Financial Accounting

Tax Group

Introduction/Purpose:

The tax group organises related taxes for efficient administration. It simplifies compliance by applying consistent rules to interconnected taxes, reducing burden and promoting uniformity.

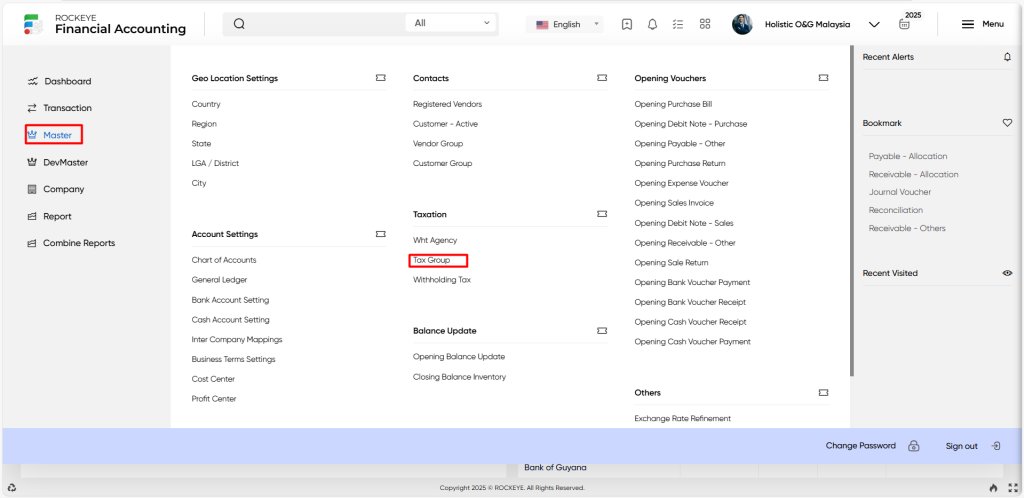

How To Navigate To Tax Group:

The navigation includes the following steps for viewing the tax group in the Financial Accounting system

- Click on the master tab: The master can be accessed by clicking on the master tab on the side menu.

- Click on tax group: The tax group can be accessed by clicking it from the tax section.

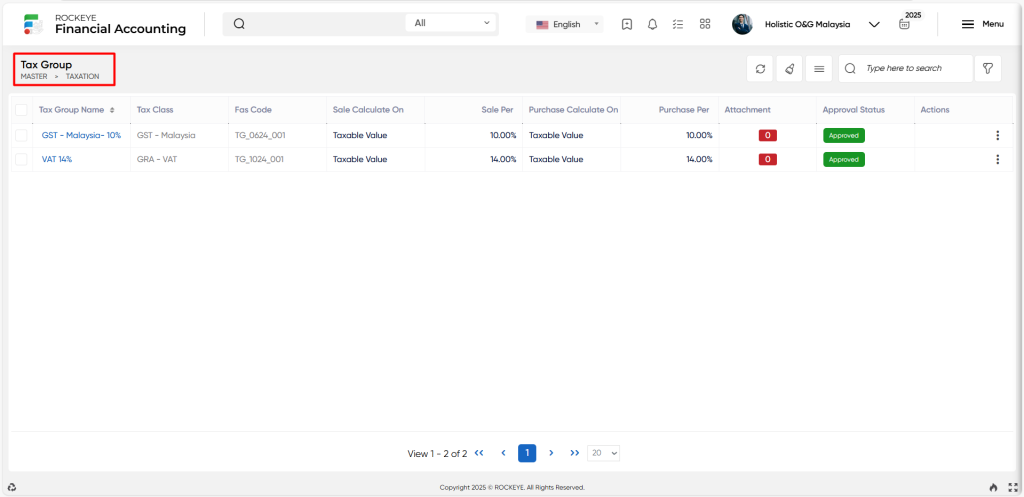

Listing:

A tax group listing in a Financial Accounting system is a feature that provides a list of all tax groups.

- Users can view the following information on the tax groups listing page

- Tax group name

- Tax class

- Fas code

- Sale calculated on

- Sale per

- Purchase calculated on

- Purchase per

- Attachment

- Approval status

User can perform the following actions

- Add new: The “Add new” function allows you to create and add a new tax group to the system.

- Show all listing records: The “Show all listing” function is to display and update a list or collection of tax groups within a system or interface.

