Tax Group

Introduction/Purpose:

The Tax Group Master in a procurement system allows organisations to define and manage tax-related information for goods and services. It streamlines tax calculations and reporting processes. It synchronises with the FINAS system for accurate financial ledger postings.

Tax rules are based on specific goods and conditions applied to purchase transactions. Tax percentages are defined, and calculation methods can be chosen (taxable value, previous value, etc.). Overall, it simplifies tax management, ensures accuracy, and facilitates compliance and financial reporting.

Dependency:

The Tax Group Master in a procurement system serves as a critical dependency for several key aspects of tax management within the procurement process. Here are some of the dependencies and interconnections:

- Tax Compliance: The Tax Group Master ensures compliance with tax regulations by allowing organisations to define tax rules and rates that align with applicable tax laws. It enables the proper application of taxes based on specific goods, conditions, and jurisdictions. Failure to adhere to tax regulations can result in penalties, fines, or legal consequences. The Tax Group Master ensures that procurement transactions comply with tax requirements, reducing compliance risks.

- Financial Ledger Integration: The Tax Group Master often integrates with the organisation’s financial accounting system, such as FINAS. This integration is crucial for accurate financial ledger postings related to taxes. By synchronising with the financial system, the Tax Group Master ensures that tax-related transactions are correctly recorded, providing accurate financial reporting and supporting auditing processes.

In summary, the Tax Group Master is highly dependent on accurate tax data, integration with financial systems, adherence to tax regulations, and reliable data sources. It plays a central role in facilitating accurate tax calculations, ensuring compliance, integrating with financial systems, generating tax reports, and managing tax-related processes within the procurement system.

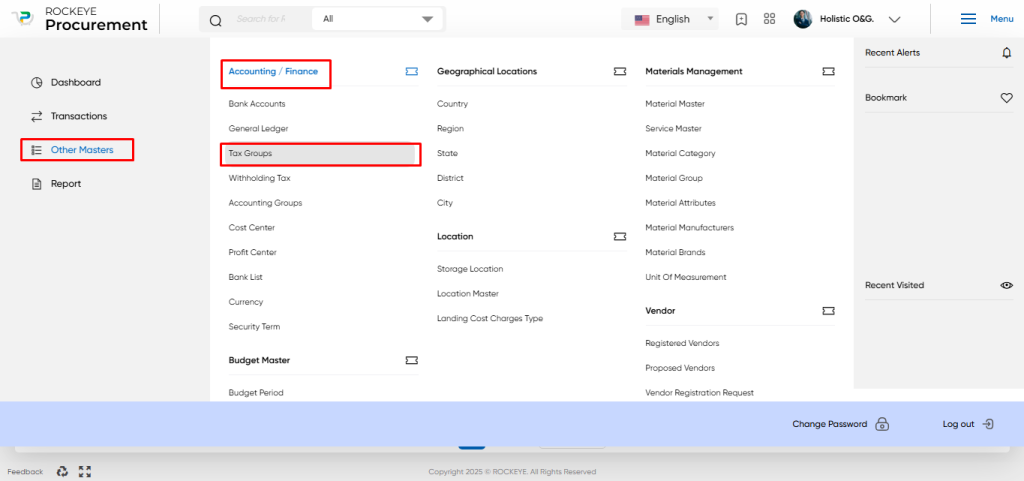

How to Navigate:

The navigation to record a tax group in a procurement system typically involves the following steps:

- Click on the main navigation icon: The main navigation icon may be located in the top right corner of the screen. Clicking on this icon will open the navigation menu, which typically includes links to various sections of the procurement system.

- Click on the Other Masters section: The Other Masters section is located under the left section of the screen; clicking on this section will display a list of masters related to procuring.

- Find the Accounts/Finance section: The Accounts/Finance section is located in the list of Master under the Master section. Clicking on this section will display a list of masters related to accounts/finance.

- Click on the Tax Group link: The Tax Group link is located under the Accounts/Finance section. After clicking on this link, you can navigate to Tax Group in the listing, and from that, you can easily upload new transactions into the system.

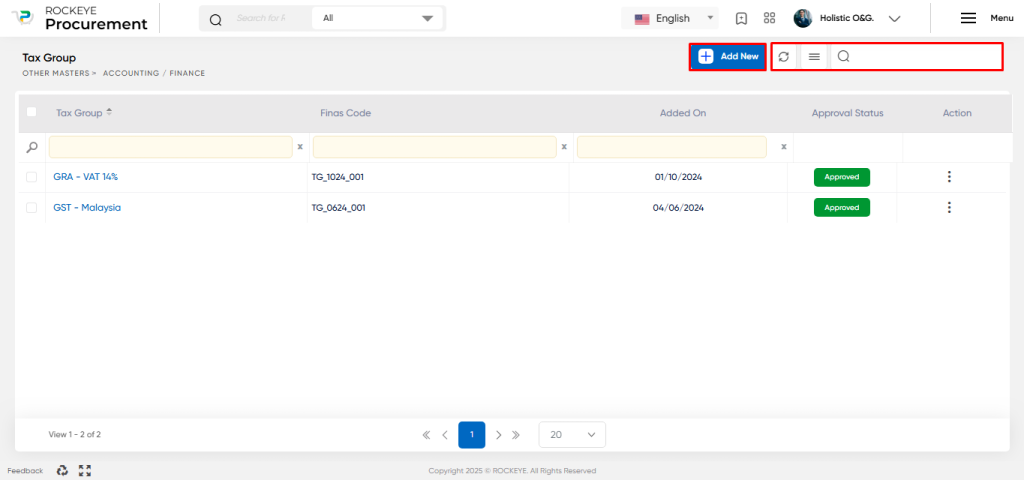

Listing:

