Financial Accounting

Sales invoice

Introduction/Purpose:

A sales invoice is an official record that itemises the products or services provided and serves as the seller and buyer’s formal record of the transaction. It simplifies billing and financial record-keeping and aids in account receivable management.

Dependency:

- Customer: The sales invoice must be connected to the customer information that is used while creating the sales invoice.

- Profit centre: The sales invoice must be connected to the profit centre information which is used while creating the sales invoice.

- Chart of account: Sales invoice must be integrated with the chart of accounts which is used while creating the sales invoice.

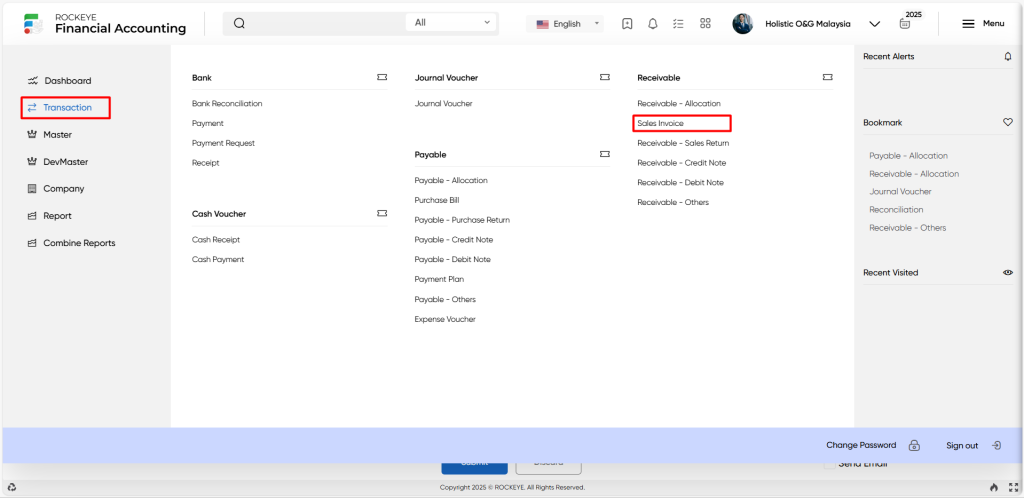

How To Navigate:

The navigation includes the following steps for viewing the sales invoice in the Financial Accounting system.

- Click on the transactions tab: The transactions can be accessed by clicking on the transactions tab on the side menu.

- Click on the sales invoice: The sales invoice can be accessed by clicking it from the receivable section.

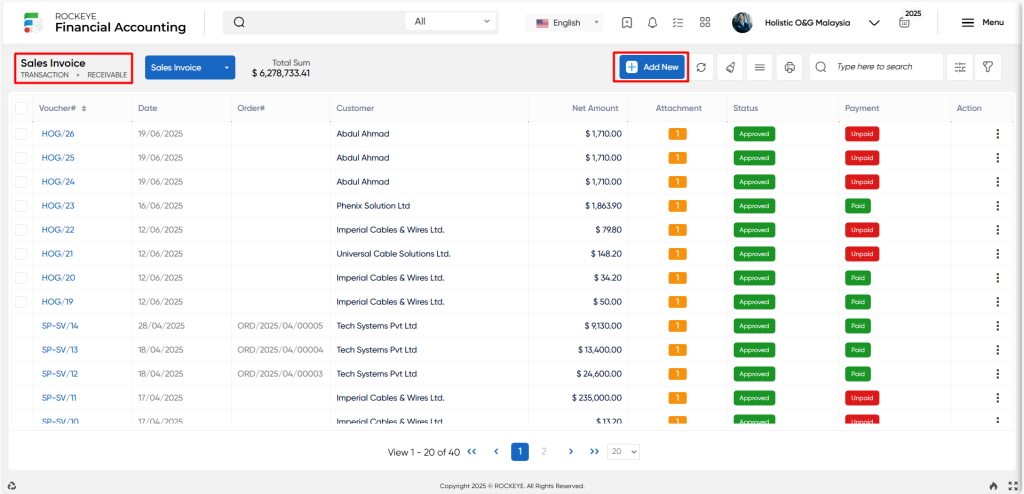

Listing:

A sales invoice listing in a Financial Accounting system is a feature which provides a list of all sales invoices.

- Users can view the following information in the sales invoice listing

- Voucher, date

- Customer and order.

- General ledger and currency

- Exchange rate and taxable

- Net amount and net amount(LC)

- Attachment, payment & status

User can perform the following actions

- Add new: The “Add new” function allows you to create and add new sales invoices or entries to the system.

- Show all listing: The “Show all listing” function is to display and update a list or collection of sales invoices within the system.

- Clear cache: The “Clear cache” function clears the cached data associated with the sales invoice.

- More options: The “More options” function provides the user with more actions or functionalities.

- Print records: The “Print records” function allows users to print content by opening a print dialogue or displaying a preview of the content to be printed.

