Financial Accounting

Purchase bill

Introduction/Purpose:

The purchase bill is often kept on file and maintained electronically, making it simple to manage, process, and connect with other modules like accounts payable and the general ledger. It is a crucial part of financial records and helps an organisation make decisions and report financial data accurately.

Dependency:

- Accounts payable integration: Purchase bills are often tightly connected with the accounting system. This integration guarantees that purchase bills are captured, tracked, and linked to the appropriate vendor accounts and payment processes.

- Approval workflow: Purchase bills may require clearance from specific individuals or departments, depending on the organisation’s internal processes. Integration with approval workflows guarantees that purchase invoices are authorised before they are recorded and processed.

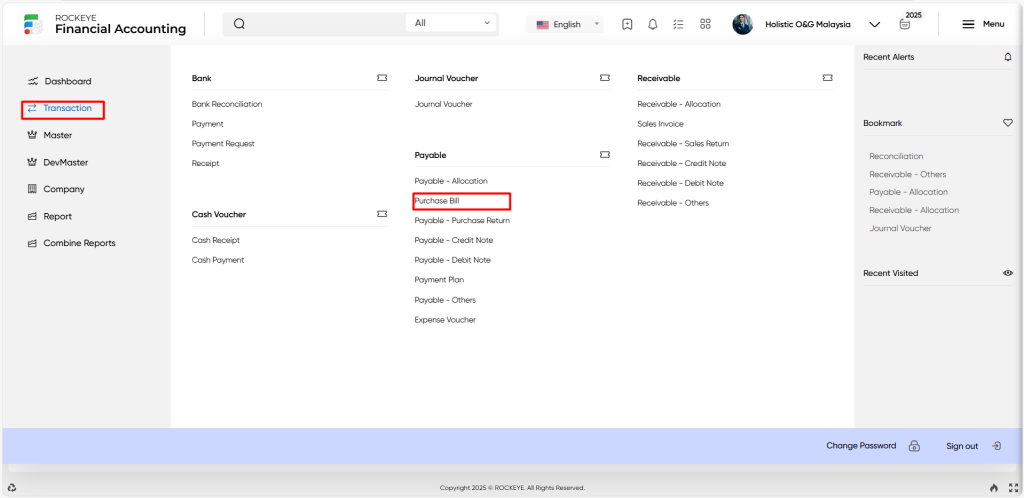

How To Navigate:

The navigation includes the following steps for viewing the purchase bill in the financial management system.

- Click on the transactions tab: The transactions can be accessed by clicking on the transactions tab on the side menu.

- Click on the purchase bill: The purchase bill can be accessed by clicking it from the payable section.

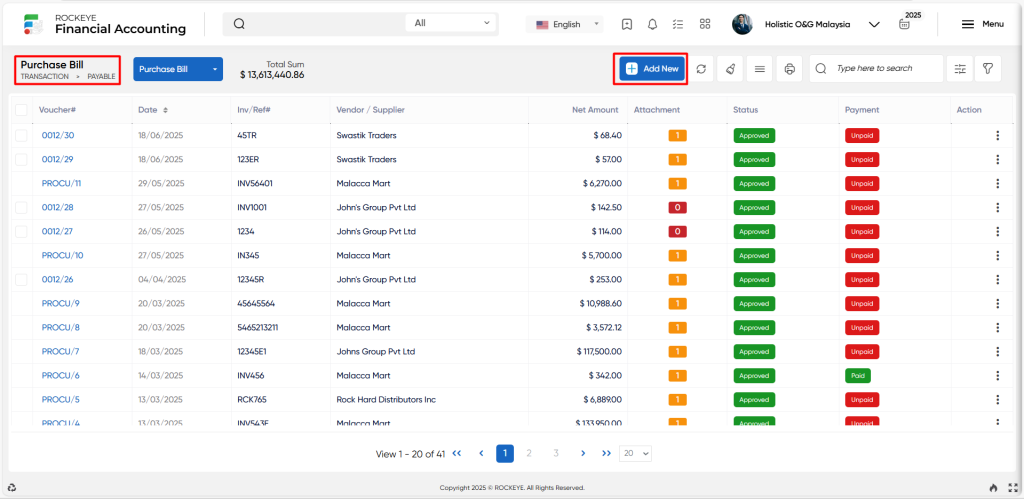

Listing:

A purchase bill listing in a financial management system is a feature that provides a list of all purchase bills.

