Purchase Voucher

Introduction/Purpose:

A purchase voucher entry in a procurement system is a record of a transaction that documents the purchase of goods or services from a vendor. When a company buys goods or services from a supplier, the supplier will issue a purchase invoice to the company detailing the items purchased, the price, and any applicable taxes or fees.

In a procurement system, the purchase invoice entry is typically created when the company receives the invoice from the supplier. The entry includes information such as the date of the transaction, the supplier’s name and address, the purchase order number, the invoice number, material or service which was acquired and the total amount of the invoice, and any other relevant details.

Dependency:

To record a purchase invoice in a procurement system, there are several dependent master or key elements that are required in the form. These elements include:

- Invoice number

The invoice number is a unique identifier assigned to the purchase invoice by the supplier. It is used to track and reference the invoice in the procurement system.

- Supplier/vendor details:

The form must have accurate and up-to-date supplier/vendor details, including the name, address, and contact information of the supplier in the master module

- Item/Material/Service details

The form must include details of the items purchased, including the quantity, unit price, and total price, where Items are master and connected with the inventory system (if it’s an integrated solution) - Tax details

The form must include tax details such as the tax rate, tax amount, and any exemptions or exceptions, where we have to pull VAT & WHT master (from the Finance system if it’s integrated)

- Payment terms

The form must include payment terms, including the due date and any applicable discounts or penalties for early or late payment.

- Receipt details

The form must include details of the receipt of goods or services, including the date of receipt, quantity received, and any discrepancies or damages, aligned to this procurement system, have GRN & Service Confirmation module and purchase invoice generated aligned to this.- Goods Receipt: generally it’s accepted by the user department using the inventory module.

- Service Completion: it’s added by the user department in the procurement system itself.

In summary, these dependent master or key elements are necessary in the form to ensure that the purchase invoice is accurately recorded in the procurement system and can be properly tracked and referenced for future purposes.

Process Flow:

How To Navigate:

The navigation to record a purchase invoice in a procurement system typically involves the following steps:

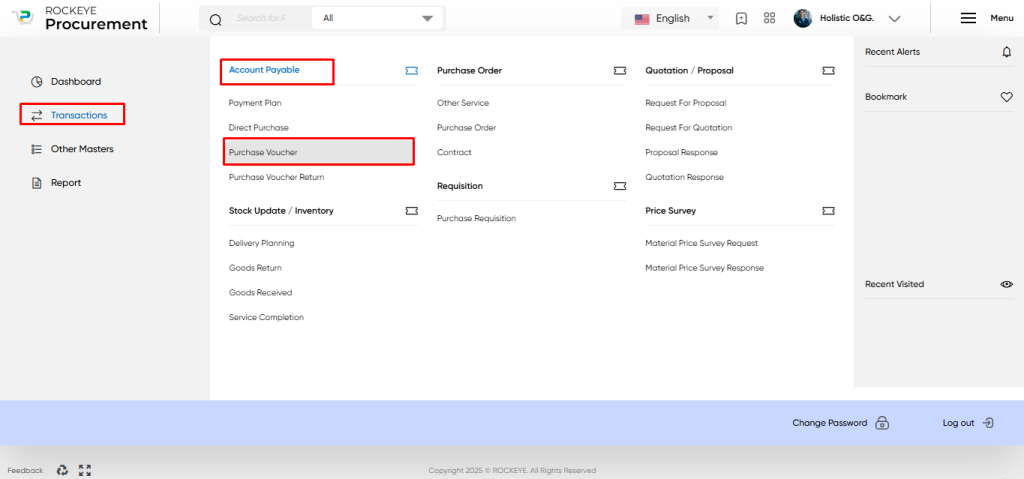

- Click on the main navigation icon: The main navigation icon may be located in the top right corner of the screen. Clicking on this icon will open the navigation menu, which typically includes links to various sections of the procurement system.

- Click on the transaction section: The transaction section is located under the left section of the screen clicking on this section will display a list of transactions related to procuring.

