Financial Accounting

Withholding Tax

Introduction/Purpose:

Withholding tax transfers tax payment responsibility from the recipient to the payer. The payer deducts tax and remits it to the authority, ensuring timely collection, deterring evasion, and simplifying compliance. It boosts revenue consistency and reduces non-compliance risk.

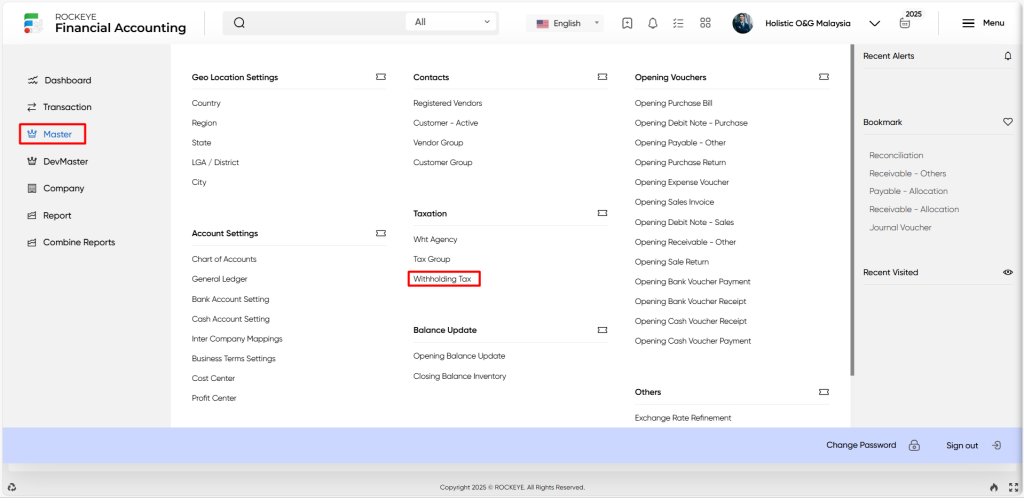

How To Navigate:

The navigation includes the following steps for viewing the withholding tax in the Financial Accounting system.

- Click on the master tab: The master can be accessed by clicking on the master tab on the side menu.

- Click on withholding tax: The withholding tax can be accessed by clicking it from the tax section.

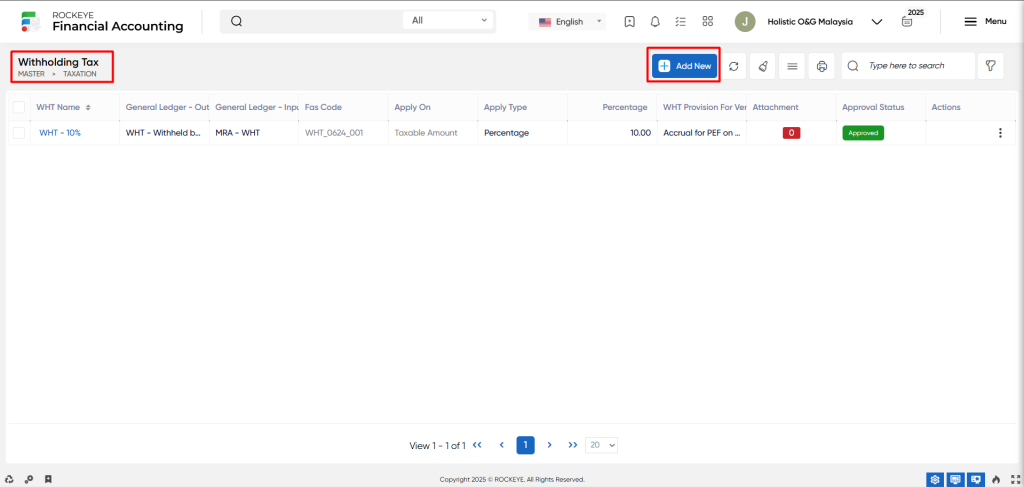

Listing:

A withholding tax listing in a Financial Accounting system is a feature that provides a list of all withholding taxes.

