WithHolding Tax

Introduction/Purpose:

Withholding tax in a procurement system refers to the deduction of a specific percentage of the payment made to a supplier or vendor by the procuring entity. Its primary purpose is to ensure tax compliance and facilitate the collection of taxes at the source of income generation.

In many procurement systems, there is integration with a financial accounting system known as FINAS (Financial Accounting System). This integration allows for the automatic synchronisation of withholding tax information from the FINAS system into the procurement system.

Dependency:

The creation of withholding tax in a procurement system typically relies on several dependencies. Here are some key dependencies involved in creating withholding tax in a procurement system:

- Tax Regulations and Laws: The creation of withholding tax in a procurement system is dependent on the tax regulations and laws of the relevant jurisdiction. These regulations define the applicable withholding tax rates, thresholds, exemptions, and other requirements that need to be followed when deducting and remitting taxes.

- Integration with Financial Systems: A crucial dependency is the integration between the procurement system and the financial accounting system. This integration allows for the synchronisation of withholding tax information from the financial system into the procurement system. It ensures that accurate tax data is available during the procurement process.

It’s important to note that the specific dependencies may vary depending on the procurement system and the jurisdiction in which it operates. Organisations implementing a procurement system with withholding tax functionality should consider these dependencies and ensure that the necessary requirements are met for accurate and compliant withholding tax creation.

How to Navigate:

The navigation to record a withholding tax in a procurement system typically involves the following steps:

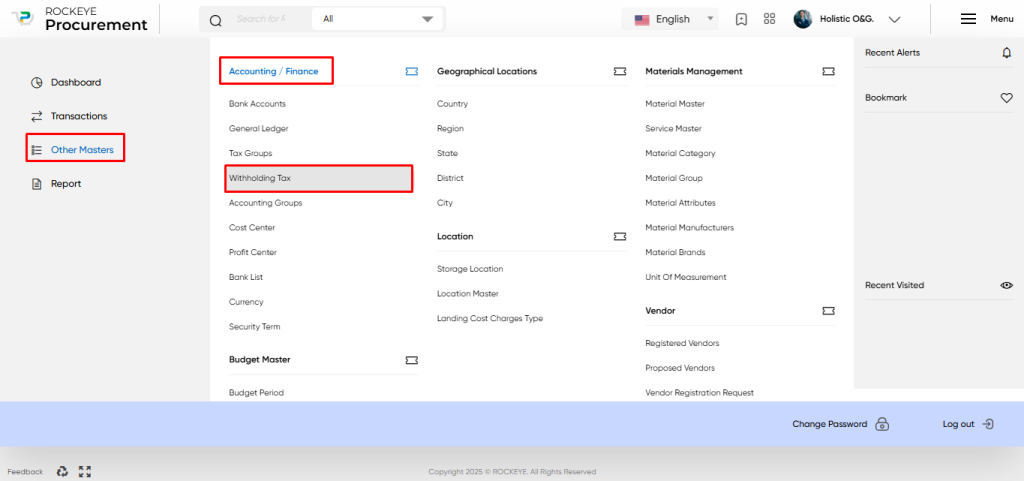

- Click on the main navigation icon: The main navigation icon may be located in the top right corner of the screen. Clicking on this icon will open the navigation menu, which typically includes links to various sections of the procurement system.

- Click on the Other Masters section: The Other Masters section is located under the left section of the screen; clicking on this section will display a list of masters related to procuring.

- Find the Accounts/Finance section: The Accounts/Finance section is located in the list of Master under the Master section. Clicking on this section will display a list of masters related to accounts/finance.

- Click on the Withholding tax link: The Withholding Tax link is located under the Accounts/Finance section. After clicking on this link, you can navigate to Withholding Tax in the listing, and from that, you can easily upload new transactions into the system.

Listing:

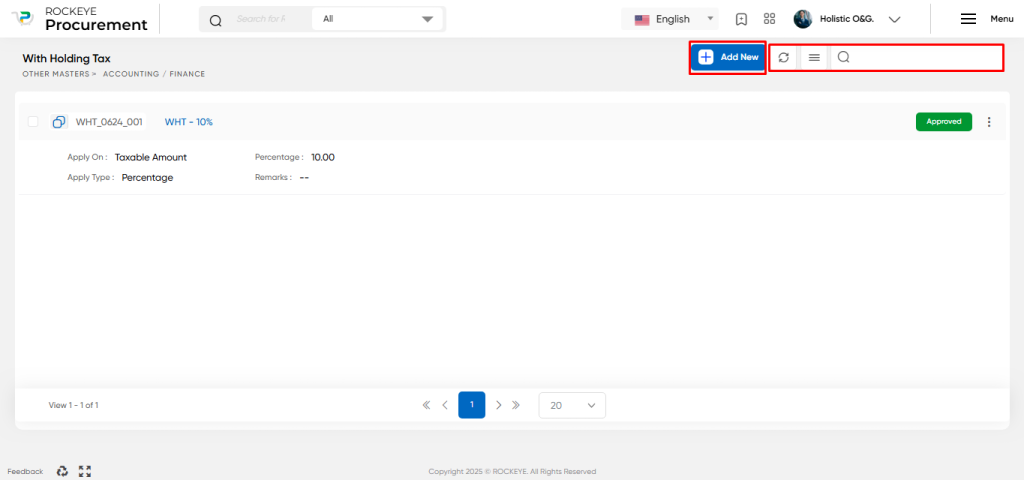

In a procurement system, the listing of withholding tax (WHT) typically includes various features and options to manage and view the withholding tax information. Based on the details provided, here is an overview of the listing options for withholding tax in a procurement system:

- Refresh: This option allows users to refresh the listing of withholding tax records, ensuring that the latest information is displayed.

