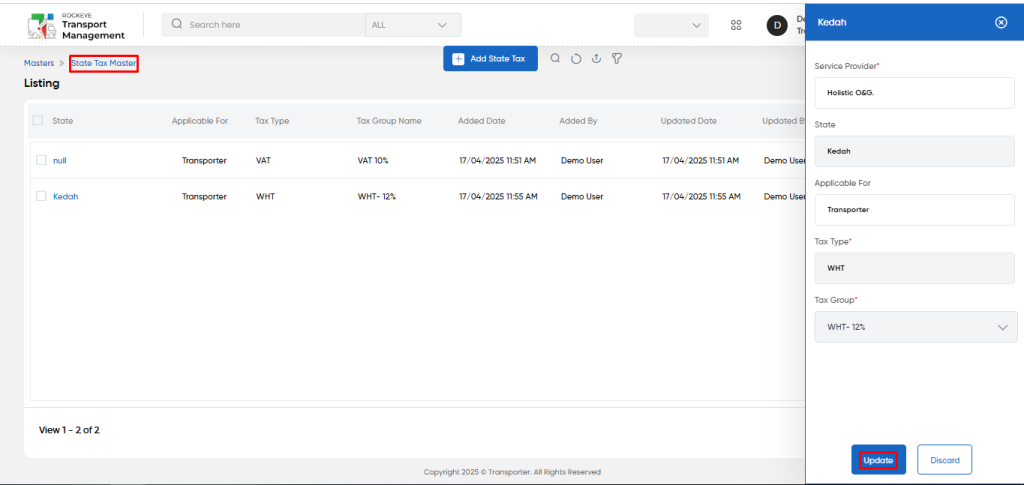

State tax Master – Recording & Update:

- Users will be able to edit and update the state tax details as shown in below screen.

Users can perform the following actions:

- Save: The “Save” function allows the user to submit the required information while creating a new state tax master.

- Discard: The “Discard” function allows the user to cancel the submission of information provided at the time of creating a new state tax master.