Bank Reconciliation Rules

Introduction/Purpose

A bank reconciliation rule is a predefined set of conditions used to automatically match transactions in a bank statement with corresponding entries in the general ledger or bank book within the ERP system. These rules define how the system identifies and links records—based on criteria such as amount, reference number, transaction description, and date—to ensure accurate and automated reconciliation.

In Rockeye ERP, bank reconciliation rule definitions are essential for automating the matching process between uploaded bank statement lines and internal financial transactions. By applying these rules, users can streamline the reconciliation process, reduce manual effort, improve efficiency, and maintain consistent and reliable financial records

Dependency:

To effectively utilize bank reconciliation rule definitions in Rockeye ERP, the following components are required:

- Accurate Internal Records: Financial transactions must be current and accurately recorded in the system for valid comparison during reconciliation.

- Bank Book Integration: The bank book must be properly linked to the reconciliation module, as it serves as the primary reference point for reconciliation.

- Bank Statements: Import complete and accurate bank statements for the target reconciliation period.

How to Navigate to Bank Reconciliation Rules

The navigation to the Bank Reconciliation Rule Definitions typically involves the following steps:

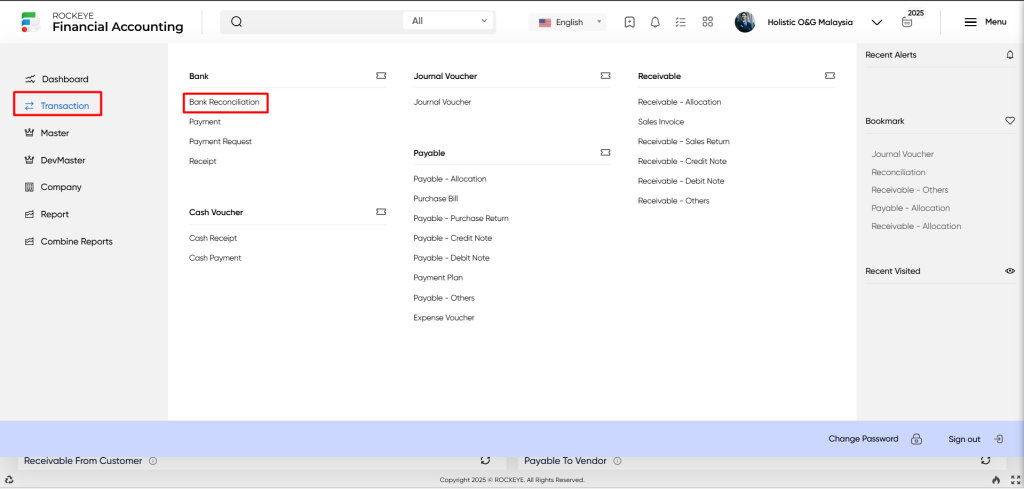

- Open the Transactions Tab: Select Transactions from the side menu to view available financial operations.

- Navigate to Bank Reconciliation: Under the Bank section, click Bank Reconciliation to access the rule definitions.

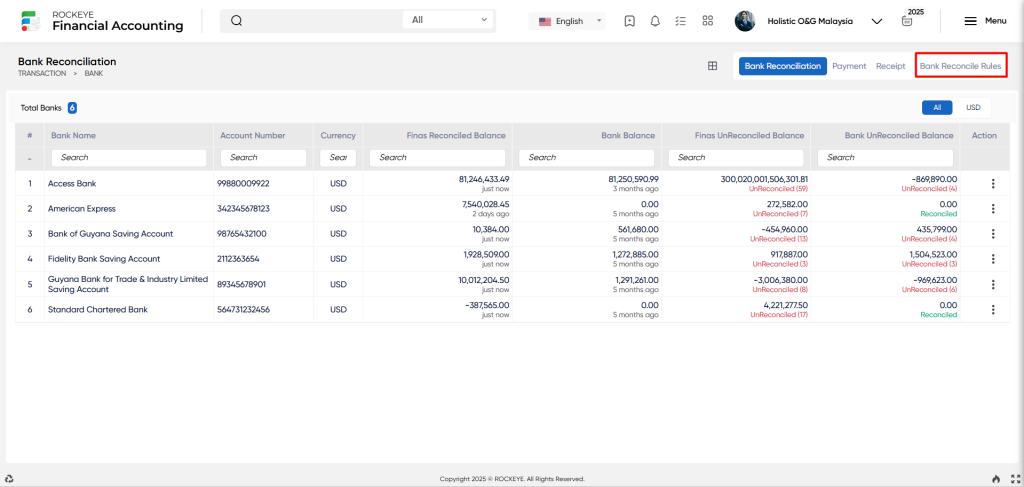

- Access Bank Reconciliation Rules: In the top-right corner of the reconciliation window listing, click Bank Reconcile Rules to view or manage rule definitions.

