Financial Accounting

Vendors / Suppliers

Introduction/Purpose:

Vendors provide organisations with goods, services, and resources that are necessary for effective supply chains and high-quality products. They help with procurement, expense management, and financial system accounts payable. The system combines vendor information for accurate invoice, purchase orders, and expenditure recording, tracking, and payment.

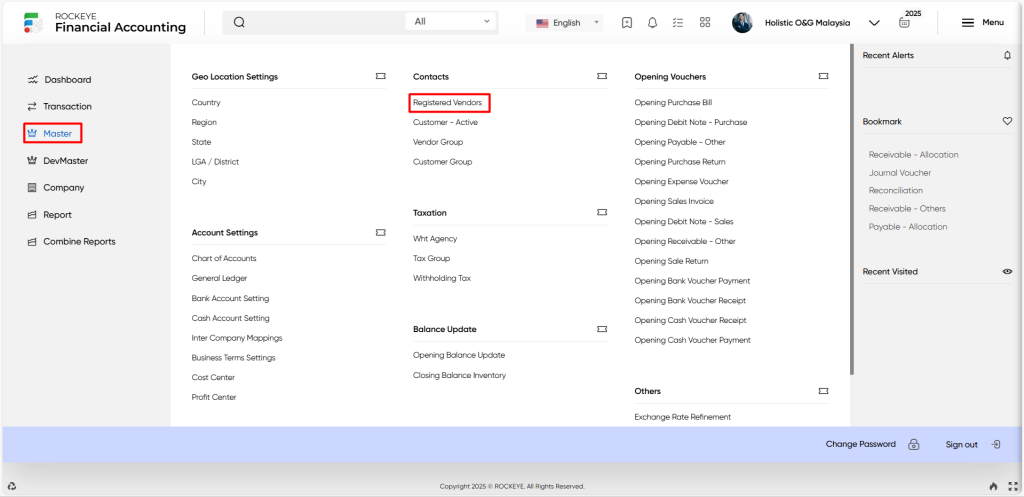

How To Navigate:

The navigation includes the following steps for viewing the vendor/supplier in the Financial Accounting system

- Click on the master tab: The master can be accessed by clicking on the master tab on the side menu.

- Click on Registered Vendors: The vendor/supplier can be accessed by clicking it from the contacts section.

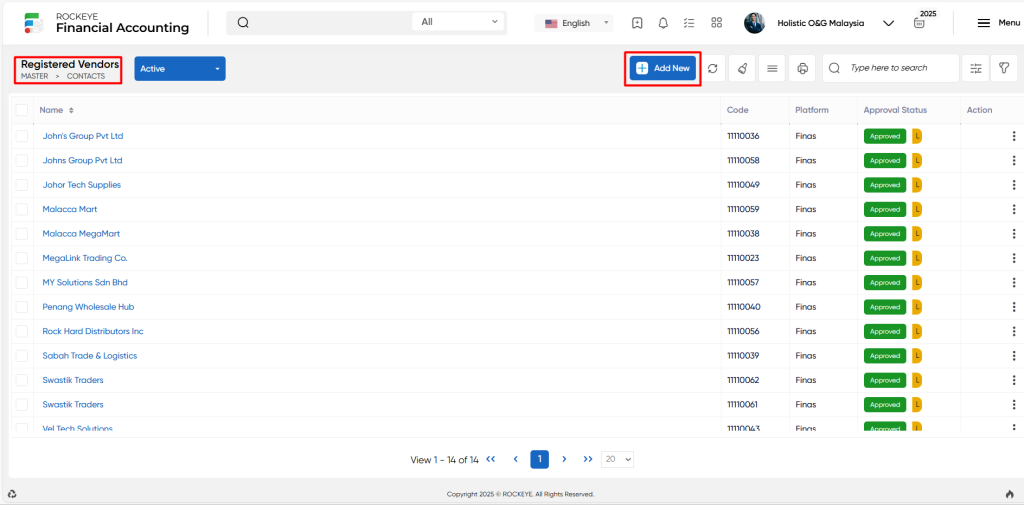

Listing:

A vendor/supplier listing in a Financial Accounting system is a feature that provides a list of all vendors/suppliers.

