Financial Accounting

Tax Class

Introduction/Purpose:

Tax class categorises entities and items for taxation, guiding rates and rules. It ensures fairness by considering attributes like structure, income, or goods or services. It structures taxation for equity and clarity.

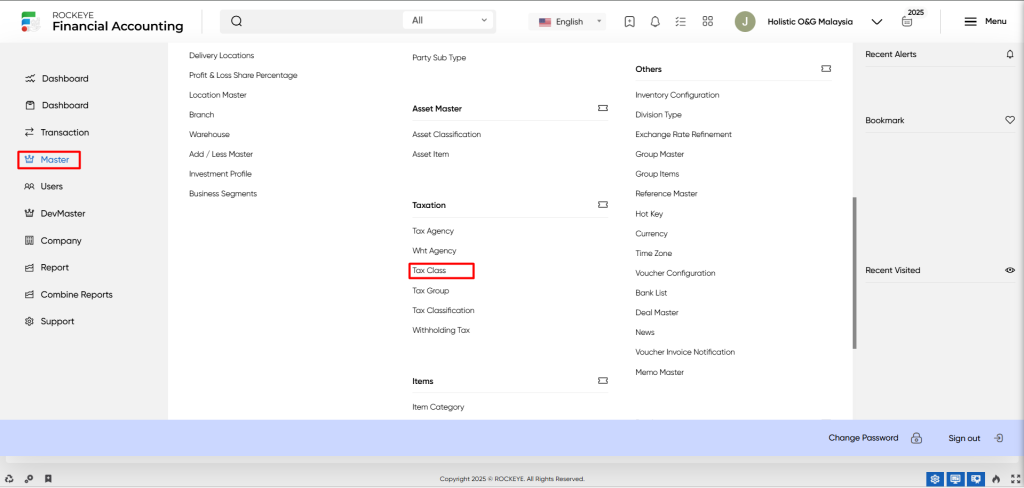

How To Navigate:

The navigation includes the following steps for viewing the tax class in the Financial Accounting system

- Click on the master tab: The master can be accessed by clicking on the master tab on the side menu.

- Click on the tax class: The tax class can be accessed by clicking it from the tax section.

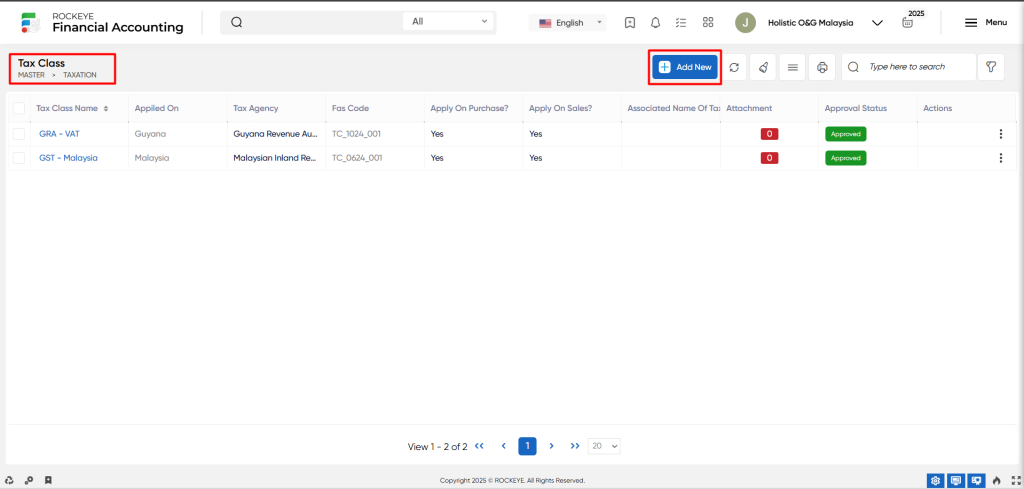

Listing:

A tax class listing in a Financial Accounting system is a feature that provides a list of all tax classes.

- Users can view the following information in the tax class listing page

- Tax class name

- Applied on

- Tax agency

- Fas code

- Apply on purchase

- Apply on sales

- Associated name of the tax

- Attachment

- Approval status

User can perform the following actions

- Add new: The “Add new” function allows you to create and add new tax classes or entries to the system.

- Show all listing records: The “Show all listing” function is to display and update a list or collection of tax classes within the system.