- Find the payable section: The payable section is located in the list of transactions under the transaction section. Clicking on this section will display a list of transactions related to payables and invoices.

- Click on the purchase invoice link: The purchase invoice link is located under the payable section, after clicking on this link you can navigate to the purchase invoice listing and from that, you can easily upload new transactions into the system.

Listing:

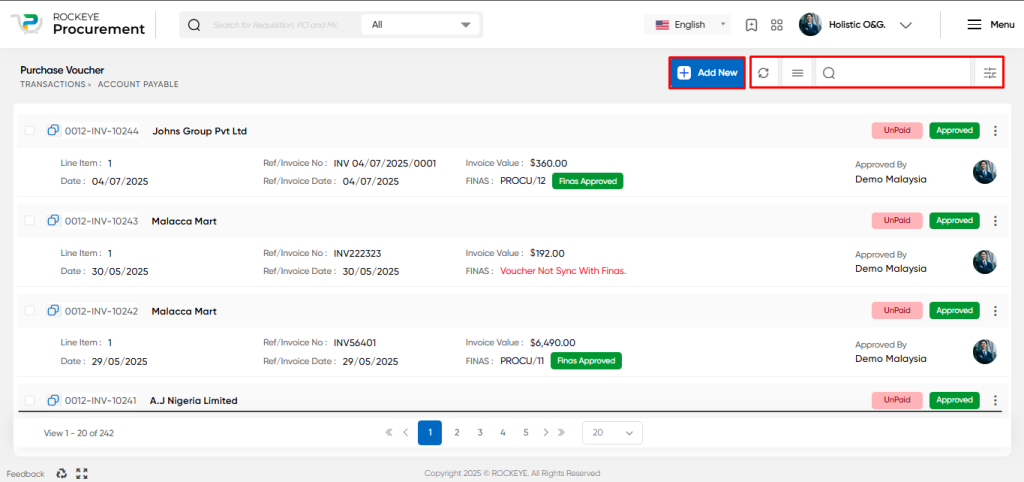

The purchase invoice listing is an essential feature of a procurement system that allows users to view and manage all recorded purchase invoices. The key features of the purchase invoice listing include:

- Record Filter

The purchase invoice listing may include a filter option that allows users to filter the list of invoices based on specific criteria, such as date range, payment status, vendor name, or approval status.

- Transaction Search

The purchase invoice listing may include a search function that allows users to search for specific invoices by transaction number, supplier invoice number, financial document number, or other keywords.

- Export transaction

The purchase invoice listing may include an export transaction option that allows users to export the list of invoices to a spreadsheet or other file format for further analysis or reporting. - Extended features for each transaction

The purchase invoice listing includes extended features for each transaction such as print, view, activity log, tracking history, and more.

- Listing view

The purchase invoice listing may display each invoice in a card format view that includes key information such as transaction number, amount, supplier invoice number, invoice date, financial document number, approval authority name, payment status, vendor name, and approval status of the transaction.

- Payment status: The purchase invoice listing displays the payment status of each invoice, indicating whether it has been paid, unpaid, or partially paid.

- Approval status: The purchase invoice listing displays the approval status of each invoice, indicating whether it has been approved or not.

In summary, the purchase invoice listing is a crucial feature of a procurement system that provides users with an overview of all recorded purchase invoices and allows them to filter, search, export, and manage invoices efficiently. It also includes extended features for each transaction and displays key information such as payment status, vendor name, and approval status in a card format view.

Recording & Update:

Purchase invoice recording in a procurement system typically involves two main methods:

Procurement Flow: In this method, the purchase invoice is generated based on the goods or services received against a purchase order. The procurement system automatically matches the invoice to the purchase order and verifies the details such as the quantity, price, and other terms and conditions. The user can then review and approve the invoice for payment.

Off-the-Shelf Invoice: In this method, the purchase invoice is generated directly without a purchase order. This may happen when a business needs to make an off-the-shelf purchase or when there is an emergency purchase that needs to be made. The user can manually enter the details of the invoice into the procurement system and verify the details such as the supplier name, invoice date, item details, taxes, and other terms and conditions.