- Users can view the following information on the vendor or supplier listing page

- Name

- Code

- Parent GL

- Currency

- Ref code

- Attachments

- Approval status

User can perform the following actions

- Add new: The “Add new” function allows you to create and add a new vendor/supplier to the system.

- Show all listing: The “Show all listing” function is to display and update a list or collection of vendors/suppliers within a system or interface.

- Clear cache: The “Clear cache” function to the process of deleting temporary files, data, or stored information that is stored in a cache.

- More options: The “More options” function provides the user with more actions or functionalities.

- Print record: The “Print records” feature allows users to print content by opening a print dialogue or displaying a preview of the content to be printed.

- Search: The “Search” function allows the user to look for a specific entry within the available data and presents the results that match the search parameters.

- Filter: The “Filter” function allows users to refine and narrow down the list of vendors or suppliers based on specific criteria or conditions

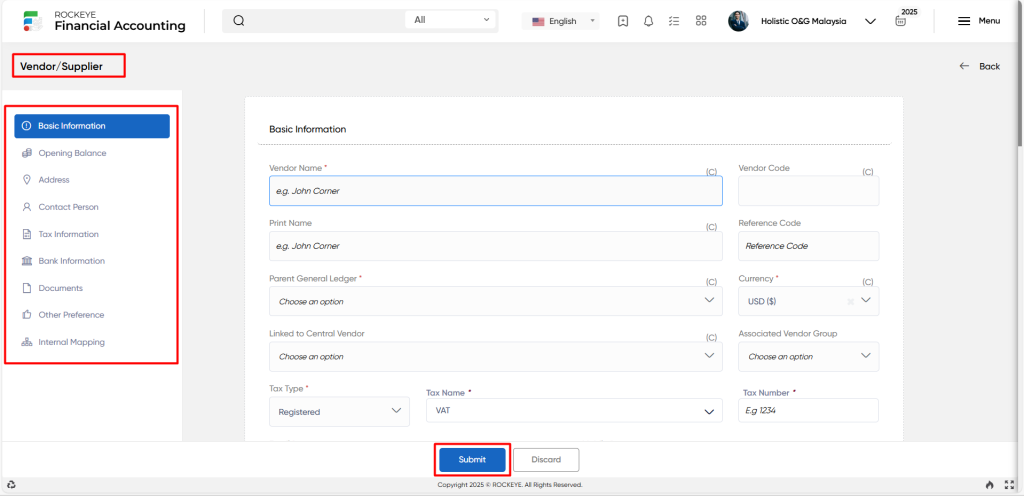

Recording & Update:

Add New vendor /supplier:

- Vendor name: The “Vendor name” refers to the descriptive name/tag provided to the vendor/supplier.

- Vendor code: The “Vendor code” refers to a specific code or alphanumeric identifier assigned to the vendor for easy reference and identification.

- Print name: The “Print name” refers to an alternative name or shorter version of the vendor name, which may be used for printing or display purposes.

- Reference code: The “Reference code” refers to the code or reference number that can be assigned to the vendor for internal tracking or cross-referencing purposes.

- Parent GL code: The “Parent GL code” refers to the parent or main general ledger (GL) code associated with the vendor. This code helps categorise vendors under specific GL accounts.

- Currency: The “Currency” refers to the currency in which the vendor conducts business or expects to be paid.

- Linked to central vendor: The” Linked to central vendor” refers to the vendor that is linked to a central or parent vendor in cases where there are subsidiary or associated vendor entities.

- Associated vendor group: The “Associated vendor group” refers to the vendor group or category to which the vendor belongs. Vendor groups are often used to classify vendors based on certain criteria or characteristics.

- Tax type: The “Tax type” refers to the type of tax or tax category applicable to the vendor, such as sales tax, value-added tax (VAT), or goods and services tax (GST).

- Tax name: The “Tax name” refers to the name or title of the specific tax associated with the vendor.

- Tax number: The “Tax number” refers to the tax identification number assigned to the vendor by the relevant tax authority.

- Email: The ”Email” refers to the email address associated with the vendor for communication purposes.