- More options: The “More options” function provides the user with more actions or functionalities.

- Clear cache: The “Clear cache” function is the process of deleting temporary files, data, or stored information that is stored in a cache.

- Print records: The “Print Records” function allows users to generate physical or digital copies of the records or information displayed on the screen.

- Search: “The “Search” function allows the user to look for a specific entry within the available data and presents the results that match the search parameters.

- Quick search: The “Quick Search” function refers to a simplified or streamlined search function that enables users to perform a rapid search for specific records or information.

Recording & Update:

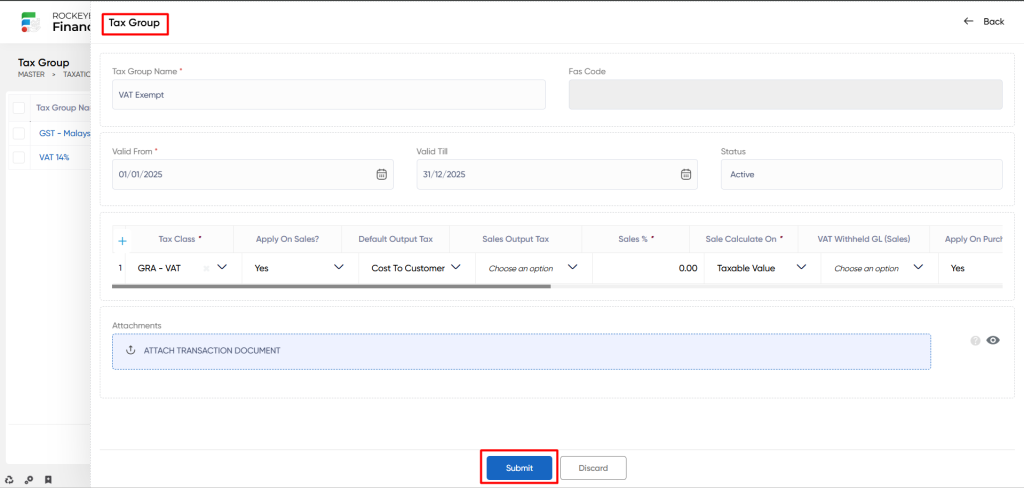

Add New Tax Group:

- Tax group name: The “Tax group name” refers to the designation or label given to a specific grouping or classification of taxes within a tax system.

- Valid from: The “Valid from” refers to the starting date or effective date from which a particular tax group or tax-related information becomes valid or applicable.

- Valid till: The “Valid till” refers to the end date or expiration date until which a particular tax group or tax-related information remains valid or applicable.

- Status: The “Status” refers to the current condition or state of a particular entity or item.

- Tax class: The “Tax class” refers to the classification or category of a specific tax within a tax system.

- Apply on sales: The “Apply on sales” refers to whether the tax group or tax class is applicable to sales transactions.

- Default output tax: The “Default output tax” refers to the predetermined or standard tax rate or amount applied to the output or sales transactions within a tax group or tax class.

- Sales output tax: The “Sales output tax” refers to the tax amount charged or levied on sales transactions within a tax group or tax class.

- Sales %: The “Sales %” refers to the tax rate or percentage applied to sales transactions within a tax group or tax class.

- Sale calculated on: The “Sale calculated on” refers to the basis or method used to calculate the taxable amount for sales transactions within a tax group or tax class.

- Apply on purchase:The “Apply on purchase” refers to whether the tax group or tax class is applicable to purchase transactions.

- Purchase output tax: The “Purchase output tax” refers to the tax amount charged or levied on purchase transactions within a tax group or tax class.

- Input tax credit: The “Input tax credit” refers to the tax credit or deduction that a business can claim for the taxes paid on its purchases.

- Purchase %: The “Purchase %” refers to the tax rate or percentage applied to purchase transactions within a tax group or tax class.

- Purchase calculate on The “Purchase calculate on” refers to the basis or method used to calculate the taxable amount for purchase transactions within a tax group or tax class.

- Remark: The “Remark” refers to additional comments, notes, or observations related to a specific item or transaction.

- Action: The “Action” typically refers to a specific operation or task that can be performed on a particular item or within a system

Users can perform the following actions

- Submit: The “Submit” function allows the user to submit the required information while creating a new tax group.

- Discard: The “Discard” function allows the user to cancel the submission of information provided at the time of creating a new tax group.