Financial Accounting

Receivable allocation

Introduction/Purpose:

The goal of receivable allocation is to handle payments from customers and outstanding invoices accurately, ensuring efficient revenue recording, cash flow management, and financial transparency.

Dependency:

- Integration with Payment Systems: By automatically recording payment data and updating the accounts receivable ledger, integration with payment systems or platforms, such as electronic fund transfer systems or online payment gateways, helps streamline the receivable allocation process.

- Payment Matching Logic: To accurately match incoming payments with outstanding bills, the Financial Accounting system must have advanced payment matching logic.

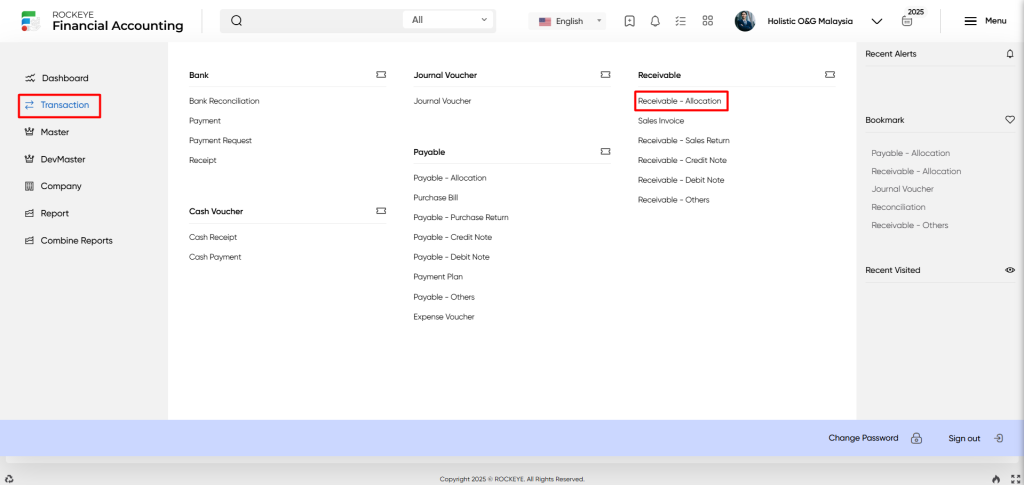

How To Navigate:

The navigation includes the following steps for viewing the receivable allocation in the Financial Accounting system.

- Click on the transactions tab: The transactions can be accessed by clicking on the transactions tab on the side menu.

- Click on the receivable allocation: The receivable allocation can be accessed by clicking it from the receivable section.

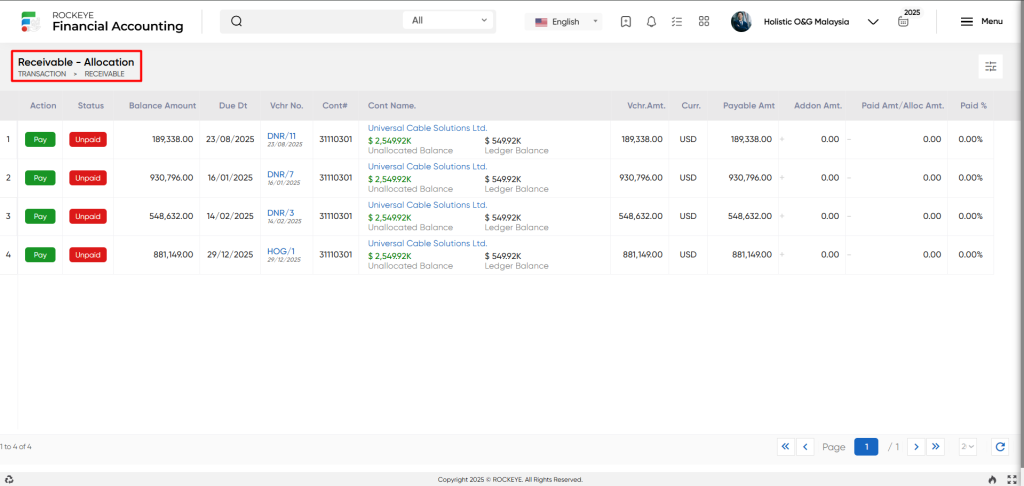

Listing:

A receivable allocation listing in a Financial Accounting system is a feature that provides a list of all allocations.

- Users can view the following information in the receivable allocation listing

- Voucher no & cont

- Cont name and voucher name

- Currency and payable amount

- Addon amount and paid amount

- Balance and paid%

- Due days and due days

- Action and status

User can perform the following actions

- Contact Name: With the “Filter” function available in the receivable allocations, the user can search by the contact name related to the transaction.

- Contact Code: With the “Filter” function available in the receivable allocations, the user can search by the contact code related to the transaction.

- Voucher Code: With the “Filter” function available in the receivable allocations, the user can search by the voucher code related to the transaction.

- Voucher amount: With the “Filter” function available in the receivable allocations, the user can search by the voucher amount related to the transaction.

- Paid Amount: With the “Filter” function available in the receivable allocations, the user can search by the paid amount related to the transaction.

- Voucher Date: With the “Filter” function available in the receivable allocations, the user can search by the voucher date related to the transaction.

- Status: With the “Filter” function available in the receivable allocations, the user can search by the status related to the transaction.

- Paid %: With the “Filter” function available in the receivable allocations, the user can search by the amount paid related to the transaction.(e.g., less than 10%, less than 50%, larger than 50%, equal to 100%, or an error of less than 100%).

- Native currency or other currency: With the “Filter” function available in the receivable allocations, the user can search by the native currency / other currency related to the transaction.

- Voucher type: With the “Filter” function available in the receivable allocations, the user can search by the voucher type related to the transaction.

- All: The “All” refers to a view or option that allows users to see or display all receivable allocations without using any filters or constraints. The user can also view a list of allocated and unallocated receivables.

- Refresh: The “Refresh” option allows users to update or reload the receivable allocation list with the most recent data.

- Export: The “Export” allows users to extract receivable allocation data from the Financial Accounting system and save it in a format that can be used outside of the system.