- Search & Quick search: The “Quick search” refers to the option that allows for detailed searches based on multiple parameters such as vendor name and date range, while the ” Search” option allows for short searches based on keywords or selective terms.

Recording & Update:

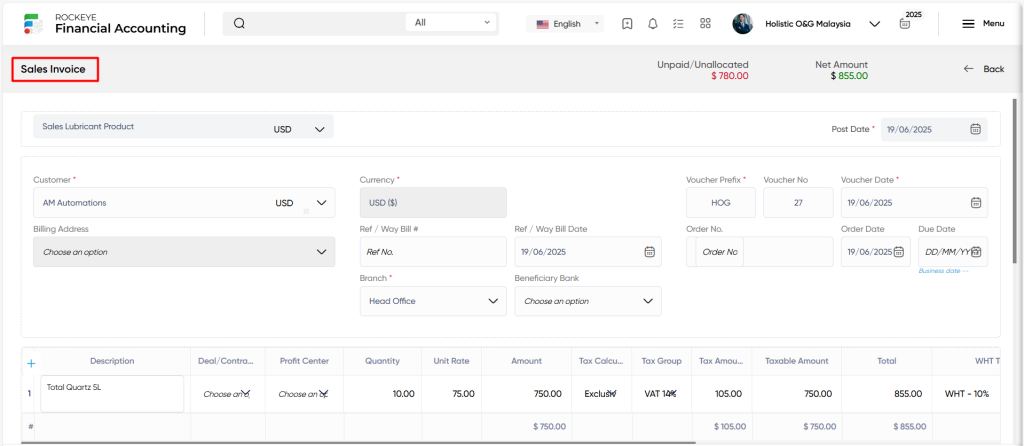

Add New Sales Invoice:

- Choose an option: The “Choose an option CoA” refers to the option where the user must select the chart of accounts with which this specific sales invoice is related.

- Customer: The “Customer” refers to the name or identity of the customer taking part in the transaction.

- Currency: The “Currency” refers to the type of money used in the transaction.

- Exchange rate & date: The “Exchange rate” refers to the exchange rate applied to convert the transaction amount from one currency to another, while the “Exchange date” refers to the day that the currency exchange rate was determined.

- Prefix voucher number & date: The “Prefix voucher number & date” refers to the reference number allocated to the payment transaction and the voucher date associated with the transaction

- Billing address: The “Billing address” refers to the address to which the invoice or billing statement for the receivable transaction is mailed/sent.

- Order no. and date: The “Order no & date” refers to a payment transaction that is related to a purchase order, the order number and date represent the request data.

- Ref date & no and Receipt date: The “Reference date, number, and date” refers to the file linked with the payment transaction as well as the date when the transaction’s receipt was issued.

- VAT withheld: The “ VAT withheld“ refers to the percentage or amount of VAT that is withheld from payments made as per tax regulations.

- Due date: The “Due date” refers to which payment for the due transaction is expected to be made.

- Deal master, Profit centre, Cost centre, Quantity, Unit rate, Amount, Tax calculation, Tax group, and so on: These terms refer to various details and attributes related to the receivable transaction, such as a transaction description, deal master information, allocation to profit centres or cost centres, quantity, unit rate, amount, tax calculation method, tax group, and other relevant information.

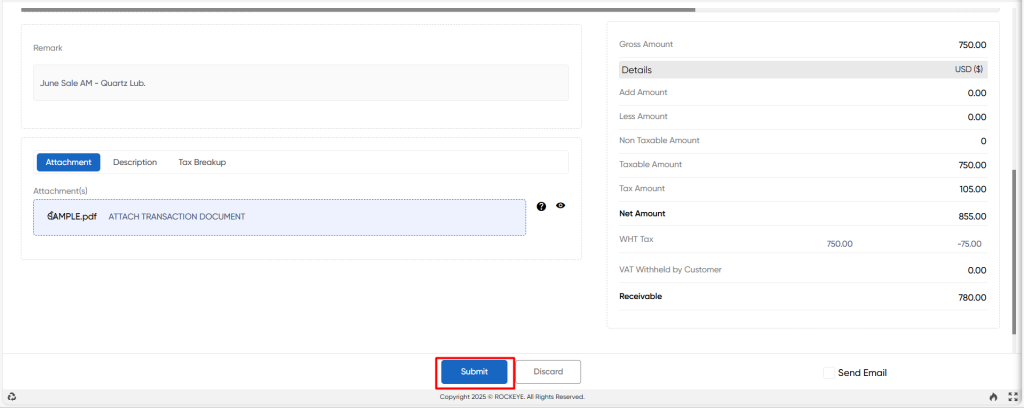

- Attachment, Narration, Tax breakup & Payment summary: These elements provide additional details and supporting information for the receivable transaction, such as attachments of relevant documents, narrations or comments, a tax breakup that shows tax components, and a payment-related information summary.

Users can perform the following actions

- Submit: The “Submit” function allows the user to submit the required information while creating a new sales invoice.

- Discard: The “Discard” function allows the user to cancel the submission of information provided at the time of creating a new sales invoice.