The Tax Group Listing is a feature within a procurement system that provides an organised view of the tax groups defined in the system. It offers various functionalities for managing and monitoring tax groups. Here’s a breakdown of the key elements typically found in a tax group listing:

- Refresh: The refresh function allows users to update the tax group listing with the latest information. By clicking the refresh button, the system retrieves and displays the most recent tax group data, ensuring users have the most up-to-date information at their disposal.

- Search: The search feature enables users to easily locate specific tax groups within the Tax Group Listing. Users can enter search criteria such as tax group names, FINAS codes, or other relevant parameters. This functionality streamlines the process of finding specific tax groups within the system.

- Sync with Tax Group from FINAS: This option allows for the synchronisation of tax group data between the procurement system and the FINAS (Financial Accounting System) integration. By selecting this option. This ensures consistency and accuracy in tax-related information across both systems.

- Listing Information: The Tax Group Listing typically displays essential details for each tax group. This includes information such as the tax group name, FINAS code, the date the tax group was added, and the approval status of the tax group within the procurement system. In Other Information, you will get the option to check the activity log for any specific tax group.

The Tax Group Listing offers a user-friendly interface that allows procurement system users to efficiently navigate and manage tax groups. It enables quick searching and synchronisation with FINAS, displays relevant tax group information, and provides an activity log to track changes made to tax groups over time.

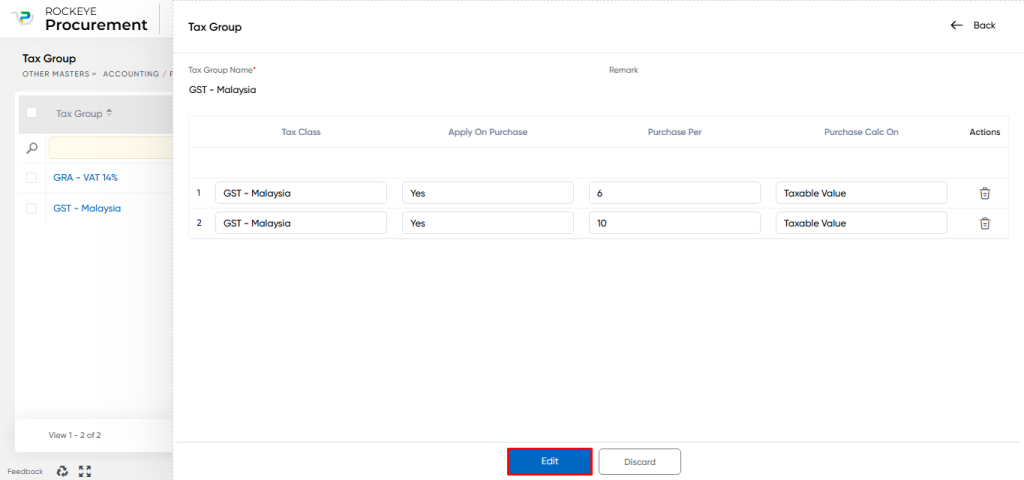

Recording & Update:

In the procurement system, there may be scenarios where it becomes necessary to add or update a tax group locally within the system, even though the tax groups are primarily fetched from the FINAS system. When adding or updating a tax group in the procurement system, the following details are typically required:

- Tax Group Name: A unique name or identifier for the tax group being added or updated.

- Remark: Additional comments or notes that provide further details or context about the tax group.

- Tax Class: Selection of a tax class from a predefined list. The tax class categorises the tax group based on specific criteria, such as regional tax regulations or tax types.

- Apply on Purchase: An option to specify whether the selected tax class should be applied in the tax group to purchase transactions. It can be set as “Yes” or “No” depending on the applicability of the tax group to purchases.

- Purchase Percentage: The tax percentage to be applied for purchases within the tax group. This determines the amount of tax to be levied on the taxable value of the goods or services being procured.

- Purchase Calculate On: This option defines the calculation method to be used for applying taxes to purchases. It specifies whether the tax should be calculated based on the previous value, previous total, or taxable value.

It’s important to note that when adding or updating a tax group in the procurement system, these changes are stored at the local level and do not get synchronized or updated back to the FINAS system. The procurement system typically fetches tax group records from FINAS, but any modifications made within the procurement system remain confined to the local environment.

The user can perform the following actions in this section:

- Submit: This option allows the user to publish the transaction information. If the system has an approval flow, the maker will submit the information, and it will be sent to the approval authority or checker for approval.

- Discard: This option allows the user to discard the transaction before saving it.

Key Notes Tax Group:

- The tax group mainly will get fetched from the FINAS system in the procurement system.