Financial Accounting

WHT Agency

Introduction/Purpose:

The WHT (Withholding Tax) agency is essential to Financial Accounting for taxation and compliance. It manages sums that have been withheld from payments and submits them to tax authorities. This organisation supervises precise withholding computations and prompt transfers to ensure proper taxation.

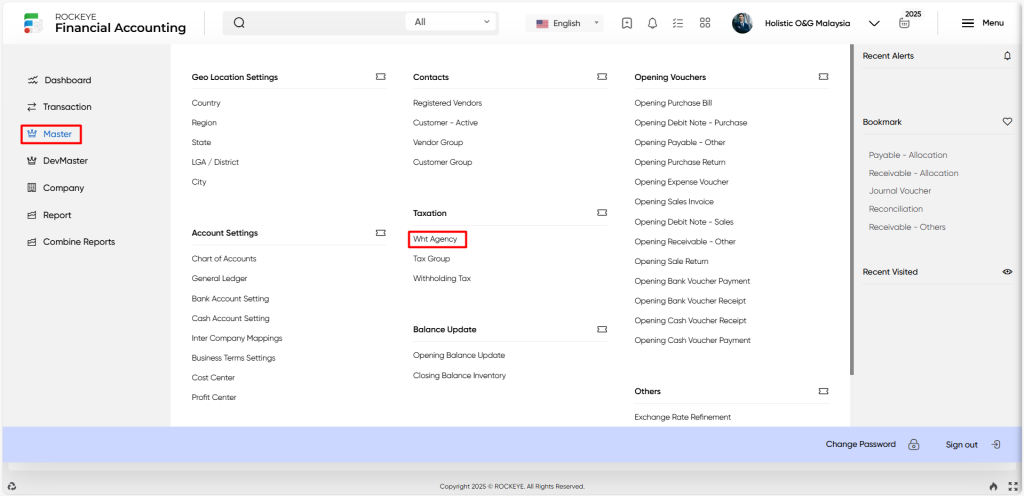

How To Navigate:

The navigation includes the following steps for viewing the WHT agency in the Financial Accounting system.

- Click on the master tab: The master can be accessed by clicking on the master tab on the side menu.

- Click on WHT agency: The WHT agency can be accessed by clicking it from the tax section.

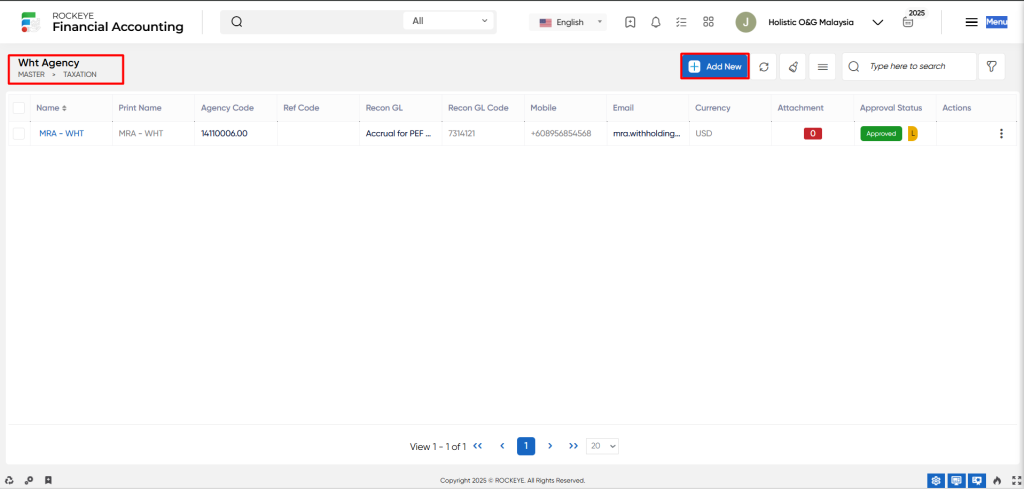

Listing:

A WHT agency listing in a Financial Accounting system is a feature which provides a list of all WHT agencies.

- Users can view the following information on the Wht agency listing page

- Name

- Print name

- Agency code

- Ref code

- Recon gl

- Recon gl code

- Mobile

- Currency

- Attachment

- Approval status

User can perform the following actions

- Add new: The “Add new” function allows you to create and add a new WHT agency to the system.

- Show all listing records: The “show all listing” function is to display and update a list or collection of WHAT agency within a system or interface.

- Clear cache: The “Clear cache” function is the process of deleting temporary files, data, or stored information that is stored in a cache.

- More options: The “More options” function provides the user with more actions or functionalities.

- Search: The “Search” function allows the user to look for a specific entry within the available data and presents the results that match the search parameters.

- Quick search: The “Quick Search” function refers to a simplified or streamlined search function that enables users to perform a rapid search for specific records or information.

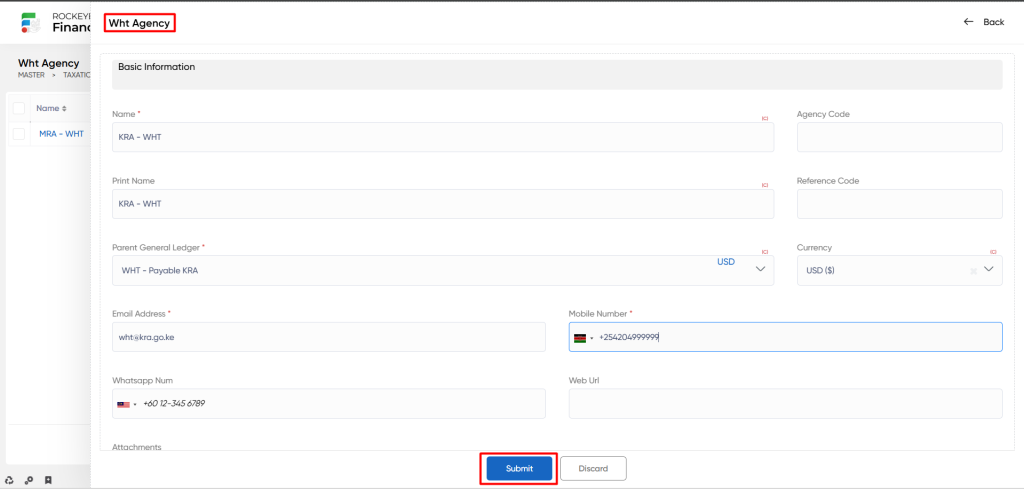

Recording & Update:

Add New WHT Agency:

- Name: The “Tax agency name” refers to the descriptive name/tag provided to the WHT agency.

- Agency code: The “Agency code” refers to a unique identifier or code assigned to WHAT agency.

- Print name: The “Print name” refers to the name of an individual or entity as it should appear in printed materials or documents.

- Reference code: The “Reference code” refers to a unique identifier or code assigned to a particular item or entity for reference purposes.

- Parent general ledger: The “Parent General Ledger” refers to the main or higher-level account within a chart of accounts

- Currency: The “Currency” refers to the medium of exchange used in financial transactions.

- Email address: The “Email address” refers to a unique identifier used for electronic mail communication.

- Mobile number: The “Mobile number” refers to a unique numerical identifier assigned to a mobile device or phone line.

- WhatsApp number: The “WhatsApp number” refers to a mobile phone number associated with the WhatsApp messaging application.

- Web URL: The “Web URL” refers to the URL of the tax agency.

Users can perform the following actions

- Submit: The “Submit” function allows the user to submit the required information while creating a new WHT agency.

- Discard: The “Discard” function allows the user to cancel the submission of information provided at the time of creating a new WHT agency.