Purchase Voucher Return

Introduction

A Purchase Voucher Return transaction is utilized when goods or services are returned to a vendor due to issues such as defects or non-compliance with the terms of the original contract. This transaction is essential for accurately documenting the return process, ensuring that both the organization and the vendor are aligned on the return details.

When initiating a Purchase Voucher Return, the organization records specific information regarding the items being returned, including the vendor details, reference numbers from the original purchase, and the quantity of goods or services being sent back. This process helps to maintain transparency in the procurement cycle and ensures that the vendor is properly notified of the return.

Moreover, the transaction plays a crucial role in adjusting future payments or credits owed to the organization, thereby streamlining the financial reconciliation process. The Purchase Voucher Return not only serves as a formal record of the return but also reinforces the organization’s commitment to upholding quality standards and contractual obligations in vendor relationships.

In summary, the Purchase Voucher Return transaction is integral to maintaining effective procurement practices, facilitating communication with vendors, and ensuring compliance with established contractual terms.

Dependency

To process a Purchase Voucher Return, certain dependencies exist that must be addressed to ensure a smooth transaction. The key components that require attention include reference to the original purchase voucher and communication with the vendor regarding the return.

- Original Purchase Voucher: The return process necessitates a reference to the original purchase voucher. This reference is crucial for tracking the initial transaction and ensuring that the return is accurately recorded in the procurement system. Without this reference, the return cannot be processed, as it establishes the legitimacy of the transaction.

- Vendor Communication: Effective communication with the vendor is essential for processing the return. This involves notifying the vendor about the returned goods or services and any relevant details regarding the reason for the return. Maintaining clear communication ensures that the vendor understands the circumstances and can adjust future transactions accordingly.

In summary, managing the Purchase Voucher Return involves critical dependencies that highlight the importance of referencing the original purchase and maintaining open communication with the vendor. Addressing these components is essential for successful transaction processing and maintaining good vendor relationships.

Process Flow

Need to add the process flow

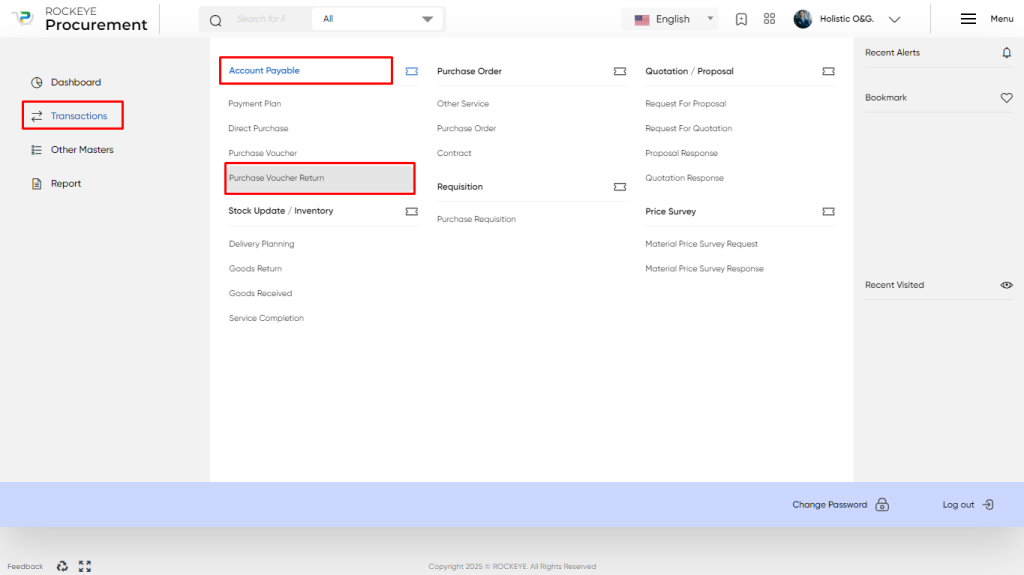

How To Navigate

The navigation to record a Purchase Voucher Return in the procurement system typically involves the following steps:

- Access the Main Navigation Menu: Begin by locating the main navigation icon, usually positioned in the top right corner of the screen. Clicking this icon will reveal the main navigation menu containing various sections of the procurement system.

- Select the Transactions Section: From the main navigation menu, click on the Transactions section. This section will display a list of transaction categories related to procurement activities.

- Find Accounts Payable Section: Within the Transactions menu, locate the “Accounts Payable Section” to view relevant purchase voucher-related functions.

