Financial Accounting

Cash Receipt

Introduction/Purpose:

A cash receipt is a record generated when a company or entity receives cash, serving as proof of payment. It plays a vital role in financial management by aiding in the monitoring and control of incoming cash flows.

Dependency:

- Integration with banking systems: The financial management system should be able to integrate with banking systems in order to receive transaction data and automatically create receipts.

- Integration with accounting systems: Integration with accounting systems allows cash receipt data to be seamlessly sent for further processing, such as general ledger entries and financial statement preparation.

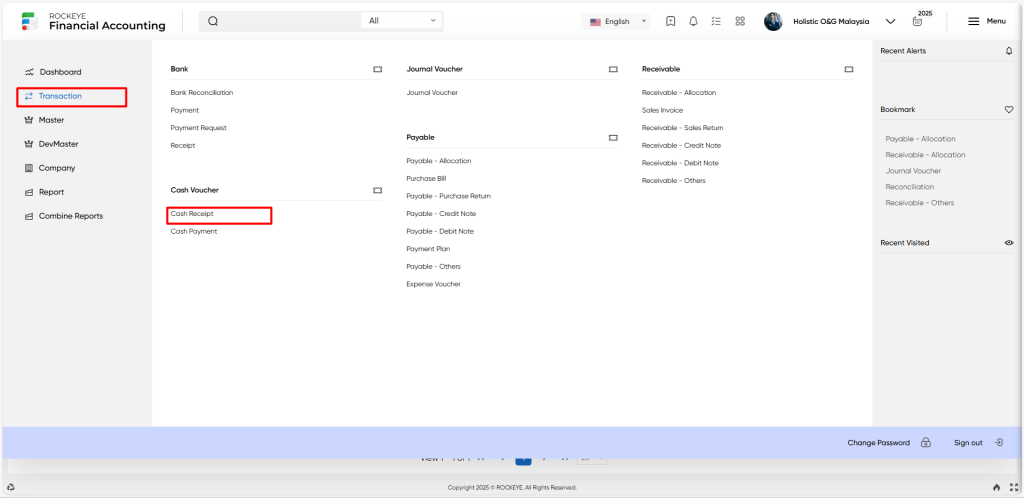

How To Navigate To Cash Receipt:

The navigation includes the following steps for viewing the cash receipt in the financial management system.

- Click on the transactions tab: The transactions can be accessed by clicking on the transactions tab on the side menu.

- Click on the cash receipt: The cash receipt can be accessed by clicking it from the cash voucher section.

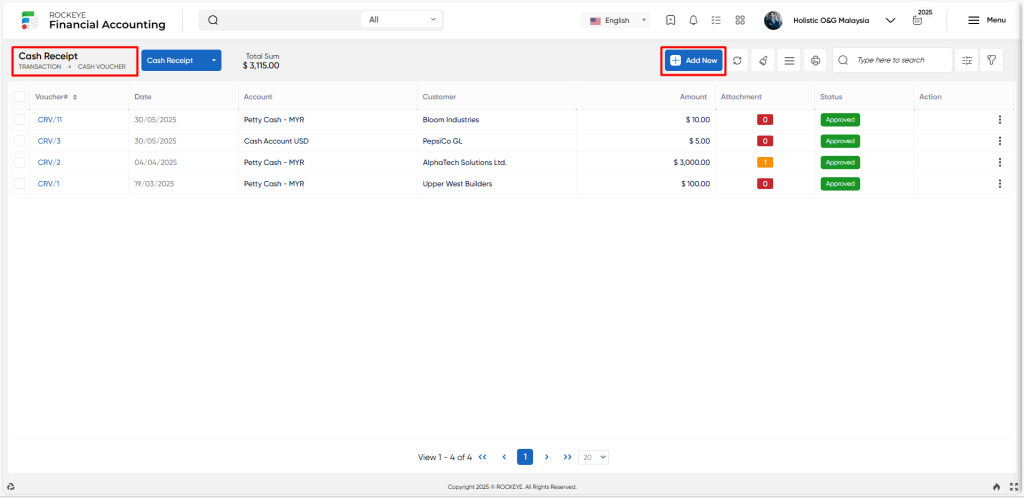

Listing:

A cash receipt listing in a financial management system is a feature which provides a list of all cash receipts.

- Users can view the following information in the cash receipt listing

- Voucher and date

- Account and its type

- Account/Contact

- Currency

- Exchange rate and amount

- Amount lc

- Attachments

- Reconciled

- Allocated and status

User can perform the following actions

- Add new: The “Add new” function allows you to create and add a new cash receipt to the system.

