Financial Accounting

Tax Classification

Introduction/Purpose:

Tax classification involves categorising taxes based on characteristics for organised management. It provides a structured framework to differentiate and apply tax rules efficiently

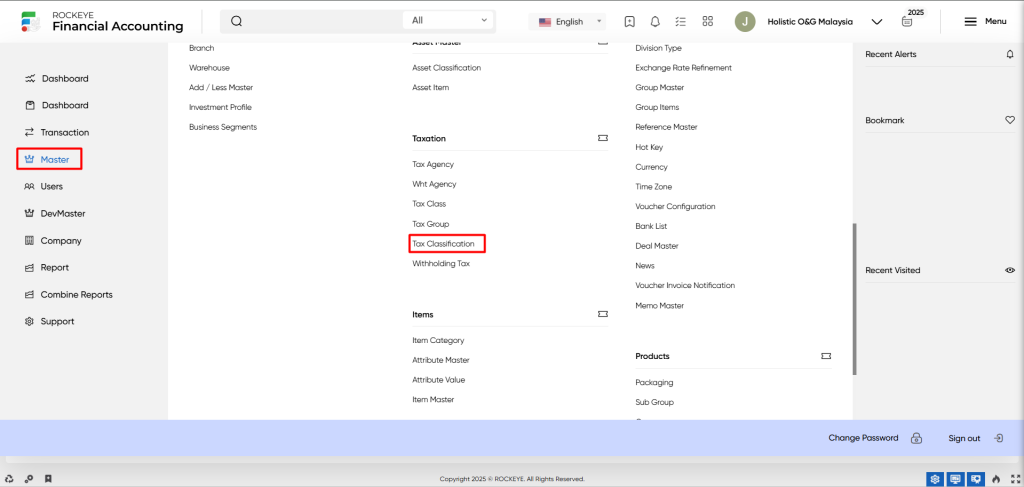

How To Navigate:

The navigation includes the following steps for viewing the tax classification in the Financial Accounting system

- Click on the master tab: The master can be accessed by clicking on the master tab on the side menu.

- Click on tax classification: The tax classification can be accessed by clicking it from the tax section.

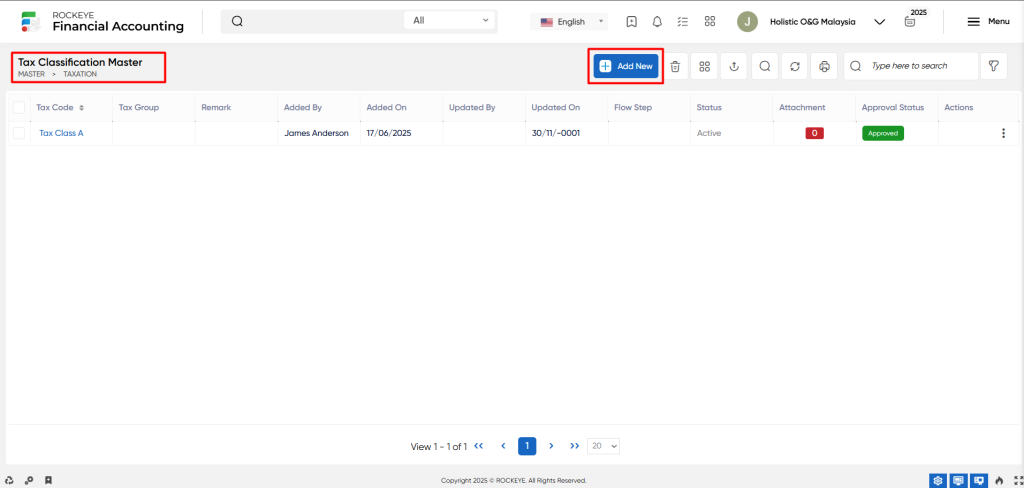

Listing:

A tax classification listing in a Financial Accounting system is a feature that provides a list of all tax classifications.

- Users can view the following information on the tax classification listing page

- Tax code

- Tax Group

- Remark

- Added by

- Added on

- Updated by

- Updated on

- Status

- Attachment

- Approval status

User can perform the following actions

- Add new: The “Add new” function allows you to create and add a new tax classification to the system.

- Delete: The “Delete” function allows the user to remove or permanently erase a selected entry or record from a system or database.

- Hide/Show columns: The “Hide/Show columns” function refers to the feature that allows users to selectively display or hide specific columns of data in a table or listing.

- Export: The “Export” function allows the user to save or transfer data from a system or application to an external file format or destination.

- Search: The “Search” function or tool that allows users to look for specific records, data, or information within a system or database.

- Show all listing records: The “Show all listing” function is to display and update a list or collection of tax classifications within a system or interface.

- Print records: The “Print records” function allows users to generate physical or digital copies of the records or information displayed on the screen.

- Quick search: The “Quick Search” function is a simplified or streamlined search function that enables users to perform a rapid search for specific records or information.

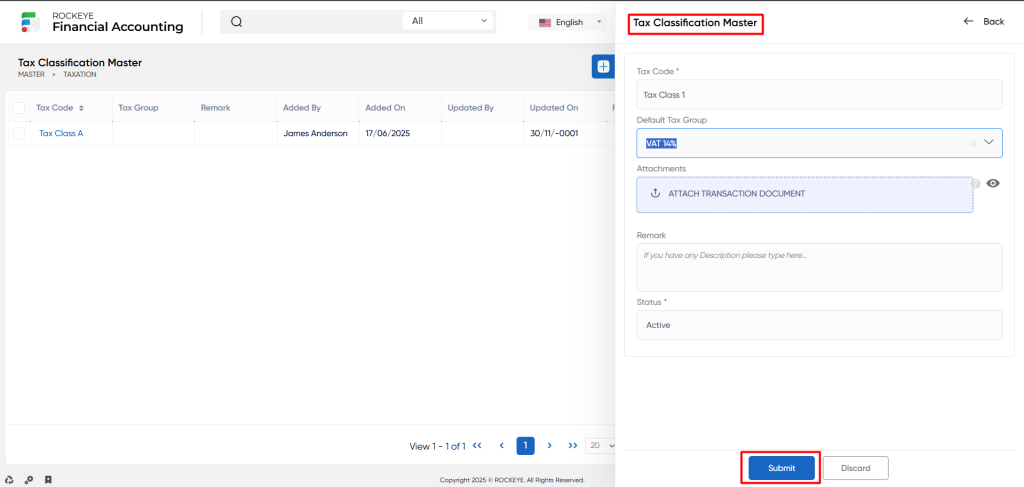

Tax Classification- Recording & Update:

Add New Tax Classification :

- Tax code: The “Tax code” refers to a unique identifier or alphanumeric representation assigned to a specific tax within a tax system.

- Default tax group: The “Default tax group” refers to the predefined or primary tax group that is automatically assigned or associated with a particular transaction or entity when no specific tax group is specified.

- Remark: The “Remark” refers to additional comments, notes, or observations related to a specific item, record, or transaction.

- Status: The “Status” refers to the current condition, state, or stage of a specific item, record, or transaction.

Users can perform the following actions

- Submit: The “Submit” function allows the user to submit the required information while creating a new tax classification.

- Discard: The “Discard” function allows the user to cancel the submission of information provided at the time of creating a new tax classification.