Financial Accounting

Tax Agency

Introduction/Purpose:

A tax agency is an entity responsible for supervising tax affairs within a system. In Financial Accounting systems, it provides tools to automate tax processes, and ensure precise calculations, timely reporting, and legal adherence. This element simplifies tax management and aids in various tax-related functions.

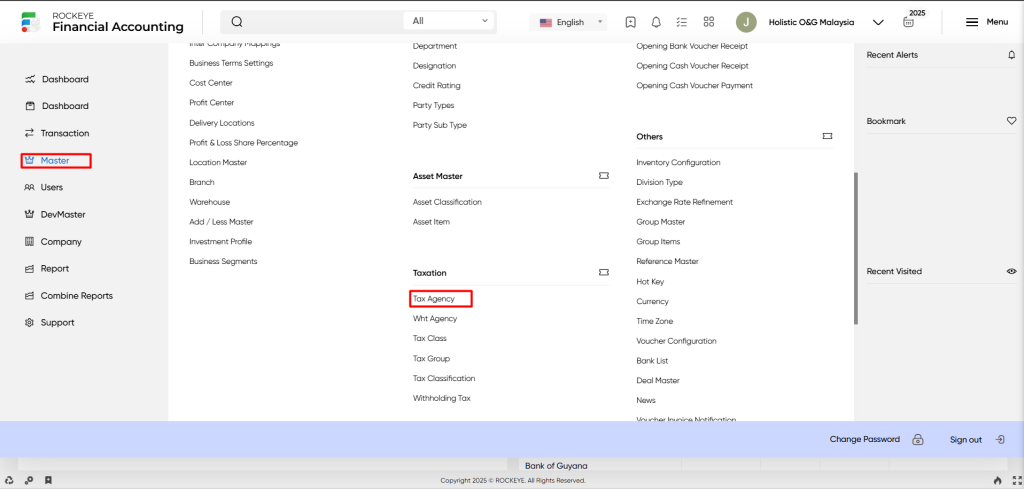

How To Navigate:

The navigation includes the following steps for viewing the tax agency in the Financial Accounting system.

- Click on the master tab: The master can be accessed by clicking on the master tab on the side menu.

- Click on the tax agency: The tax agency can be accessed by clicking it from the tax section.

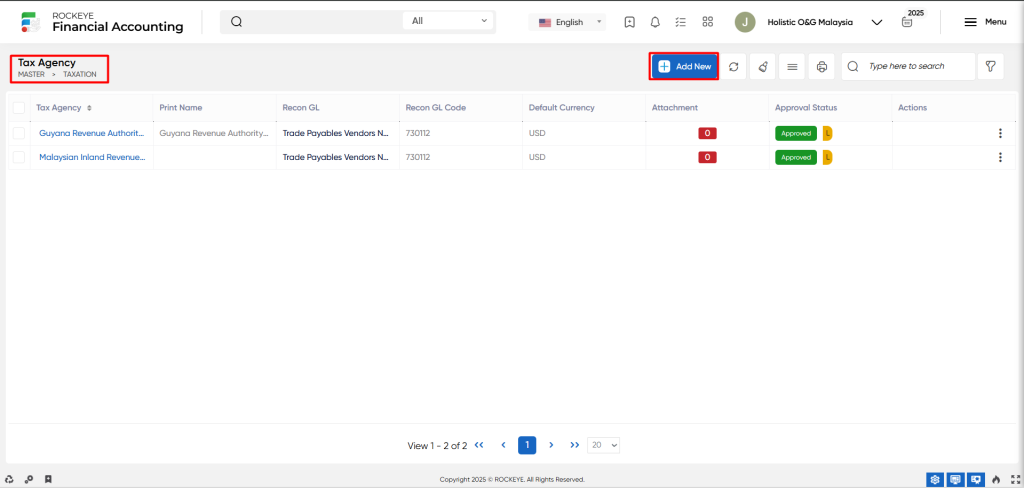

Listing:

A tax agency listing in a Financial Accounting system is a feature that provides a list of all tax agencies.

- Users can view the following information on the tax agency listing page

- Tax agency

- Print name

- Recon gl

- Recon gl code

- Default currency

- Attachment

- Approval status

User can perform the following actions

- Add new: The “Add new” function allows you to create and add new tax agencies or entries to the system.

- Show all listing records: The “show all listing” function is to display and update a list or collection of tax agencies within the system.

- Clear cache: The “Clear cache” function clears the cached data associated with the tax agency.

- More options: The “More options” function provides the user with more actions or functionalities.

- Print records: The “Print records” feature allows users to print content by opening a print dialogue or displaying a preview of the content to be printed.

- Search & Quick search: The “quick search” refers to the option that allows for detailed searches based on multiple parameters such as vendor name and date range, while the ” Search” option allows for short searches based on keywords or selective terms.

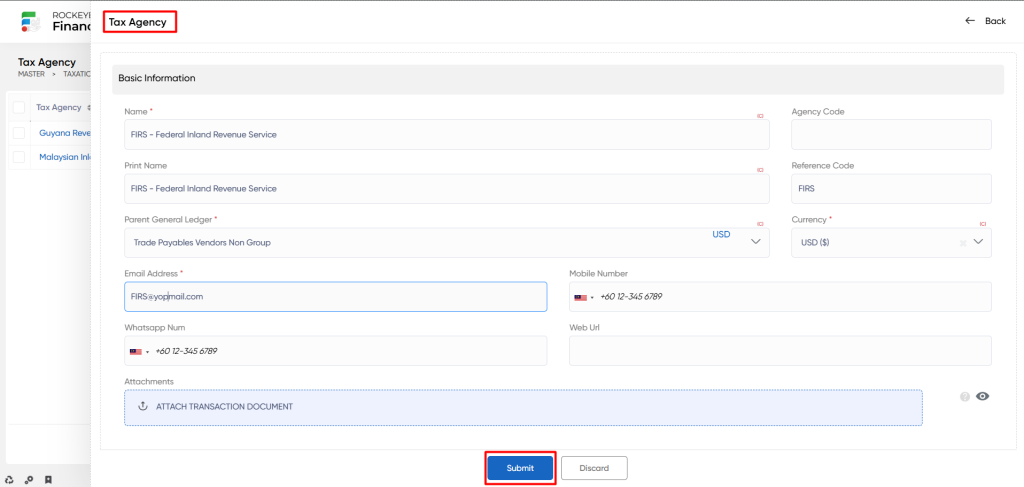

Recording & Update:

Add New Tax Agency :

- Name: The “tax agency name” refers to the descriptive name/tag provided to the tax agency.

- Agency code: The “Agency code” refers to a unique identifier or code assigned to an agency.

- Print name: The “Print name” refers to the name of an individual or entity as it should appear in printed materials or documents.

- Reference code: The “Reference code” refers to a unique identifier or code assigned to a particular item or entity for reference purposes.

- Parent GL: The “Parent General Ledger” refers to the main or higher-level account within a chart of accounts.

- Currency: The “Currency” refers to the medium of exchange used in financial transactions.

- Email address: The “Email address” is a unique identifier used for electronic mail communication.

- Mobile number: The “Mobile number” refers to a unique numerical identifier assigned to a mobile device or phone line.

- WhatsApp number: The “WhatsApp number” refers to a mobile phone number associated with the WhatsApp messaging application.

- Web URL: The “Web URL” refers to the URL of the tax agency.

Users can perform the following actions

- Submit: The “Submit” function allows the user to submit the required information while creating a new tax agency.

- Discard: The “Discard” function allows the user to cancel the submission of information provided at the time of creating a new tax agency.