- Show all listing records: The “Show all listing” function is to display and update a list or collection of cash receipts within a system or interface.

- More options: The “More options” function provides the user with more actions or functionalities.

- Print records: The “Print records” feature allows users to print content by opening a print dialogue or displaying a preview of the content to be printed.

- Search: The “Search” function allows the user to look for a specific entry within the available data and presents the results that match the search parameters.

- Quick search: The ”Quick Search” function allows users to quickly search and locate specific cash receipts within the system.

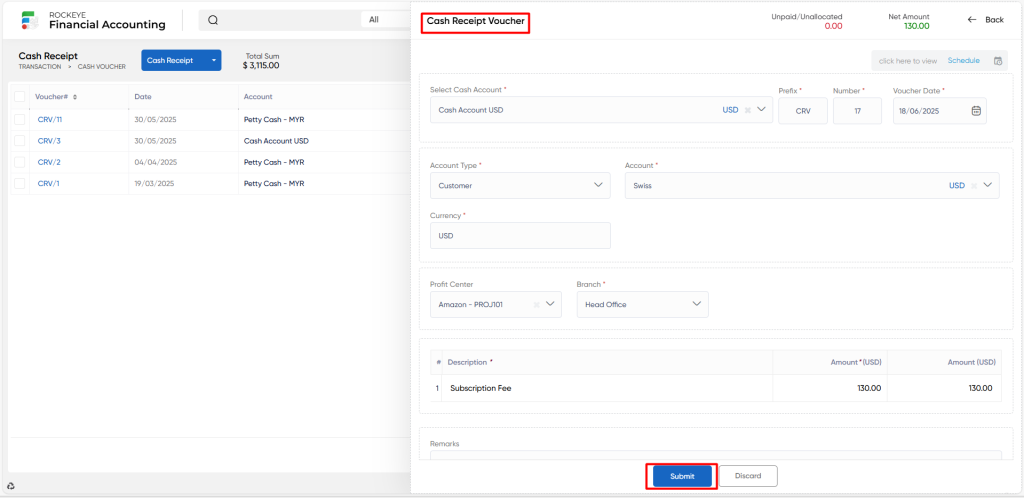

Recording & Update:

Manage cash receipt:

- Cash book: The “Cashbook” refers to an option where the user must select a bank book associated with the cash receipt.

- Prefix: The “Prefix refers to the prefix or identification number connected with the cash receipt which is used to record the cash receipt in the financial management system represented by this field.

- Number: The “Number ” refers to the unique number assigned to the cash receipt in while creating the cash receipt in the financial management system.

- Account type: The “Account type” refers to the kind of account that the payment is associated with, such as a general account, a supplier account, or a specific account code.

- Account: The “Account” refers to the account associated with the cash receipt. You must select the proper account from a list of options or enter the account information.

- Currency: The “Currency” refers to the currency used to make the payment. Depending on the transaction, it could be local currency or any other international currency.

- Exchange rate: The “Exchange date” refers to a day on which a particular exchange rate was used to convert one currency into another.

- Exchange rate: The “Exchange rate” refers to the rate at which one currency is exchanged for another.

- Narration: The “Narration” refers to the area wherein a quick overview or explanation of the bank receipt transaction is provided.

- Amount: The “Amount” refers to the field where the user can enter the receipt amount and specify the transaction’s numerical value.

- Mode: The “Mode” refers to the method or channel by which the payment is made, such as a cheque, cash, or any other payment mode enabled by the financial management system.

- Ref no: The “Reference no” refers to a commonly used term to record a unique reference number associated with the payment, such as an invoice number or a specific identity provided by the beneficiary.

- Ref date: The “Reference date” refers to a date connected with the reference number specified above.

- Ref bank: The “Reference bank” refers to the bank details or the name of the beneficiary or recipient of the payment.

- Contract / Deal: The “contract/deal” refers to the contract if any associated with the bank receipt.

- Profit centre: The “Profit centre” refers to a specific division, department, or project within an organisation to which the payment is allocated or attributed.

- Remarks: The “Remarks” refers to a field that allows users to insert any relevant notes or comments concerning the payment.

- Attachments: The “Attachment” refers to a field where the user can upload supporting papers or files linked to the payment, such as invoices, receipts, or any other necessary paperwork.

Users can perform the following actions

- Submit: The “Submit” function allows the user to submit the required information while creating new cash receipts.

- Discard: The “Discard” function allows the user to cancel the submission of information provided at the time of creating a new cash receipt.