Accounting Group

Introduction/Purpose:

In a procurement system, the Accounting Group Master is a feature or functionality that allows organizations to define accounting General Ledgers Groups within the system. An accounting group is a categorization or classification of financial transactions based on specific criteria, such as cost of sale, purchase, inventory adjustment, default cost and profit, tax group, and other relevant factors.

The Accounting Group Master is used to connect accounting groups with the Material/Service master data. Each material or service within the procurement system can be associated with a specific accounting group. This association ensures that all financial transactions related to a particular material or service are posted to the respective general ledger accounts defined in the accounting group master.

Dependency:

To record the Accounting Group dependencies in a procurement system, the following elements need to be defined:

- General Ledgers: Define specific General Ledger accounts for purchase, sale, and inventory transactions, ensuring accurate recording in the General Ledger.

- Default Cost/Profit Center: Establish default cost and profit centers to attribute procurement transactions to the relevant departments or divisions, enabling cost allocation and performance analysis.

- Default Tax Group/WHT Group: Define default tax and withholding tax groups to apply the correct tax rates and regulations to procurement transactions, ensuring compliance and accurate financial reporting.

In summary, These dependencies ensure accurate financial recording, enable cost allocation and performance analysis, and ensure compliance with tax regulations. By establishing these dependencies, organizations can streamline their procurement processes and maintain accurate financial reporting throughout the system.

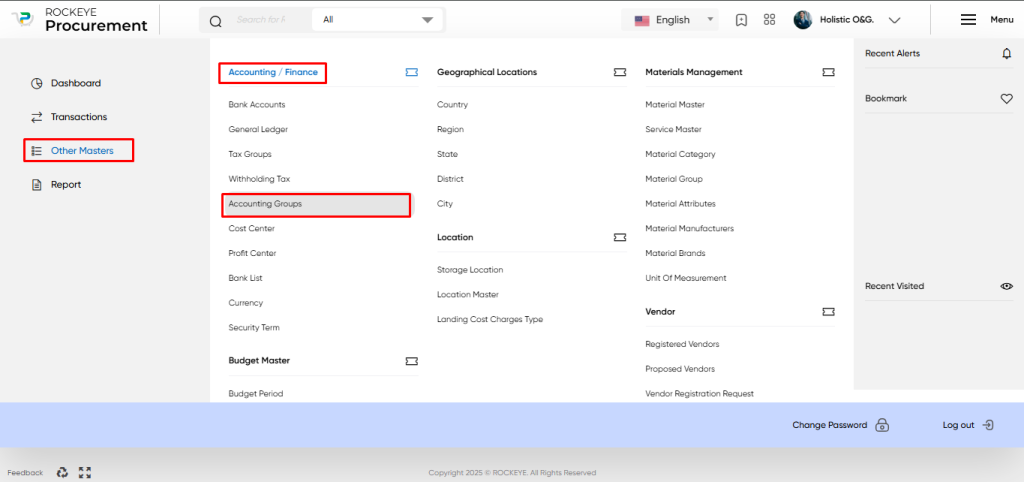

How To Navigate:

The navigation to record an Accounting Group in a procurement system typically involves the following steps:

- Click on the main navigation icon: The main navigation icon may be located in the top right corner of the screen. Clicking on this icon will open the navigation menu, which typically includes links to various sections of the procurement system.

- Click on the Other Master section: The Other Master section is located under the left section of the screen; clicking on this section will display a list of masters related to procuring.

- Find the Accounts/Finance section: The Accounts/Finance section is located in the list of Master under the Master section. Clicking on this section will display a list of Master related to accounts/finance.

- Click on the Accounting Group link: The Accounting Group link is located under the Accounts/Finance section. After clicking on this link, you can navigate to Accounting Group in the listing, and from that, you can easily upload new transactions into the system.

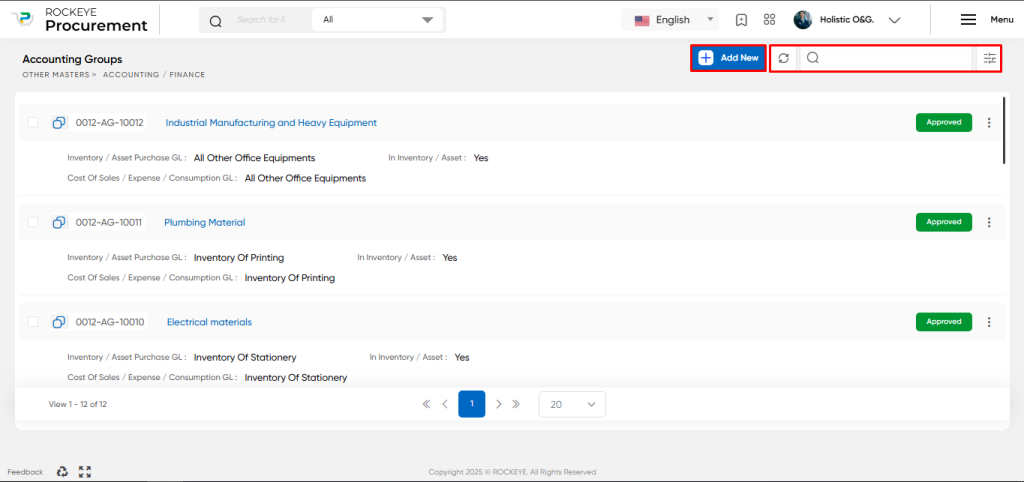

Listing:

The key features of the Accounting Group listing, which includes search, refresh, and card view, are as follows:

- Record Search: The Accounting Group listing may include a search function that allows users to search for specific Accounting Group master by Code, or other keywords.