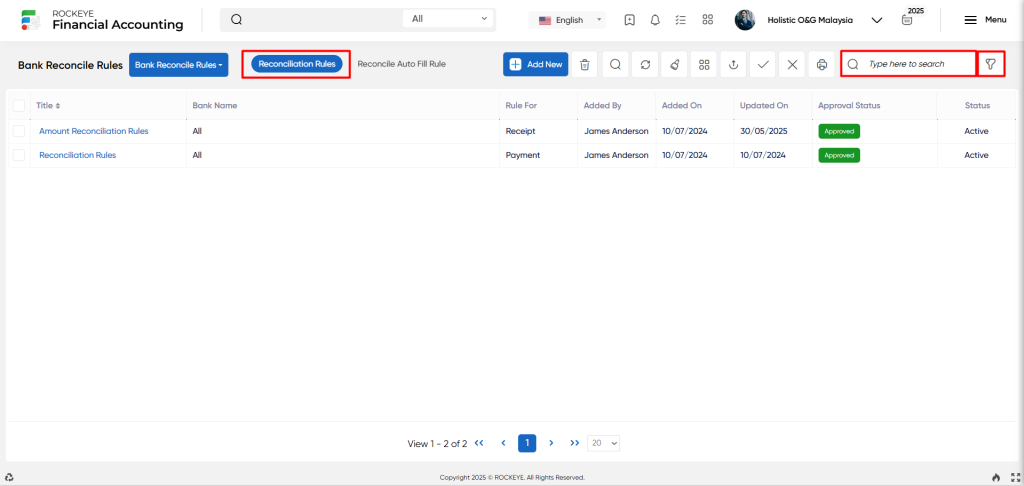

Bank Reconciliation Rule Listing

A Bank Reconciliation Rule Listing is a feature that displays all defined reconciliation rules within the financial system.

It provides a structured overview of each rule, summarizing key details through the following fields:

- Title: The name assigned to the bank reconciliation rule.

- Bank: The specific bank account to which the rule applies.

- Rule For: Indicates the type of transaction the rule targets, either bank payment or bank receipt.

- Added By: The user who initially created the rule.

- Added On: The date the rule was created in the system.

- Updated On: The date when the rule was last modified.

- Approval Status: Reflects whether the rule has been reviewed and approved for use.

- Status: Shows whether the rule is currently active or inactive in the system.

Available Actions:

The user can perform the following actions:

- Add new: The “Add new” function allows you to create and add a new bank reconciliation rule.

- Show all listing records: The “Show all listing” function is to display and update a list or collection of reconciliation rules within a system or interface.

- Clear cache: Clears cached data to refresh listing views and ensure updated information.

- Hide/Show Column: Toggle visibility of specific columns for a customized view.

- Export: Download rules in Excel, CSV, or PDF formats.

- Active: The “Active” allows users to mark selected reconciliation rules as active, enabling them for use in the bank reconciliation process.

- Inactive: The Inactive” allows users to mark selected reconciliation rules as inactive, disabling them from being applied during reconciliation.

- Print records: The “Print records” function allows users to print content by opening a print dialogue or displaying a preview of the content to be printed.

- Search: The “Search” function allows the user to look for a specific entry within the available data and presents the results that match the search parameters.

- Quick search: The ”Quick Search” function allows users to quickly search and locate specific reconciliation rules within the system.

Recording & Update:

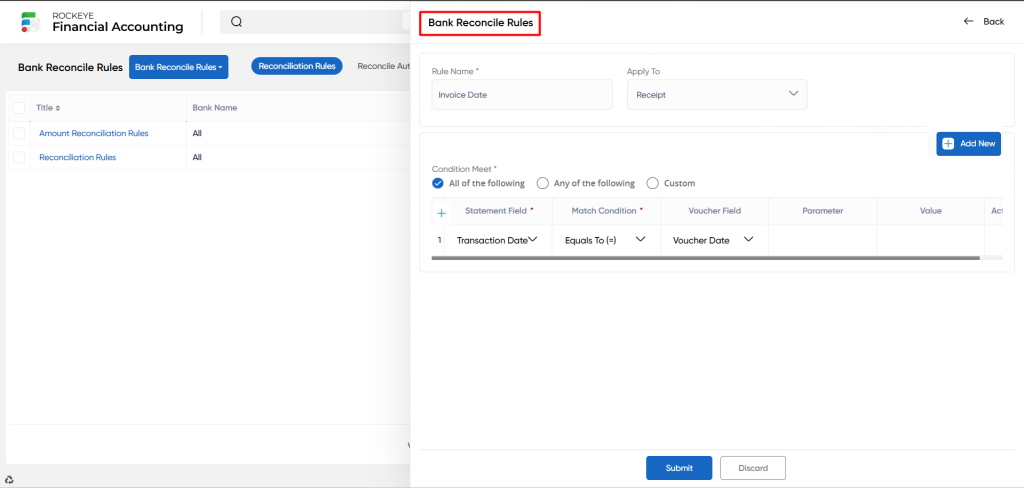

Add a New Reconciliation Rule:

- Rule Name: A user-defined name for the reconciliation rule. This should be descriptive enough to identify the purpose or criteria of the rule.

- Apply To: Specifies the type of transaction the rule will apply to either Bank Payment or Bank Receipt. This ensures the rule only processes applicable transactions during reconciliation.

- Conditions Meet: Defines how multiple conditions within the rule should be evaluated.

- All of the following: All specified conditions must be met for the rule to trigger automatic reconciliation.

- Any of the following: The rule will execute if at least one of the conditions is met.

- Custom: Allows advanced users to configure complex logic combining multiple conditions using logical operators (AND/OR).

- Statement Field: Refers to the field in the uploaded bank statement that will be evaluated (e.g., Description, Reference, Amount). This field is the input used for comparison during rule matching.

- Match Condition: Defines the logical condition used to compare the statement field with system data (e.g., equals to, greater than, less than). Determines how closely the values must match for reconciliation to occur.

- Voucher Field: A field from the internal financial records (voucher or ledger data) to be matched against the Statement Field.

- Parameter: A supporting variable used to refine the condition logic. For example, this may define a date range, text pattern, or numerical threshold to be used in the comparison.

- Value: The specific value to be compared against the parameter or used in the rule condition. For example, if the condition is equals, the value could be a specific transaction description or amount.

Users can perform the following actions:

Submit: The “Submit” action is used to finalize and save the details entered when creating a new bank reconciliation rule.

Discard: The “Discard” option enables the user to cancel the rule creation process and clear all entered data without saving.