Financial Accounting

Payable Purchase Return

Introduction/Purpose:

Payable purchase returns involve sending products or services back to a supplier in exchange for a credit or reimbursement. As well as ensuring correct records and lowering overdue payables, it entails reversing the initial accounts payable entry and decreasing the responsibility owing to the provider.

Dependency:

- Reconciliation: In order to assure accuracy and address any differences, it is essential to compare the payable purchase return with supplier/vendor statements. It aids in confirming that the credit or refund received corresponds to the amount anticipated.

- Accounts Payable integration: Accounts Payable system integration is required for the purchase return process to be integrated with Accounts Payable. Due to this connection, liabilities owed to suppliers are accurately adjusted and financial records are kept consistent.

- Compliance with policies & regulations: When processing payable purchase returns, it’s critical to adhere to all corporate policies, contractual commitments, and relevant regulations. It makes sure that rules are followed and lowers the chance of legal and financial problems.

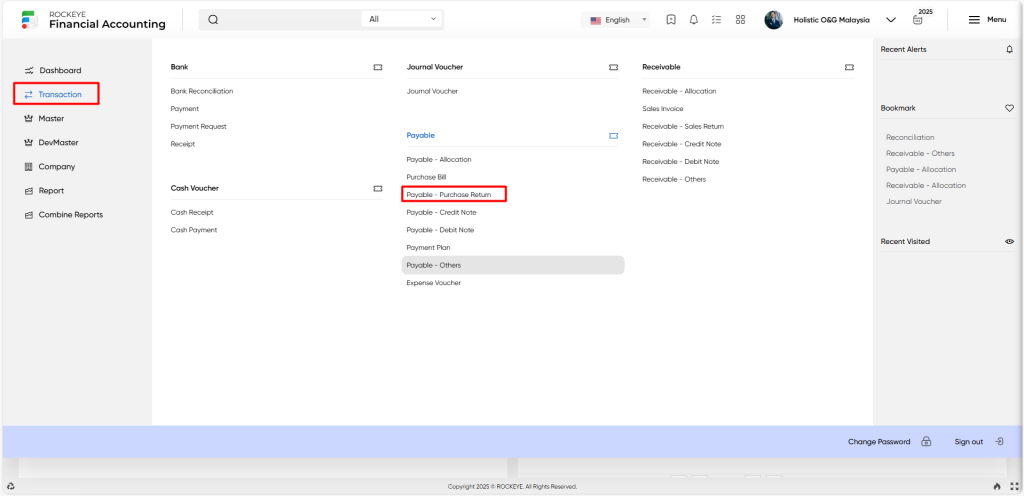

How To Navigate To Payable Purchase Return:

The navigation includes the following steps for viewing the payable purchase return in the financial management system.

- Click on the transactions tab: The transactions can be accessed by clicking on the transactions tab on the side menu.

- Click on the payable purchase return: The payable purchase return can be accessed by clicking it from the payable section.

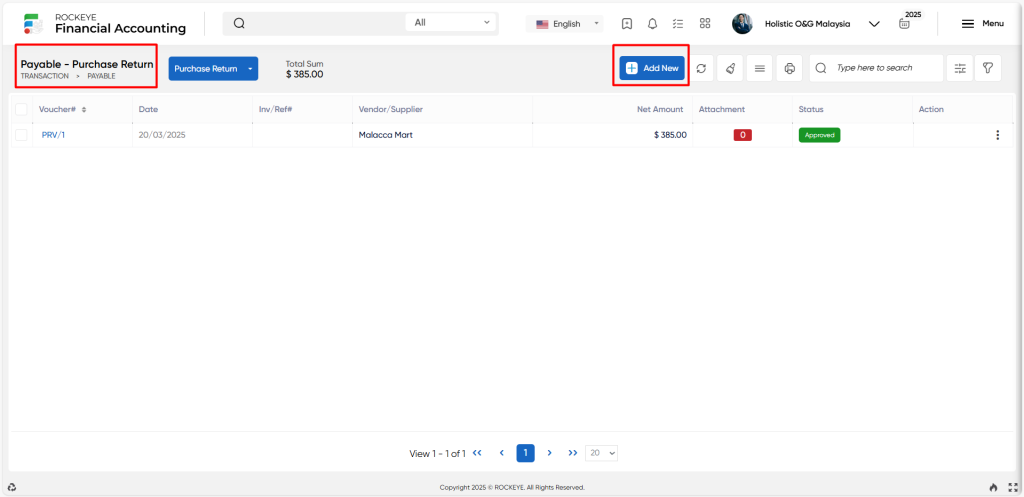

Listing:

A payable purchase return listing in a financial management system is a feature that provides a list of all payable purchase returns.

- Users can view the following information in the payable purchase return listing

- Voucher and date

- Inv / Ref and vendor/supplier

- Purchase general ledger name

- Currency and exchange rate

- Taxable, Net amount and Net amount(LC)

- Attachment and status

User can perform the following actions

- Add new: The “Add new” function allows you to create and add a new payable purchase return to the system.

- Show all listing: The “Show all listing” function is to display and update a list or collection of payable purchase returns within a system or interface.