- Listing view; The Accounting Group listing may display each Code in a card format view that includes key information such as Group Name, Group Code, GL Code, and Approval Status.

Overall, the Accounting Group listing with search, refresh, and card view features provide a user-friendly interface for accessing and managing accounting groups. It allows users to easily search for specific groups, view essential details such as name, code, and GL codes for purchases and sales, and track approval statuses.

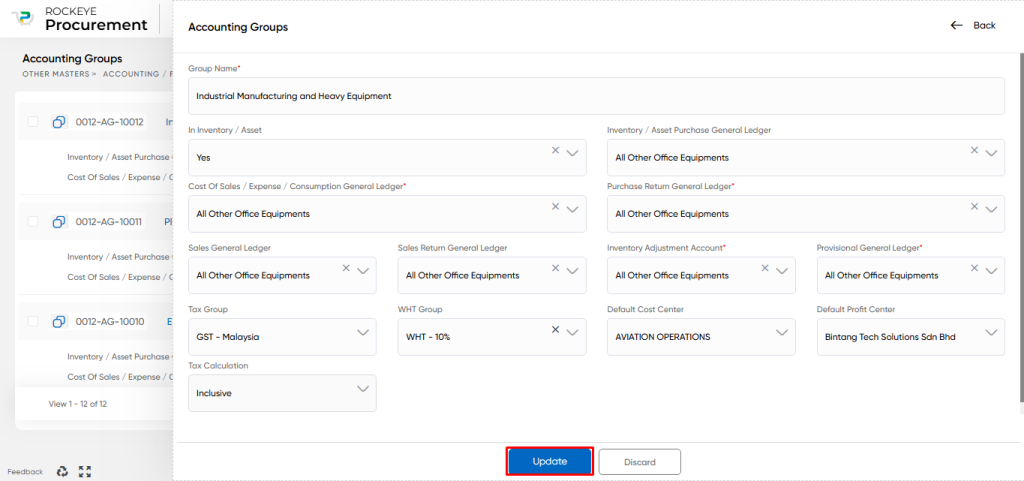

Recording & Update:

Accounting Group Recording and Update Transactions involve capturing and maintaining the necessary information for various accounting-related aspects. Here’s a breakdown of the key components involved:

- Group Name: Each accounting group is assigned a unique name for identification and categorization purposes within the system.

- In Inventory/Asset: This attribute specifies whether the accounting group is associated with inventory or assets. It helps determine the appropriate accounting treatment for related transactions.

- Inventory/Asset Purchase General Ledger: This refers to the General Ledger account code or ledger specifically designated for recording purchases of inventory or assets.

- Cost Of Sales / Expense / Consumption General Ledger: This represents the General Ledger account used to record costs associated with sales, expenses, or consumption of goods or services.

- Purchase Return General Ledger: The General Ledger account dedicated to recording returns of purchased items is specified here.

- Sales General Ledger: This denotes the General Ledger account used to record revenue generated from sales transactions.

- Sales Return General Ledger: The General Ledger account assigned for recording returns or refunds related to sales transactions.

- Inventory Adjustment Account: This indicates the General Ledger account where adjustments to inventory quantities or values are recorded.

- Provisional General Ledger: Indicates the default general ledger account to be used for provisional or temporary postings associated with this accounting group

- Tax Group: The Tax Group specifies the tax-related details associated with the accounting group, such as tax rates, rules, and regulations applied to relevant transactions.

- WHT Group: The WHT (Withholding Tax) Group defines the withholding tax details, such as rates and requirements, applicable to transactions involving the accounting group.

- Default Cost Centre: This identifies the default cost centre or department to which costs are allocated for transactions associated with the accounting group.

- Default Profit Centre: The Default Profit Centre represents the primary profit centre or division associated with revenue generated from transactions related to the accounting group.

- Tax Calculation: Indicates how tax is to be applied on the transaction amount. This setting defines whether the tax amount is included in the transaction total or calculated in addition to it.

In the recording and updating of transactions, these accounting group attributes are utilized to ensure accurate and consistent financial recording within the procurement system. Each transaction is assigned the relevant accounting group, enabling the system to automatically post the transactions to the appropriate General Ledger accounts based on the specified attributes. This ensures proper financial tracking, reporting, cost allocation, and compliance with tax and accounting standards.

The user can perform the following actions in this section:

- Submit: This option allows the user to publish the transaction information. If the system has an approval flow, the maker will submit the information, and it will be sent to the approval authority or checker for approval.

- Discard: This option allows the user to discard the transaction before saving it.