- Users can view the following information on the withholding tax listing page

- WHT name

- General ledger – output

- General ledger – input

- Fas code

- Apply on

- Apply type

- Percentage

- WHAT provision for vendor (payable account )

- Attachment

- Approval status

User can perform the following actions

- Add new: The “Add new” function allows you to create and add a new withholding tax to the system.

- Show all listing records: The “show all listing” function is to display and update a list or collection of withholding tax within a system or interface.

- Clear cache: The “clear cache” function is the process of deleting temporary files, data, or stored information that is stored in a cache.

- More options: The “more options” function provides the user with more actions or functionalities.

- Print records: The “Print Records” function allows users to generate physical or digital copies of the records or information displayed on the screen.

- Search: “The “Search” function allows the user to look for a specific entry within the available data and presents the results that match the search parameters.

- Quick search: The “Quick Search” function allows users to use a simplified or streamlined search function that enables users to perform a rapid search for specific records or information.

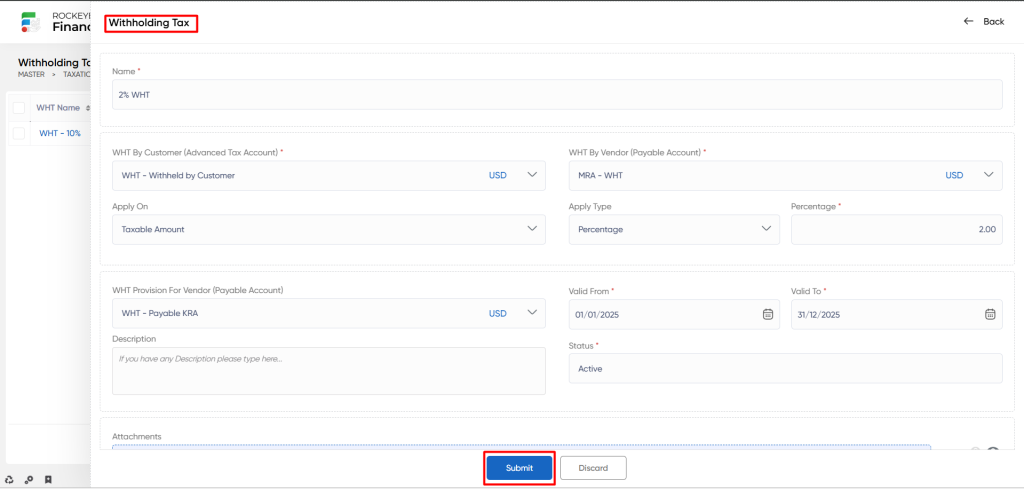

Recording & Update:

Add New With Holding Tax:

- Name: The “Withholding tax name” refers to the designation or label given to a specific grouping or classification of withholding taxes within a tax system.

- WHT by customer (advanced tax account): The “WHT by customer” refers to the tax amount withheld by a customer or client at the time of making a payment to a vendor or service provider.

- WHT by vendor (payable account): The “WHT by vendor” refers to the withholding tax amount applied by a vendor or supplier when receiving payment from a customer.

- Apply on: The “Apply on” refers to the specific transactions or types of payments to which the withholding tax is applied.

- Apply type: The “Apply type” refers to the method or criteria for applying the withholding tax.

- Percentage: The “Percentage” refers to the rate or percentage at which the withholding tax is calculated or applied to the applicable transactions or payments.

- WHT provision for vendor (payable account): The “WHT provision for vendor” refers to the provision made in the payable account to account for the withholding tax amount that the vendor is required to withhold and remit to the tax authorities.

- Valid from/Valid to: The “Valid from/ Valid to” refers to the period or duration during which the specific withholding tax settings, rates, or provisions are valid or applicable.

- Description: The “Description” refers to the additional details or information about the specific entry or record.

- Status: The “Status” refers to the current state or condition of the entry or record. It could be active, or inactive.

Users can perform the following actions

- Submit: The “Submit” function allows the user to submit the required information while creating a new withholding tax.

- Discard: The “Discard” function allows the user to cancel the submission of information provided at the time of creating a new withholding tax.