- Sync with WHT of FINAS: This extra option enables users to synchronise withholding tax information from the FINAS (Financial Accounting System) into the procurement system. It ensures that the withholding tax data is up-to-date and consistent across both systems.

- Search: The search functionality allows users to search for specific withholding tax records based on criteria such as WHT code, WHT name, or other relevant attributes. This feature helps users quickly locate and retrieve the desired withholding tax information.

- Card View: The listing of withholding tax records is typically presented in a card view format. Each card displays essential details related to the withholding tax, including:

- WHT Code: A unique code assigned to each withholding tax type or category.

- WHT Name: The name or description of the withholding tax.

- Apply on: Specifies whether the withholding tax is applied to the taxable amount or the net amount of the payment.

- Apply Type: Indicates the type of withholding tax calculation, such as a percentage or a fixed amount.

- Percentage: The percentage value used for calculating the withholding tax amount.

- Remark: Any additional notes or comments related to the withholding tax.

- Activity Log: Provides a log of activities or changes made to the withholding tax record, allowing for transparency and audit trails.

The listing functionality in a procurement system helps users effectively manage and view the withholding tax records. It provides a user-friendly interface with features like synchronization, search capabilities, card view with essential details, and additional options for record management and reporting. These features streamline the process of working with withholding tax information within the procurement system.

Recording & Update:

Withholding tax can be created in a procurement system using two different methods: fetching from the FINAS system or creating it manually within the procurement system.

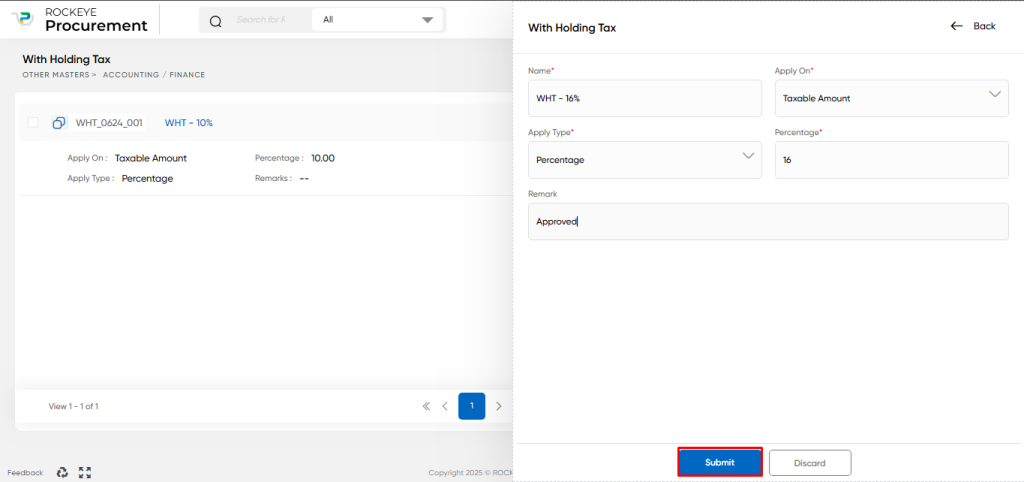

If a procurement user needs to manually create a withholding tax master in the procurement system, here are the key fields they would typically need to fill:

- Name: Provide a descriptive name for the withholding tax master. This name helps identify the withholding tax type or category.

- Apply on: Specify whether the withholding tax is to be applied on the taxable amount or the net amount of the transaction. This determines the base on which the withholding tax calculation will be performed.

- Apply Type: Choose the type of withholding tax calculation, which can be either fixed or percentage-based. This determines how the withholding tax amount will be calculated.

- Percentage: If the Apply Type is set to a percentage, enter the percentage value to be used for calculating the withholding tax amount. This value represents the portion or rate of the transaction amount that will be withheld as tax.

- Remark: Provide any additional remarks or notes related to the withholding tax master. This field allows users to add relevant information or details about the withholding tax type, such as specific conditions or regulations.

Once the withholding tax master is manually created in the procurement system, it can be used in transactions as needed. The system allows the procurement user to apply the withholding tax master to transactions and calculate the withholding tax amount based on the specified rules.

It’s important to note that once the withholding tax master is fetched from the FINAS system, it typically cannot be updated by the procurement user within the procurement system. However, if the withholding tax master is created manually in the procurement system, the user will have the ability to update it if any changes or modifications are required.

The ability to create and update withholding tax masters in the procurement system allows for flexibility in managing tax requirements and ensures accurate withholding tax calculations for procurement transactions.

The user can perform the following actions in this section:

- Submit: This option allows the user to publish the transaction information. If the system has an approval flow, the maker will submit the information, and it will be sent to the approval authority or checker for approval.

- Discard: This option allows the user to discard the transaction before saving it.

Key Notes on Withholding Tax:

- Withholding Tax mainly will get fetched from the FINAS system in Procurement System