In both methods, the procurement system provides functionality to record purchase invoice information. This includes fields such as supplier name, invoice date, invoice number, payment terms, item details, taxes, and other relevant information. The user can also attach supporting documents such as receipts or purchase orders to the invoice record for future reference. Once the invoice is recorded, the procurement system allows the user to track the invoice status, view payment history, and generate reports for analysis. This functionality helps businesses to manage their accounts payable process efficiently and ensures timely payment of invoices.

The purchase invoice entry into a procurement system is typically divided into three parts which is mentioned below.

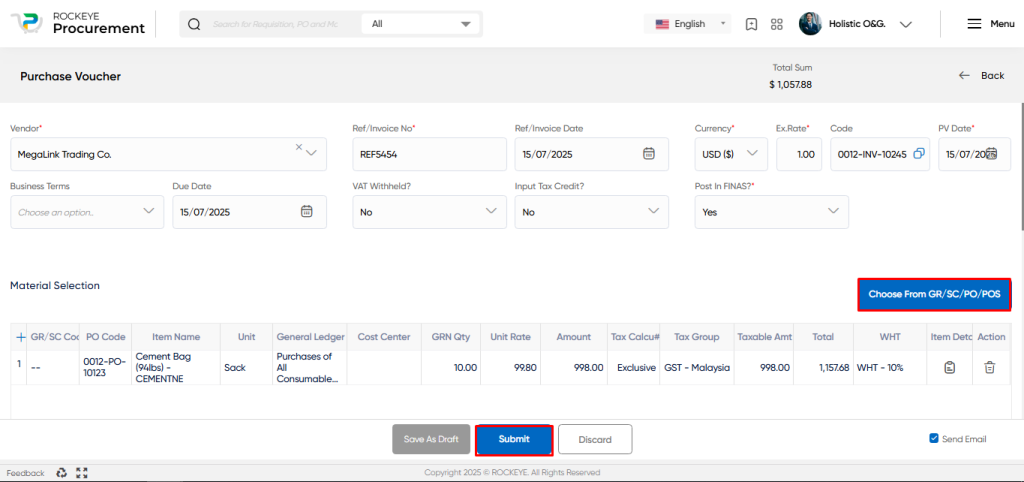

Basic Information

The first part of the purchase invoice entry displays information related to the transaction, this will include below fields.

- Supplier: The user needs to select the supplier name from the dropdown list. The dropdown list may include all the active suppliers in the procurement system and recorded under the master section.

- Reference Invoice: The user needs to enter the reference invoice number and reference invoice date of the purchase invoice which is provided by the supplier and helpful for tracking in future.

- Transaction Currency: The user needs to select the transaction currency of the purchase invoice. If the transaction currency is in foreign currency, the exchange rate value needs to be entered.

- Recording Document: The procurement system automatically generates a document number for the purchase voucher entry along with the recording date, by default the system will use the current date and if users want change that they can do as per need.

- Business Term: The user needs to select the business term and due date of payment based on the business term agreed with the supplier.

- Taxation info: The user needs to enter the taxation fields like below and this may impact on final calculation based on entry

- VAT withheld

VAT (Value Added Tax) withheld refers to the amount of VAT that a buyer deducts from the payment made to a supplier in certain circumstances - Input Tax Credit

Input Tax Credit (ITC) is a mechanism that allows businesses to claim a credit for the VAT they have paid on their purchases

- VAT withheld

- Goods & Service Selection

- The user needs to select on button if they want to record sales invoice based on procurement flow that means from GRN (Goods Receipt Note) or SC (Service Completion) which is confirmed by the user department, the system will show all the receipts which are not invoiced till now.

- Here the payable officer is able to see the document number, purchase order number, material name and quantity which is received and he/she selects that value for generating the purchase invoice into the system.

