Financial Accounting

Customer

Introduction/Purpose:

Customers are people or organisations purchasing goods or services and receiving what a business provides. In Financial Accounting, tracking customers is crucial for interactions, transactions, and financial connections, as their details are essential for various financial processes.

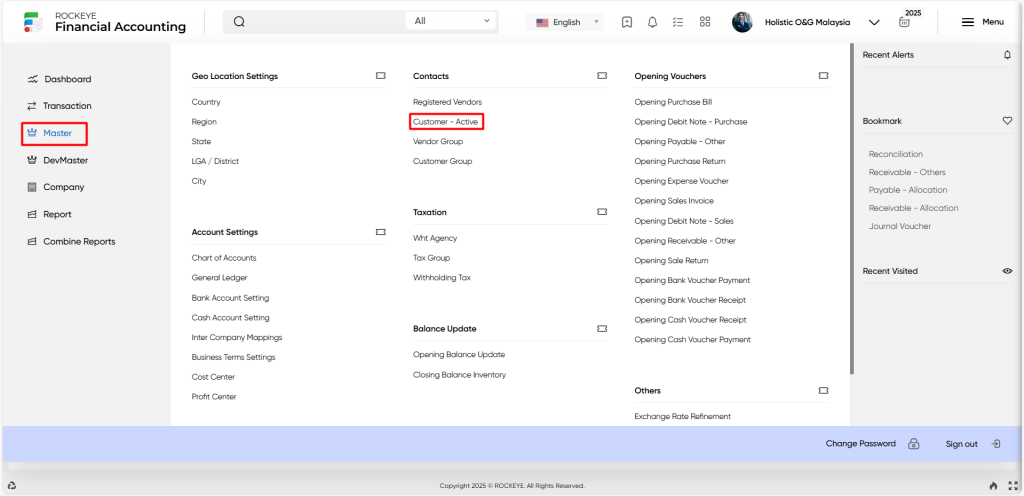

How To Navigate:

The navigation includes the following steps for viewing the customer in the Financial Accounting system

- Click on the master tab: The master can be accessed by clicking on the master tab on the side menu.

- Click on the customer: The customer can be accessed by clicking it from the customer section.

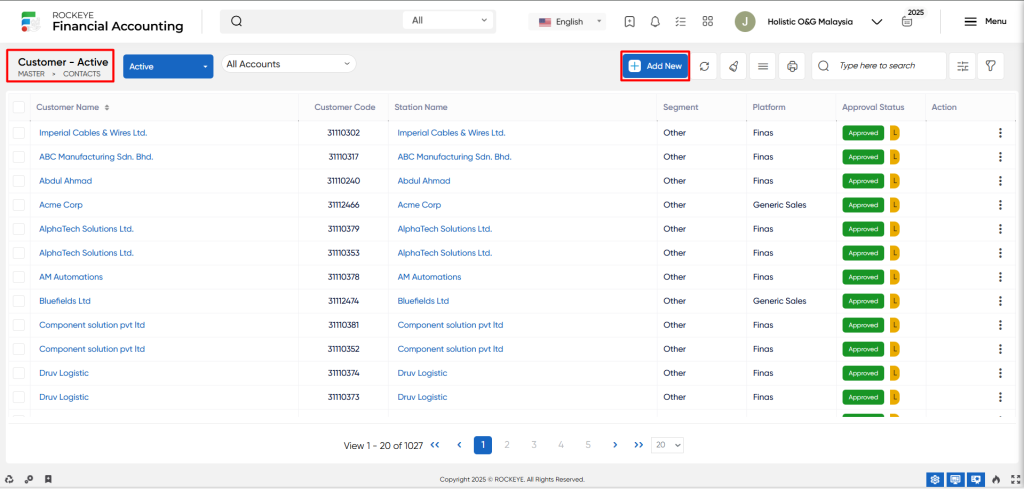

Listing:

A customer listing in a Financial Accounting system is a feature that provides a list of all customers.

- Users can view the following information on the customer listing page

- Name

- Code

- Parent gl

- Currency

- Profile type

- Account type

- Ref code

- Payment allocation

- Attachments

- Approval status

User can perform the following actions

- Add new: The “Add new” function allows you to create and add new customers or entries to the system.

- Show all listing: The “Show all listing” function is to display and update a list or collection of customers within the system.

- Clear cache: The “Clear cache” function clears the cached data associated with the customer.

- More options: The “More options” function provides the user with more actions or functionalities.

- Print records: The “Print records” function allows users to print content by opening a print dialogue or displaying a preview of the content to be printed.

- Search: The “Search” function allows the user to look for a specific entry within the available data and presents the results that match the search parameters.

- Filters: The “Filter” function allows users to refine their search or narrow down the displayed customer records based on specific criteria.