- Select the Purchase Voucher Return Option: In the Purchase Voucher section, look for the Purchase Voucher Return link. By clicking on this link, you will navigate to the interface specifically designed for processing Purchase Voucher Returns, where you can initiate the return transaction.

Listing

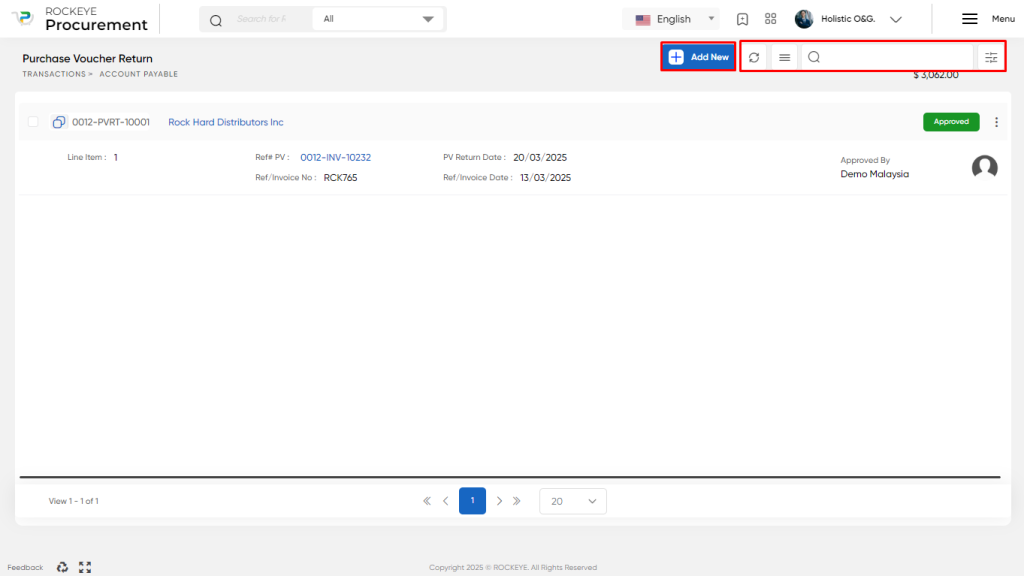

The Purchase Voucher Return listing is a vital feature of a procurement system that enables users to view and manage all recorded Purchase Voucher Returns. The key features of the Purchase Voucher Return listing include:

- Show All Listing: The Purchase Voucher Return Listing includes a “Show All” option that allows users to view all recorded purchase voucher returns without any filters or restrictions. This feature ensures comprehensive visibility of all returns for better management and oversight.

- More Options: The Purchase Voucher Return Listing may include a “More Options” menu, providing users with additional functionalities such as printing selected transactions, accessing detailed views, or performing bulk actions on multiple returns for enhanced efficiency.

- Export Transactions: The Purchase Voucher Return Listing features an export option that enables users to download the list of returns in various formats, such as spreadsheets or PDF files. This functionality allows for easy sharing and further analysis of return data.

- Search Transactions: The Purchase Voucher Return Listing incorporates a search function that allows users to find specific returns using transaction numbers or other relevant keywords. This feature enhances navigation and aids in quickly locating pertinent information.

- Filter Transactions: The Purchase Voucher Return Listing includes a filter option that allows users to narrow down the displayed returns based on criteria such as date range, vendor name, or return status. This capability enables more efficient management and tracking of returns.

In summary, the Purchase Voucher Return listing is a crucial feature of a procurement system that provides users with an overview of all recorded purchase voucher returns. It allows users to filter, search, export, and manage the returns efficiently. Additionally, it includes extended features for each transaction and displays key information, such as Return Status and Vendor Communication, in a card format view.

Recording & Update

Purchase Voucher Return recording and updating transactions are essential steps in the procurement process, ensuring that all returns are properly documented and tracked.

In the procurement flow, the process begins when goods or services are identified as defective or not in compliance with the contract terms. The procurement team then initiates a Purchase Voucher Return transaction to formally document the return of these goods or services to the vendor. This process is critical for notifying the vendor and ensuring that future payments are adjusted accordingly.

For off-the-shelf procurement where direct purchases are made, the need for a Purchase Voucher Return becomes paramount when there is a discrepancy or issue with the received items. In such cases, recording and updating these transactions are vital for maintaining accurate financial records and ensuring effective communication with vendors.