- Mobile: The “Mobile” refers to the mobile number of a contact person or representative from the vendor organisation.

- WhatsApp number: The “WhatsApp number” refers to a WhatsApp messaging application number associated with the vendor for direct communication.

- Website URL: The “Website URL” refers to the web address or URL of the vendor’s official website.

- Account type: The ”Account type” refers to the type of account or classification assigned to the vendor within the Financial Accounting system.

- Sub-account type: The “Sub-account type” refers to the Further categorised or classified vendor account under specific subcategories or types.

- Your Preferred bank for payment: The “Your preferred bank for payment ” refers to the preferred bank account or financial institution to which the vendor prefers to receive payments.

- Opening balance: The “Opening balance” refers to the opening balance in the vendor or supplier refers to the outstanding balance or amount owed to the vendor or supplier at the beginning of a financial period.

- Address: The” Address” refers to the address of the vendor or supplier, which refers to the physical location or mailing address of the vendor or supplier’s business or organisation.

- Address type: The” Address type” refers to the categorization or classification of the address, such as billing address, shipping address, or mailing address.

- Default shipping: The” Default shipping” refers to the designated or preselected shipping address that is automatically used when creating purchase orders or shipping products from the vendor/supplier.

- Default billing: The” Default billing” is the preselected billing address that is automatically used for financial transactions and invoicing related to the vendor/supplier.

- Address: The “Address” refers to the specific details of the vendor/supplier’s physical location or mailing address, including the street name, building number, and any additional information necessary to accurately identify the address.

- Country: The “Country” refers to the country in which the vendor/supplier is located.

- Region: The “Region” refers to a broader geographical region within the country, such as a state or province.

- State: The ”State” refers to the specific state or province in which the vendor/supplier is situated.

- LGA/District: The “LGA/District” refers to the Local Government Area or District and is applicable in certain countries or regions for further geographical classification within a state or province.

- City: The ”City” refers to the city or town where the vendor/supplier is located.

- Zip: The “ZIP” refers to the postal code or ZIP code associated with the vendor/supplier’s address.

- Contact person: The “Contact person” refers to an individual associated with the vendor/supplier’s organisation who serves as the primary point of contact for communication and interaction with the organisation.

- Title: The ”Title” refers to the honorific or professional title of the contact person, such as Mr., Mrs.etc.

- Name & Gender: The “Name” refers to the full name of the contact person and the “gender” refers to the gender of the contact person, typically represented as male or female.

- Designation: The “Designation” refers to the job title or position held by the contact person within the vendor/supplier’s organisation.

- Contact type: The “Contact type” refers to the type of contact, such as primary contact, secondary contact.. etc

- Mobile number: The “Mobile number” refers to the contact person’s mobile phone number, which can be used for direct communication via calls or text messages.

- Phone number: The “Phone number” refers to the contact person’s landline or office phone number.

- Email address: The “Email address” refers to the email address of the contact person, which serves as a primary mode of communication for written correspondence.

- Website URL: The “Website URL” field contains the website address of the vendor/supplier or the contact person’s personal website.

- WhatsApp number: The “WhatsApp number” refers to a WhatsApp messaging application number associated with the contact person for direct communication.

- Skype: “Skype” refers to the contact person’s Skype username or ID, which can be used for video calls or instant messaging.

- Imo: The “Imo” refers to a communication platform similar to Skype. This field indicates the contact person’s Imo username or ID.

- Messenger: The “Messenger” refers to the contact person’s username or ID for other messaging platforms, such as Facebook Messenger or Google Hangouts.

- Snapchat: The “Snapchat” refers to the contact person’s Snapchat username or ID, if applicable.

- Telegram: The “Telegram” refers to Telegram, a messaging app. This field indicates the contact person’s Telegram username or ID.

- Slack: The “Slack” refers to the contact person’s Slack username or ID, which is a platform for question-and-answer discussions on various topics.

- Discard: The “Discard” refers to the option to discard or delete the contact person’s information.

- Tax information: The “Tax information” refers to the tax information of the vendor or supplier and refers to the details related to their tax obligations and compliance.

- Tax name: The “Tax name” refers to the specific name or label given to a particular tax imposed by a government or tax authority.