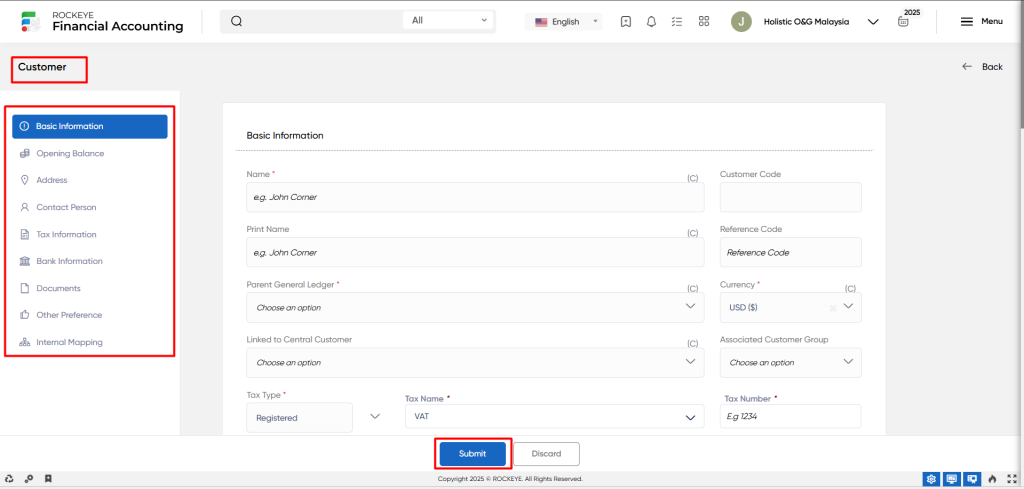

Recording & Update:

Add New Customer:

- Name: The “Name” refers to the descriptive label provided to the customer..

- Customer code: The “Customer code” refers to a unique identifier or code assigned to the customer for easy reference and identification.

- Print name: The “Print name” refers to an alternative name or shorter version of the customer name, which may be used for printing or display purposes.

- Reference code: The “Reference code” refers to the code or reference number that can be assigned to the customer for internal tracking or cross-referencing purposes.

- Parent GL: The “Parent GL code” refers to the parent or main general ledger (GL) code associated with the customer. This code helps categorise customers under specific GL accounts.

- Currency: The “Currency” refers to the currency in which the customer conducts business or expects to be paid.

- Linked to the central customer: The” Linked to the central customer” refers to the customer that is linked to a central or parent customer in cases where there are subsidiary or associated customer entities.

- Associated customer group: The “Associated customer group” refers to the customer group or category to which the customer belongs. Customer groups are often used to classify customers based on certain criteria or characteristics.

- Tax type: The “Tax type” refers to the type of tax or tax category applicable to the customer, such as value-added tax (VAT), or goods and services tax (GST).

- Tax name: The “Tax name” refers to the name or title of the specific tax associated with the customer.

- Tax number: The “Tax number” refers to the tax identification number assigned to the customer by the relevant tax authority.

- Email: The ”Email” refers to the email address associated with the customer for communication purposes.

- Mobile: The “Mobile” refers to the mobile number of a customer.

- WhatsApp number: The “WhatsApp number” refers to a WhatsApp messaging application number associated with the customer for direct communication.

- Website URL: The “Website URL” refers to the web address or URL of the customer’s official website.

- Profile type: The ”Profile type” refers to the type of profile or classification assigned to the customer within the Financial Accounting system.

- Account type: The ”Account type” refers to the type of account or classification assigned to the customer within the Financial Accounting system.

- Sub-account type: The “Sub-account type” refers to the Further categorised or classified customer account under specific subcategories or types.

- Your preferred bank for payment: “Your preferred bank for payment ” refers to the preferred bank account or financial institution to which the customer prefers to receive payments.

- Opening balance: The “Opening balance” refers to the opening balance in the customer refers to the outstanding balance or amount owed to the customer at the beginning of a financial period.

- Address: The” Address” refers to the address of the customer, which refers to the physical location or mailing address of the customer.

- Address type: The” Address type” refers to the categorization or classification of the address, such as billing address, shipping address, or mailing address.

- Default shipping: The” Default shipping” refers to the designated or preselected shipping address that is automatically used when creating purchase orders or shipping products from the customer.

- Default billing: The” Default billing” is the preselected billing address that is automatically used for financial transactions and invoicing related to the customer.

- Country: The “Country” refers to the country in which the customer is located.

- Region: The “Region” refers to a broader geographical region within the country, such as a state or province.

- State: The ”State” refers to the specific state or province in which the customer is situated.

- LGA/District: The “LGA/District” refers to the Local Government Area or District and is applicable in certain countries or regions for further geographical classification within a state or province.

- City: The ”City” refers to the city or town where the customer is located.

- Zip: The “ZIP” refers to the postal code or ZIP code associated with the customer’s address.

- Contact person: The “Contact person” refers to an individual associated with the customer organisation who serves as the primary point of contact for communication and interaction with the organisation.

- Title: The ”Title” refers to the honorific or professional title of the contact person, such as Mr., Mrs.etc.

- Name & Gender: The “Name” refers to the full name of the contact person and the “gender” refers to the gender of the contact person, typically represented as male or female.

- Designation: The “Designation” refers to the job title or position held by the contact person of the customer’s organisation.

- Contact type: The “Contact type” refers to the type of contact, such as mobile number, email address.. etc

- Mobile number: The “Mobile number” refers to the contact person’s mobile phone number, which can be used for direct communication via calls or text messages.