- Users can view the following information in the purchase bill listing

- Voucher and date

- Inv/Ref and Vendor / Supplier

- General ledger and currency

- Exchange rate

- Taxable and net amount, net amount (lc)

- Attachment payments and status

User can perform the following actions

- Add new: The “Add new” function allows you to create and add new purchase bills or entries to the system.

- Show all listing: The “Show all listing” function is to display and update a list or collection of purchase bills within the system.

- Clear cache: The “Clear cache” function clears the cached data associated with the purchase bill.

- More options: The “More options” function provides the user with more actions or functionalities.

- Print Records: The “Print Records” feature allows users to print content by opening a print dialogue or displaying a preview of the content to be printed.

- Search & quick search: The “Quick search” refers to the option that allows for detailed searches based on multiple parameters such as vendor name and date range, while the ” Search” option allows for short searches based on keywords or selective terms.

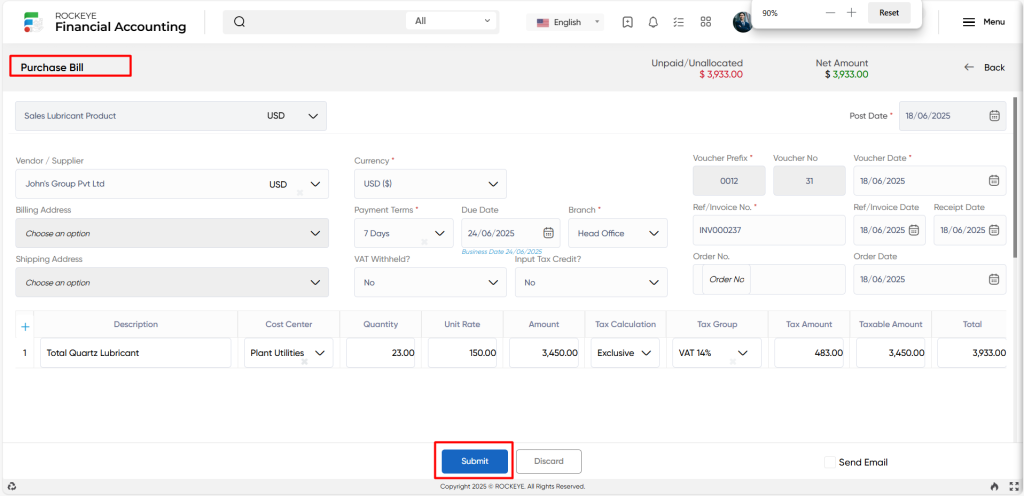

Recording & Update:

Add New Purchase Bill:

- Choose an option: The “choose an option” refers to an option where the user must select a chart of accounts from the system.

- Vendor/Supplier: The “Vendor/Supplier” refers to the name or identity of the vendor or supplier from whom the products or services are obtained in this area.

- Billing address: The “Billing address” refers to the address to which the invoice or bill should be delivered for payment represented by this field.

- Shipping address: The “Shipping address” refers to the form that specifies where the purchased products should be shipped or delivered.

- Currency: The “Currency” refers to the currency in which the transaction is being handled as specified in this section.

- Exchange date: The “Exchange date” refers to the date on which the currency exchange rate is determined.

- Exchange rate: The “Exchange rate” refers to the rate at which one currency is exchanged for another.