Overall, the recording and updating of Purchase Voucher Return transactions are crucial for maintaining transparency, accountability, and efficient management of the procurement process.

The Purchase Voucher Return entry into a procurement system is typically divided into three parts, which are mentioned below

- Total Sum: Shows the total monetary value of items in the return transaction. This adjusts as items and quantities being returned are added or removed.

- Ref PV: This is a reference to the original Purchase Voucher related to the items being returned, helping with traceability and verification.

- Vendor: Specifies the vendor involved in the original transaction. Correct vendor selection is essential for accurate return processing.

- Ref/Invoice No: The original invoice number for the purchase, used for tracking and reconciling the return with the initial transaction.

- Ref/Invoice Date: The date when the original invoice was issued, helping confirm timelines for eligibility of the return.

- Currency: The currency in which the transaction occurred (e.g., Nigerian Naira). Ensures that financial calculations are consistent with the original purchase.

- Ex. Rate: The exchange rate used if the currency is different from the company’s base currency, impacting accurate financial reporting.

- Code: A unique identifier for the Purchase Voucher Return, enabling quick retrieval in the system.

- Return Date: The date the return transaction is recorded. Helps track the return’s timeline.

- Business Terms: Any terms and conditions applicable to the return, including payment or settlement terms.

- Due Date: The deadline by which the return transaction should be completed, assisting in managing the return process on schedule.

- VAT Withheld?: Indicates whether VAT has been withheld on the transaction, relevant for tax compliance.

- Input Tax Credit?: Specifies whether input tax credit is available, important for tax-related calculations.

Material Selection:

- Material Name: Specifies the name of the material or item being returned. Identifying each item ensures that returns are processed accurately and matched with the original purchase.

- General Ledger: Indicates the general ledger account to which the cost of the returned item will be credited. This helps maintain accurate financial records by tracking expenses associated with returned items.

- Cost Center: Refers to the cost center responsible for the material return. This enables tracking of expenses and allocations related to the return at a more granular departmental level.

- Balance Quantity: Displays the remaining quantity of the item from the original purchase order that has not yet been returned. It helps ensure that only eligible quantities are returned based on the original transaction.

- Return Quantity: Specifies the quantity of the item being returned. Accurately inputting this value is essential to adjust inventory levels and update financial records correctly.

- Unit Rate: Shows the per-unit rate of the item being returned, as per the original purchase agreement. This rate is used to calculate the refund amount for the returned items.

- Amount: Displays the total amount for the returned quantity, calculated based on the unit rate. It is essential for processing refunds or adjustments accurately.

- Tax Calculation: Specifies the tax calculation method applied to the returned items. This helps ensure compliance with tax regulations and accurate accounting.

- Tax Group: Identifies the tax group applicable to the returned items, such as VAT or sales tax. This is crucial for accurate tax reporting and compliance.

- Taxable Amount: Shows the portion of the return amount that is subject to tax. Ensures clear visibility of tax implications related to the returned items.

- Total: Reflects the final total, including any applicable taxes, for the returned items. It represents the amount to be refunded or credited to the customer/vendor.

- WHT (Withholding Tax): Indicates if any withholding tax applies to the return transaction. Helps maintain tax compliance and ensure that withholding tax is handled appropriately.

Other Information

- Non-Taxable Amount: The portion of the return that is not subject to tax, which reflects the value of items exempt from tax.

- Taxable Amount: The amount subject to tax, indicating the portion of the return that will incur tax liabilities.

- Tax Amount: The calculated tax on the taxable amount, which represents the tax owed or refundable due to the return.

- Round Off: Any rounding adjustments applied to the total amount, ensuring that final calculations are accurate and practical for transactions.

- Net Amount: The final amount after all deductions, including tax and adjustments, representing what will be credited or refunded.

- VAT Withheld by Vendor: The value-added tax withheld by the vendor on the returned items, important for tax compliance and record-keeping.

- WHT Amount: The withholding tax amount applicable to the return transaction, necessary for accurate tax reporting and compliance with regulations.

- Net Pay Amount: The total amount payable after all adjustments, representing the final financial figure that will be processed for the return.

User can perform the following actions

- Submit: This option enables users to finalize and record the Purchase Voucher Return in the system. Upon submission, all details are processed, and any necessary updates to inventory and financial records are made, ensuring compliance with organizational protocols.

- Discard: Users can select this option to cancel the current Purchase Voucher Return entry, removing any unsaved changes. This ensures that no erroneous or unintended data is recorded, maintaining the integrity of the procurement process.