Financial Accounting

Bank Reconciliation

Introduction/Purpose:

Bank reconciliation is the process of ensuring the accuracy of internal financial records with bank statements. By comparing the two sets of data, it detects discrepancies and ensures financial accuracy.

Dependency:

- Accurate internal records: The financial management system must be used to keep internal financial records accurate and up to date. These records are utilised to compare the bank statements during the reconciliation procedure.

- Bank book: The system’s bank records must be integrated with the bank reconciliation process.Because the bank book serves as the foundation for bank reconciliation.

- Bank statements: Obtain bank statements for the relevant period from the bank. You must have access to correct and up-to-date bank statements in order to compare and reconcile the transactions.

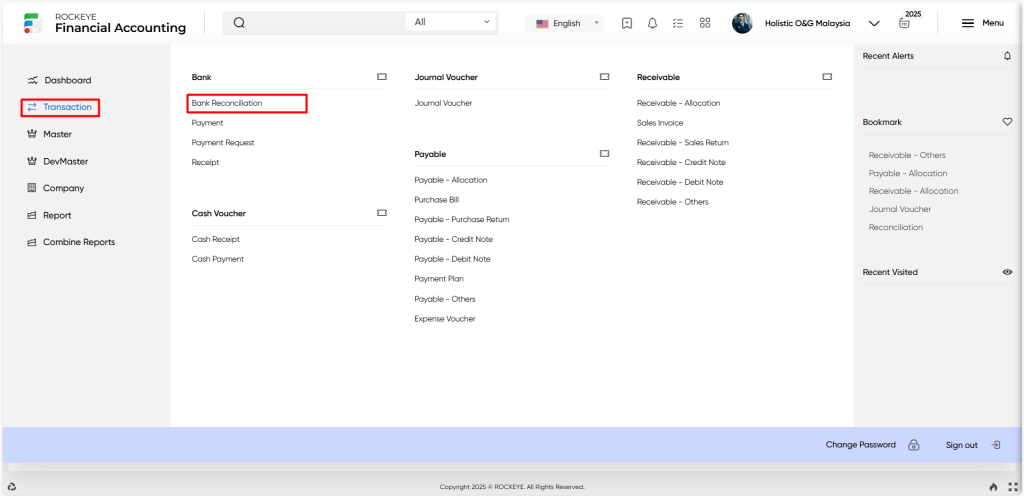

How To Navigate To Bank Reconciliation:

The navigation includes the following steps for viewing the bank reconciliation in the financial management system.

- Click on the transactions tab: The transactions can be accessed by clicking on the transactions tab on the side menu.

- Click on the bank reconciliation: The bank reconciliation can be accessed by clicking it from the bank section.

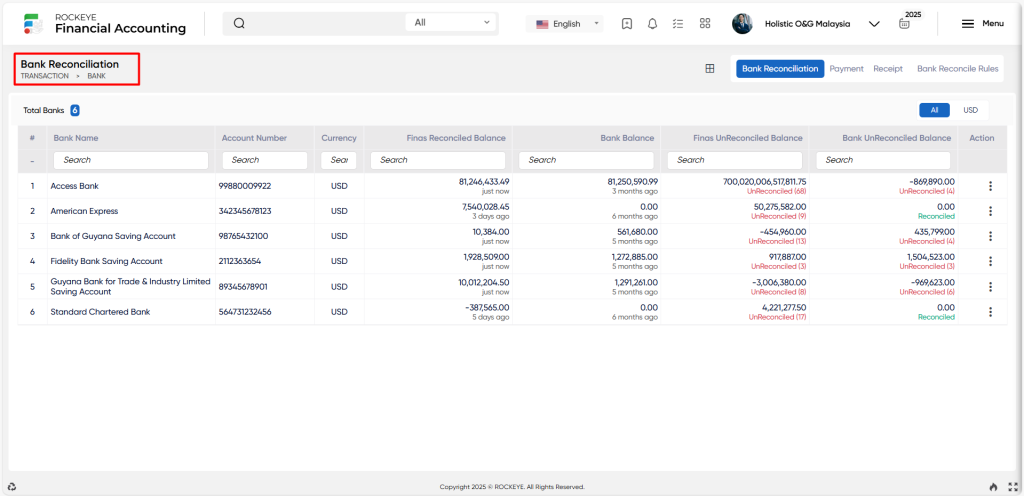

Listing:

A bank reconciliation listing is a feature in a financial system that displays a list of all banks in the system along with the total amount reconciled and the amount that remains unreconciled.

- Users can view the following information on the bank reconciliation page

- Bank name, statement balance, system balance, total amount unreconciled, and a linear graph depicting refunded and pending amounts are all displayed.

- The user will be able to view the bank book, statement, reconciliation rules, and reports for each bank section.

User can perform the following actions

- Email config: The “Email config” function is used for unreconciled vouchers, sending emails to configured individuals about pending vouchers for reconciliation. We predefined actions to notify them of pending work.

- Reconcile: The “Reconcile” function allows the user to reconcile means to compare two sets of financial records to ensure that they are consistent.

- Change page view: The “Change page view” function allows users to change the appearance or layout of a page within a system or application.

- Add new bank/Change page view: The “Adding a new bank or changing the page view” function is used when adding a new bank to describe the process of incorporating a new bank account into a financial management system.

Search: The “Search” function in bank reconciliation is a search tool that helps users to locate certain data.