- Clear cache: The “Clear cache” function clears the cached data associated with the tax class.

- More options: The “More options” function provides the user with more actions or functionalities.

- Print records: The “Print records” function allows users to print content by opening a print dialogue or displaying a preview of the content to be printed.

- Search & Quick search: The “Quick search” refers to the option that allows for detailed searches based on multiple parameters and date ranges, while the ” Search” option allows for short searches based on keywords or selective terms.

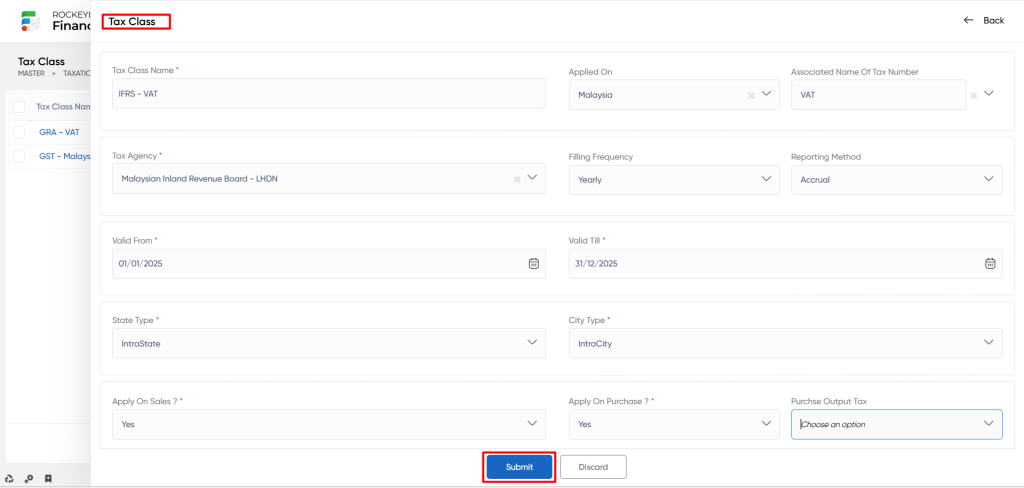

Recording & Update:

Add New Tax Class :

- Tax class name: The “Tax class name” refers to the descriptive name/tag provided to the tax class.

- Applied on: The “Applied on” refers to the entities or transactions to which the tax class is applied.

- Associated name of tax number: The “Associated name of tax number” refers to the name or entity associated with a specific tax identification number.

- Tax agency: The “Tax agency” refers to the government authority or agency responsible for administering and enforcing tax laws and regulations.

- Filing frequency: The “Filing frequency” refers to the frequency at which tax returns or tax-related documents need to be filed with the tax authorities.

- Reporting method: The “Reporting method” refers to the manner in which taxpayers are required to report their tax information to the tax authorities.

- Valid from: The “Valid from” refers to the starting date or effective date from which a particular tax class or tax-related information becomes valid or applicable.

- Valid till: The “Valid till” refers to the end date or expiration date until which a particular tax class or tax-related information remains valid or applicable.

- State type: The “State type” refers to the classification or categorization of a geographical region or jurisdiction as a state.

- City type: The “City type” refers to the classification or categorization of a geographical area as a city.

- Apply on sales: The “Apply on sales” refers to whether the tax class is applicable to sales transactions.

- Apply on purchase: The “Apply on purchase” refers to whether the tax class is applicable to purchase transactions.

- Purchase output tax: The “Purchase output tax” refers to the tax amount charged or levied on purchases made by a business.

- Default output tax: The “Default output tax” refers to the predetermined or standard tax rate or amount applied to the output or sales transactions by default.

- Tax account: The “Tax account” refers to the designated account used to record tax-related transactions or liabilities.

- Input tax credit: The “Input tax credit” refers to the tax credit or deduction that businesses can claim for the taxes paid on their purchases.

- Tax input account: The “Tax input account” refers to a designated account used to record and track the input tax amounts associated with purchases made by a business.

- Status: The “Status” refers to the current condition or state of a particular entity or item.

- Remark: The “Remark” refers to additional comments, notes, or observations related to a particular tax-related item or transaction.

Users can perform the following actions

- Submit: The “Submit” function allows the user to submit the required information while creating a new tax class.

- Discard: The “Discard” function allows the user to cancel the submission of information provided at the time of creating a new tax class.