- Order no. : The “Order no” refers to the field containing the unique identifier issued to the purchase order associated with the purchase bill.

- Order date: The “Order date” refers to the date the purchase order was issued as indicated in this section.

- VAT withheld: The ”VAT withheld” refers to the field that specifies whether VAT was deducted or withheld from the purchase bill amount.

- Input tax credit: The “Input tax credit” refers to the field of whether the purchaser is qualified for VAT input tax credit.

- Voucher prefix: The “Voucher prefix” refers to the prefix or identification connected with the voucher or document used to record the purchase bill in the financial management system represented by this field.

- Voucher No.: The “Voucher no” refers to a unique number allocated to the voucher or document used to record the purchase bill captured in this field.

- Voucher date: The “Voucher date” refers to the date on which the purchase bill is recorded in the financial management system as indicated in this section.

- Ref/Invoice No: The “Ref/Invoice no” refers to the field relating to the reference or invoice number provided to the purchase bill by the vendor or supplier.

- Ref no.: The “Ref no” refers to the field that represents an additional reference number associated with the purchase bill.

- Ref/Invoice date: The “Ref/Invoice date” refers to the field that reflects the date on which the reference or invoice document was issued by the vendor or supplier.

- Receipt date: The “Receipt date” refers to the date the products or services were received and is represented by this field.

- Payment terms: The “Payment terms” refers to the section that specifies the agreed-upon payment terms and conditions, such as due dates, payment methods, and so on.

- Due date: The “Due date” refers to the date by which the purchase bill payment is expected to be made.

- Normal date: The “Normal date” refers to the field that represents the purchase bill’s usual or standard date.

- Description: The “Description” refers to a brief description or explanation of purchased goods or services.

- Category: The “Category” refers to the field that shows the purchase’s category or categorization, such as office supplies, equipment, raw materials, and so on.

- Cost centre: The “Cost centre” refers to the section/department within the organisation responsible for the purchase represented by this field.

- Deal/Contract : The “Deal/Contract” refers to the field that captures the deal or contract number linked with the purchase.

- Quantity: The “Quantity” refers to the field which indicates the number of units purchased.

- Unit rate: The “Unit rate” refers to the price per unit of the purchased item or service is specified in this section.

- Amount: The ”Amount” refers to the total amount or cost of the purchase is derived by multiplying the quantity by the unit rate.

- Tax calculation: The “Tax calculation” specifies how the tax amount is determined, for as by using a certain tax rate or formula.

- Tax group: The “Tax group” refers to which the purchase belongs, such as regular tax, exempt, or zero-rated.

- Tax amount: The “Tax amount” refers to the amount of tax applicable to the purchase is represented in this area.

- Taxable amount: The ”Taxable amount” refers to the entry indicating the part of the purchase price that is taxed.

- Total: The ”Total” refers to the field which displays the total amount payable, which includes the purchase price and any relevant taxes

- WHT tax: The “WHT tax” refers to the field that shows any withheld or deducted tax at source, such as withholding tax.

- Action: The “Action” refers to the field that provides options or actions that can be made on the purchase bill, such as changing, removing, or approving the record.

- Remark: The “Remark” refers to an option which allows users to enter any important information that does not fit into the other allocated fields.

- Attachment: The “Attachment” refers to the option where users can add supporting documents or files to a purchase bill.

- Narration: The “Narration” refers to the field used to describe or explain a specific transaction or financial event.

- Delivery location: The “Delivery Location” refers to the particular address or place to which products or services are to be delivered.

- Tax breakup: The “Tax Breakup” refers to a detailed summary of the taxes associated with a certain transaction.

- Payment summary: The “”Payment Summary” refers to a brief summary of a transaction’s payment details.

Users can perform the following actions

- Submit: The “Submit” function allows the user to submit the required information while creating a new purchase bill.

- Discard: The “Discard” function allows the user to cancel the submission of information provided at the time of creating a new purchase bill.