Material / Service Information

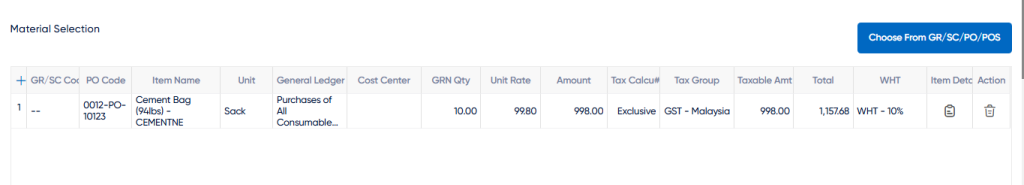

The second part of the purchase invoice entry displays information related to the items purchased, this will include the below fields.

- Reference document number This is a reference number provided by the supplier to confirm that the goods or services have been received by the user.

- Purchase Order No. This is the purchase order number that was sent to the supplier and is associated with the goods or service receipt.

- Item Name This is the name of the material or service being invoiced.

- General Ledger This is the name of the general ledger account that will be debited for the cost of the material or service.

- Cost Center This is the cost center to which the cost of the material or service will be allocated.

- Quantity This is the quantity of the material or service that was received by the user.

- Unit Rate This is the price per unit of the material or service.

- Gross Amount This is the total cost of the material or service before taxes are applied.

- Tax calculation This field indicates whether taxes are applicable or not for the line item.

- Tax group This is the tax group associated with the line item, which indicates the percentage of tax that needs to be applied.

- Taxable amount This is the amount of the line item that is subject to tax.

- Net payable value This is the total amount payable for the line item, including taxes.

- Withholding tax group This field indicates the withholding tax group (if applicable) for the line item.

- Storage Location This includes additional information about the material or service being invoiced, such as specifications or delivery location.

- Action buttons These buttons provide functionality to remove or add a line item.

Overall, the middle section of a purchase invoice provides detailed information about the goods or services being invoiced, including cost, tax information, and other relevant details.

Summary Information

The third part of the purchase invoice entry provides a summary of the transaction, and showing below information, and some additional information which is related with transaction.

Attachment

This field allows the user to upload any invoice copy or other documents related to the purchase.

- Remark

This field is used to put internal remarks or notes related to the purchase invoice.

- Description

This field allows the user to add any specific description related to the purchase invoice.

- Summary Table

The summary block provides information about Non-Taxable Values, Taxable Value, Tax Value, Net Amount, VAT Withheld by Vendor, WHT, and Net Payable to Vendor. The user can review this information to validate the calculations and ensure that the net payable value matches the supplier’s invoice.

The user can perform the following actions in this section:

- Save as Draft:

This option allows the user to save the transaction information in draft mode and publish it later. This is helpful if the user wants to review the information before submitting it for approval.

- Submit:

This option allows the user to publish the transaction information. If the system has an approval flow, the maker will submit the information, and it will be sent to the approval authority or checker for approval.

- Discard:

This option allows the user to discard the transaction before saving it.

Key Notes Purchase Invoice:

- It is possible to generate an Off the shelf Purchase Voucher in Procurement, where no Procurement flow needs to be followed

- The Purchase Invoices generated by Procurement will be automatically created in Finas Purchase Voucher.

- The approval flow for Purchase Voucher in Finas will be followed, and if it is declined, the status will be updated in Procurement PV Voucher.

- The Allocation Status of Finas Purchase Voucher will be updated in Procurement Purchase Voucher.

- Based on the Payment Plan defined in the Purchase Voucher, a Payment Voucher will be generated in Finas, and the Voucher number will be updated in the Procurement Purchase Invoice as a reference in Payment Plan.

- Vendor Portal Point

Overall, the integration between Procurement and Finas can still help streamline the procurement and accounting process, even for Off the shelf purchases.

Key Notes General:

- Once the purchase voucher is added and fully approved by the approval authority, the record is automatically posted into the finance and accounting application if the procurement system is integrated with it.

- The approval authority can decline records a number of times before approval, and each time, they need to provide notes.

- The notes are visible on the purchase invoice entry screen for the maker.

- The system also has functionality for automatic email notifications.

- The approval authority will receive a notification when the transaction is coming to their desk for approval.