Loan

Active Loan Summary:

The “Active Loan Summary” section in the Finas dashboard’s “Loan” module provides the total number of active loans, along with the bank name, loan number, and outstanding amount.

- Users will be able to view all transactions of principal paid, interest paid, principal outstanding, interest outstanding and other charges.

- Users will be able to use the refresh icon. When users click the refresh icon, the entire Active Loan Summary will be updated.

- User will be able to click on the “view statement”: By clicking the “View Statement” option, the user will be directed to a statement form displaying all associated transactions linked to the requested loan amount. Subsequent to making payments, the user must notify the Finas team to proceed with submitting or approving the entry under the provided Finas code. This Finas code will be automatically generated based on the payment type.

Once the Finas team updates the status of the bank receipt, they will communicate this to the loan department. The loan department can then click the “Re-sync” button to retrieve details from the Finas module. Upon achieving an “Approved” status, the loan department will undertake necessary actions related to the selected payment.

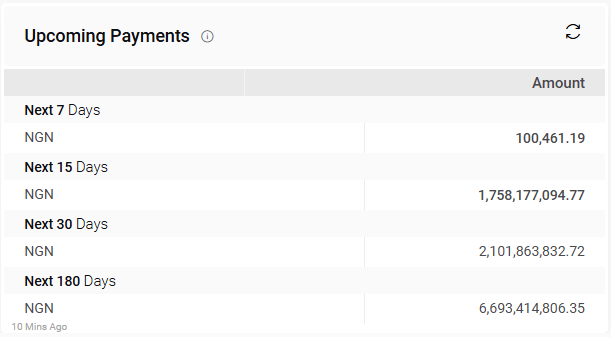

Upcoming Payments:

The “Upcoming Payments” part of the Finas dashboard’s “Loan” module displays upcoming payments such as the next 7 days and the next 15 days. Next 30 days, the next 60 days, and so on, with their corresponding amounts

- Users will be able to use the refresh icon. When users click the refresh icon, the entire Upcoming Payments will be updated.

Investments Detail:

The Investments Detail section of the Finas dashboard’s Investment module offers a comprehensive view of current investments, providing essential details such as Investment Type, Institute Name, Term Period, Principal Amount, Interest Rate, and Total Interest. This section enables users to effectively monitor their investment portfolios, including short-term and long-term fixed deposits, and to stay informed on maturity dates, interest earnings, and payment frequencies.

Investment Information:

The following details are displayed for each investment, allowing users to view the particulars of each deposit:

- Investment Type: Specifies whether the investment is a Short-Term FD or Long-Term FD.

- Institute Name: Lists the financial institution where the investment is held, such as JP Morgan or HDFC Bank.

- Investment Date: The start date of the investment.

- Term Period: The duration of the investment in days.

- Maturity Date: The date the investment matures.

- Principal Amount: The initial investment amount.

- Interest Rate (%): The percentage rate of interest applied to the investment.

- Total Interest: The total interest to be earned by maturity.

- Interest Payment Frequency: Frequency of interest payments, e.g., Half-Yearly or Quarterly.

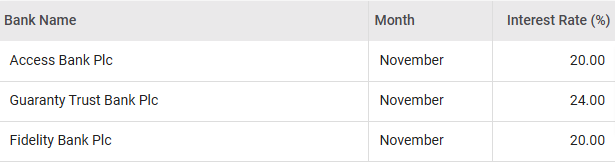

Bank Average Interest Rate:

The Bank Average Interest Rate section of the Finas dashboard’s Investment module provides users with insights into the average interest rates offered by various banks over specific months. This feature enables users to compare interest trends and assess potential investment opportunities based on historical and current interest rates.

Bank Interest Rate Details:

In this section, users can view:

- Bank: The name of the bank providing the interest rate.

- Interest Rate (%): The average interest rate for the selected period.

- Month: The month for which the interest rate data is displayed.

- Month Date: The specific date associated with the monthly interest rate data is recorded.

Interest Income:

The “Interest Income” section of the Finas dashboard’s “Loan” module indicates the amount of income from all financial and non-financial transactions. The interest income is determined by the institution, the rate of interest, the principal amount, the type of loan, and the period of time, among other factors.

- The user will be able to see the interest income from all other financial transactions, as well as the amounts associated with them.

- Users will be able to use the refresh icon. When users click the refresh icon, the entire Interest Income will be updated.

Penalty Charges:

The “Penalty Charges” part of the Finas dashboard’s “Loan” section gives information on various penalty charges associated with loans. It tabulates the names of penalty types and the accompanying penalty amounts. This information assists users in understanding any additional charges or fines incurred as a result of loan agreements, allowing for greater transparency in financial management and loan compliance.

- Users will be able to use the refresh icon. When users click the refresh icon, the entire Penalty Charges will be updated.