- Phone number: The “Phone number” refers to the contact person’s landline or office phone number.

- Email address: The “Email address” refers to the email address of the contact person, which serves as a primary mode of communication for written correspondence.

- Website URL: The “Website URL” field contains the website address of the contact person’s personal website.

- WhatsApp number: The “WhatsApp number” refers to a WhatsApp messaging application number associated with the contact person for direct communication.

- Skype: “Skype” refers to the contact person’s Skype username or ID, which can be used for video calls or instant messaging.

- Imo: The “Imo” refers to a communication platform similar to Skype. This field indicates the contact person’s Imo username or ID.

- Messenger: The “Messenger” refers to the contact person’s username or ID for other messaging platforms, such as Facebook Messenger or Google Hangouts.

- Snapchat: The “Snapchat” refers to the contact person’s Snapchat username or ID, if applicable.

- Telegram: The “Telegram” refers to Telegram, a messaging app. This field indicates the contact person’s Telegram username or ID.

- Slack: The “Slack” refers to the contact person’s Slack username or ID, which is a platform for question-and-answer discussions on various topics.

- Tax information: The “Tax information” refers to the tax information of the customer and refers to the details related to their tax obligations and compliance.

- Tax name: The “Tax name” refers to the specific name or label given to a particular tax imposed by a government or tax authority.

- Tax number: The “Tax number” refers to the unique identification number assigned to an individual or business entity by the tax authorities.

- Tax attachments: The “Tax attachments” refer to any supporting documents or files that are attached or associated with tax-related records or transactions.

- Description: The “Description” refers that the description may be used to provide additional details or clarifications regarding the nature or purpose of the tax, specific tax-related entries, or any other relevant information associated with the tax record

- Bank information: The “Bank information” refers to the details related to their banking relationships and accounts.

- Bank name: The “Bank name” refers to the name of the bank where the vendor or supplier holds their account.

- Account number: The “Account number” refers to the unique identifier assigned to the customer’s bank account.

- Branch name: The “Branch name” refers to the specific branch or location of the bank where the customer account is held.

- Branch code: The “Branch code“ refers to a numerical or alphanumeric code assigned to a specific branch of a bank.

- IBAN(International Bank Account Number): The “IBAN” refers to a standardised international numbering system used to identify bank accounts in specific countries.

- Swift code: The “Swift code” refers to a unique identification code assigned to a bank or its branches for international wire transfers.(Society for Worldwide Interbank Financial Telecommunication)

- Address: The “Address” refers to the physical location or postal address of the bank branch where the customer account is held.

- Country: The “Country” refers to the country where the bank branch is located.

- Region/State: The “Region/state” refers to the specific region or state within the country where the bank branch is situated.

- City: The “City” refers to the name of the city where the bank branch is located.

- LGA/District: The “LGA” refers to a term used in some countries to define administrative subdivisions within a city or region.

- Landmark: The “Landmark” refers to a recognizable feature or point of reference near the bank branch’s location, which can help in identifying the branch.

- Zipcode: The “ZIP code” refers to a zip code or postal code is a numerical code used in postal systems.

- Is default: The “Is default” refers to the bank account that is set as the default or primary account for the customer.

- Document: The “Document” refers to any supporting files or records associated with the customer.

- Name: The “Name” refers to the name of the document associated with the customer.

- Document: The “Document” refers to an actual file or record related to the customer.

- Doc category: The “Doc category” refers to the category or classification of the document. It helps organise and categorise different types of documents for easier retrieval and management.

- Remark: The “Remark” refers to a space provided for adding additional notes, comments, or descriptions about the document.

- Other preferences: The “Other Preference” refers to additional preferences or settings that can be configured for a specific customer.

- Default VAT group: The “Default VAT group” refers to the default VAT (Value Added Tax) group or category assigned to the customer.

- Default WHT group: The “Default WHAT group” refers to the default group or category for withholding tax purposes. It specifies the withholding tax rate or rules that apply when making payments to the customer.

- Default VAT withheld: The “Default VAT withheld“ refers to the default percentage or amount of VAT that is withheld from payments made to the customer as per tax regulations.

- Default input tax credit: The “Default input tax credit” refers to the default percentage or amount of input tax credit that can be claimed by the buyer on purchases made by the customer.

- Default cost centre: The “Default cost centre” refers to a specific segment or division within an organisation to which costs can be attributed.

- Tax calculation: The “Tax calculation” refers to the method or rules used for calculating taxes, such as VAT or withholding tax, on transactions involving the customer.

- Default payment term: The “Default payment term” refers to the default payment term or condition agreed upon with the customer, specifying the timeframe within which payment should be made.

- Payment allocation: The “Payment allocation” refers to the process or rules for allocating or distributing payments across outstanding invoices or specific invoices related to the customer.

- Internal mapping: “Internal mapping” refers to the process of associating or mapping specific internal codes or identifiers to customers.

Users can perform the following actions

- Submit: The “Submit” function allows the user to submit the required information while creating a new customer.

- Discard: The “Discard” function allows the user to cancel the submission of information provided at the time of creating a new customer.