- More options: The “More options” function provides the user with more actions or functionalities.

- Print records: The “Print records” function allows users to print content by opening a print dialogue or displaying a preview of the content to be printed.

- Search & Quick Search: The “Quick Search” function refers to the option that allows for detailed searches based on multiple parameters, while the ” Search” option allows for short searches based on keywords or selective terms.

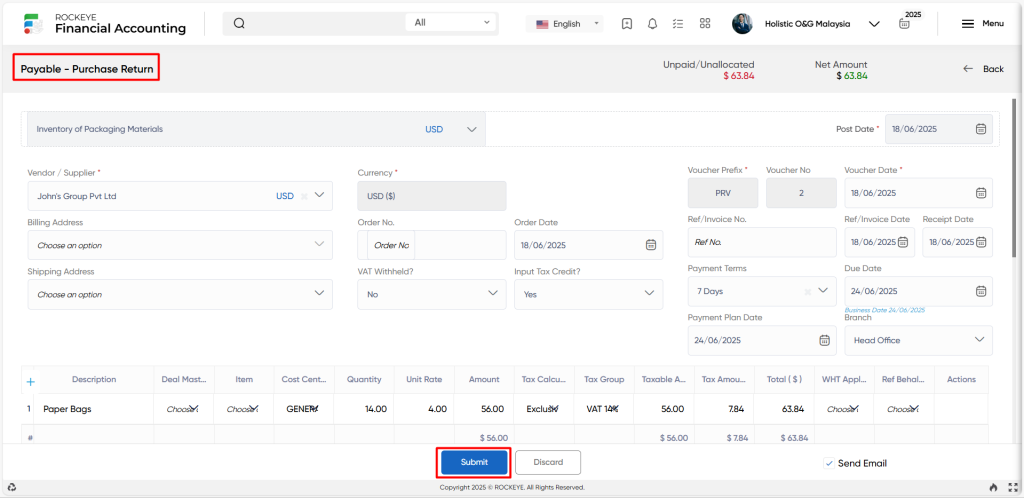

Recording & Update:

Add New Payable Purchase Return:

- Choose an option: The “Choose an option CoA” refers to the option where the user must select the chart of accounts with which this specific payable purchase return is related.

- Supplier/Vendor: “Select a vendor/supplier” refers to the option that allows users to choose the vendor or supplier who is engaged in the payment transaction.

- Vendor prefix: The “Vendor prefix” refers to a prefix or code that is used to identify or classify vendors or suppliers.

- Voucher no. : The “Voucher no” refers to a special identifying number that is given to each voucher for a payable purchase return.

- Voucher date: The “Voucher date” refers to the day the payable purchase return was issued.

- Currency: The “Currency” refers to the type of money used in the transaction.

- Exchange rate: The “Exchange rate” refers to the exchange rate applied to convert the transaction amount from one currency to another.

- Exchange date: The “Exchange date” refers to the day that the currency exchange rate was determined.

- Ref/Invoice date: The “Ref/invoice date” refers to the reference number or invoice number connected to the transaction.

- Value-added tax (VAT) withheld: The “VAT” refers to the field that shows if Value Added Tax (VAT) has been withheld or subtracted from the transaction amount.

- Input tax credit: The “Input tax credit” refers to the term used to describe the credit that a business claims for the VAT that was paid on purchases or expenses.

- Description: The “Description” refers to a brief overview or explanation of the payable purchase return.

- Deal/Contract: The “Deal/contract” refers to the field that, if applicable, denotes the deal or contract number connected to the transaction.

- Quantity, Unit Rate, & Amount: The “Quantity, Unit Rate, and Amount” refers to a field that records the number of items, the unit price, and the overall cost of the goods or services exchanged during the transaction.

- Tax calculation, Tax group, Taxable amount and tax amount: The “Tax calculation, tax group, taxable amount, and tax amount” refers to fields that pertain to how taxes are calculated and broken down, including the tax group, taxable amount, and tax amount imposed.

- Total: The “Total” refers to the entire balance of the payable credit or debit note, including taxes.

- WHT apply on, WHT tax & WHT amount: The “WHT apply on, WHT tax, WHT amount” refers to fields that relate to withholding tax and describe what is subject to the tax, the tax rate that applies, and the amount that will be withheld.

- Ref behalf: The “Ref behalf” refers to a payable purchase return that is being issued on behalf of another company

- Actions: The “Actions” refers to different operations that can be carried out on the payable purchase return, like editing, removing, or producing reports.

- Remark: The “Remark” refers to an option that enables the note to contain extra notes or comments.

- Attachments: The “Attachments” refers to the option to attach files or supporting documents to the payable purchase return.

- Narration: The “Narration” refers to the option that enables the provision of a thorough narrative or justification for the purchase return.

- Tax breakup: The “Tax breakup” refers to a detailed breakdown of the taxes incurred during the transaction.

- Payment summary: The “Payment summary” refers to the option that provides a summary of the payment information, including the method, date, and sum paid.

Users can perform the following actions

- Submit: The “Submit” function allows the user to submit the required information while creating a new payable purchase return.

- Discard: The “Discard” function allows the user to cancel the submission of information provided at the time of creating a new payable purchase return.