- Tax number: The “Tax number” refers to the unique identification number assigned to an individual or business entity by the tax authorities.

- Tax attachments: The “Tax attachments” refer to any supporting documents or files that are attached or associated with tax-related records or transactions.

- Description: The “Description” refers that the description may be used to provide additional details or clarifications regarding the nature or purpose of the tax, specific tax-related entries, or any other relevant information associated with the tax record

- Bank information: The “Bank information” refers to the details related to their banking relationships and accounts.

- Bank name: The “Bank name” refers to the name of the bank where the vendor or supplier holds their account.

- Account number: The “Account number” refers to the unique identifier assigned to the vendor or supplier’s bank account.

- Branch name: The “Branch name” refers to the specific branch or location of the bank where the vendor or supplier’s account is held.

- Branch code: The “Branch code“ refers to a numerical or alphanumeric code assigned to a specific branch of a bank.

- IBAN(International Bank Account Number): The “IBAN” refers to a standardised international numbering system used to identify bank accounts in specific countries.

- Swift code: The “Swift code” refers to a unique identification code assigned to a bank or its branches for international wire transfers. (Society for Worldwide Interbank Financial Telecommunication)

- Address: The “Address” refers to the physical location or postal address of the bank branch where the vendor or supplier’s account is held.

- Country: The “Country” refers to the country where the bank branch is located.

- Region/State: The “Region/State” refers to the specific region or state within the country where the bank branch is situated.

- City: The “City” refers to the name of the city where the bank branch is located.

- LGA/District: The “LGA” refers to a term used in some countries to define administrative subdivisions within a city or region.

- Landmark: The “Landmark” refers to a recognizable feature or point of reference near the bank branch’s location, which can help in identifying the branch.

- Zip Code: The “ZIP code” refers to a zip code or postal code is a numerical code used in postal systems.

- Is default: The “Is default” refers to the bank account that is set as the default or primary account for the vendor or supplier.

- Document: The “Document” refers to any supporting files or records associated with the vendor or supplier.

- Name: The “Name” refers to the name of the document associated with the vendor or supplier.

- Document: The “Document” refers to an actual file or record related to the vendor or supplier.

- Doc category: The “Doc category” refers to the category or classification of the document. It helps organise and categorise different types of documents for easier retrieval and management.

- Remark: The “Remark” refers to a space provided for adding additional notes, comments, or descriptions about the document.

- Other preferences: The “Other Preference” refers to additional preferences or settings that can be configured for a specific vendor or supplier.

- Default VAT group: The “Default VAT group” refers to the default VAT (Value Added Tax) group or category assigned to the vendor or supplier.

- Default WHT group: The “Default WHAT group” refers to the default group or category for withholding tax purposes. It specifies the withholding tax rate or rules that apply when making payments to the vendor/supplier.

- Default VAT withheld: The “Default VAT withheld“ refers to the default percentage or amount of VAT that is withheld from payments made to the vendor/supplier as per tax regulations.

- Default Input tax credit: The “Default input tax credit” refers to the default percentage or amount of input tax credit that can be claimed by the buyer on purchases made from the vendor/supplier.

- Default cost centre: The “Default cost centre” refers to a specific segment or division within an organisation to which costs can be attributed.

- Tax calculation: The “Tax calculation” refers to the method or rules used for calculating taxes, such as VAT or withholding tax, on transactions involving the vendor/supplier.

- Default payment term: The “Default payment term” refers to the default payment term or condition agreed upon with the vendor/supplier, specifying the timeframe within which payment should be made.

- Grace days: The “Grace days” refers to the additional days beyond the payment term deadline during which payment can still be made without incurring any penalties or late fees.

- Payment allocation: The “Payment allocation” refers to the process or rules for allocating or distributing payments across outstanding invoices or specific invoices related to the vendor/supplier.

- Internal mapping: “Internal mapping” refers to the process of associating or mapping specific internal codes or identifiers to vendors or suppliers

Users can perform the following actions

- Submit: The “Submit” function allows the user to submit the required information while creating a new vendor/supplier.

- Discard: The “Discard” function allows the user to cancel the submission of information provided at the time of creating a new vendor/supplier.