Bank Account & Cash Account Settings

Introduction/Purpose:

The bank account and cash account serve as specialized ledgers within the general ledger structure. They are segregated by the Chart of Accounts to facilitate streamlined operations and are managed with various currencies. (The general ledger will support only the native currency of the company)

Dependency:

This module has the dependency of 2 sub-modules which are listed below:

- Bank list: A particular function in bookkeeping software gathers all bank names in one location. This makes it easier to create bank books. People can rapidly access bank names without having to type much.

- Chart of Accounts: The Chart of Accounts is essential for building specific money accounts in bookkeeping software, such as the bank and cash book. When creating these accounts, it’s critical to use the correct Chart of Accounts. It helps in the neat organisation and sorting of money items.

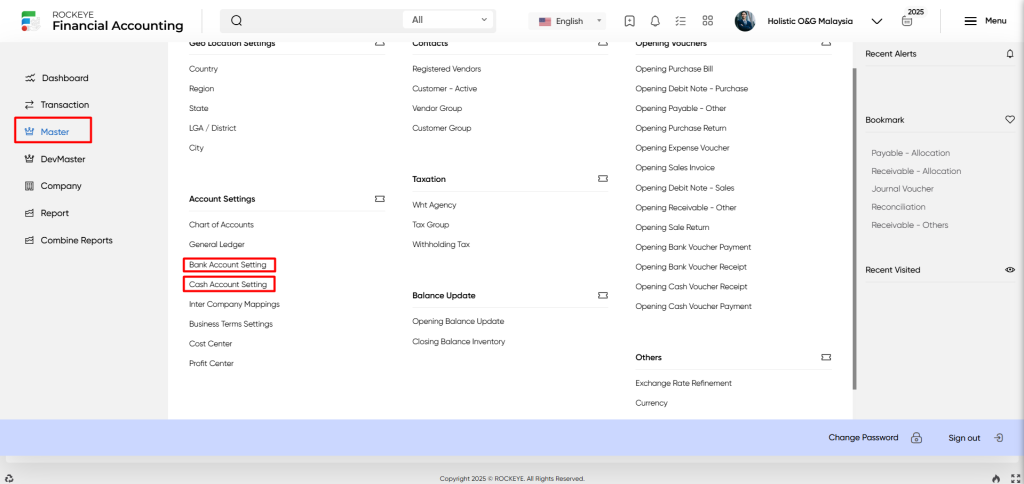

How To Navigate:

The navigation includes the following steps for viewing the cash account & bank account in the Financial Accounting system

- Click on the master tab: The master can be accessed by clicking on the master tab on the side menu.

- Click on bank account/cash account setting: The cash account/bank account can be accessed by clicking it from the account section.

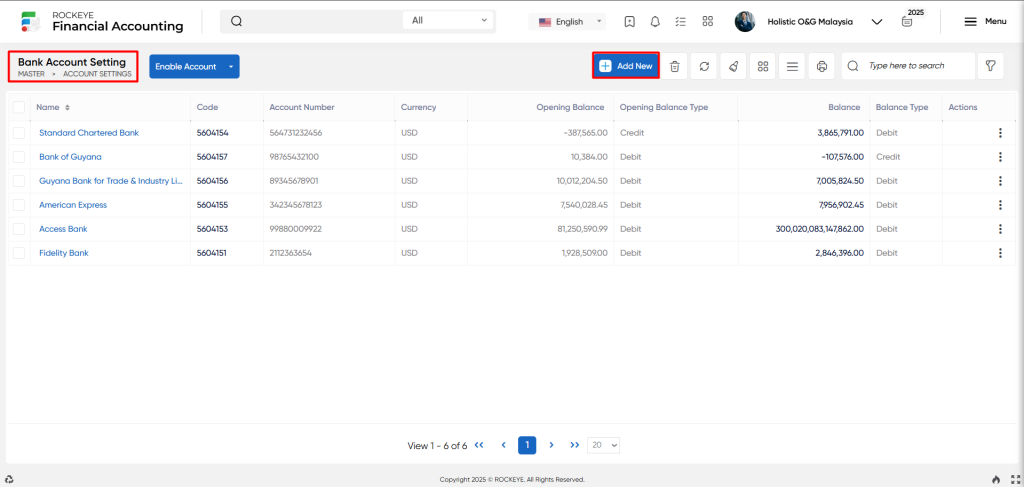

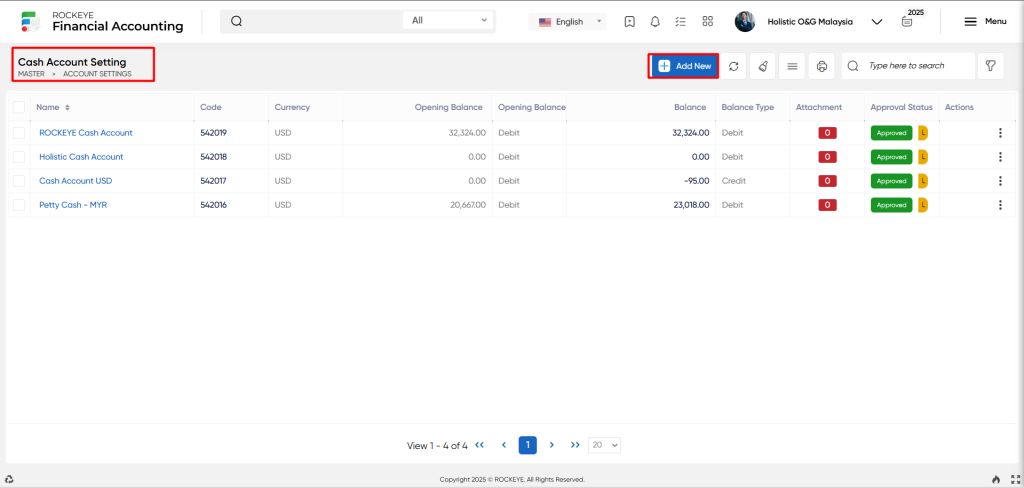

Listing:

A cash account/bank account listing in a Financial Accounting system is a feature which provides a list of all cash accounts/bank accounts.

- Account name

- FINAS code

- Account number(if any)

- Currency

- Opening balance & type

- Current balance & type

- Quick Navigation

- Bank statement

- Bank reconciliation

- Approval status

- If approval flow is integrated (BPMN)

- Approval flow is showing “L” which means the transaction is approved and usable locally (in a specific organisation) but this record is not approved on the central repository.

User can perform the following actions

- Add new: The “Add new” function allows you to create and add a new cash account/bank account to the system.

- Clear cache: The “Clear cache” function clears the cached data associated with the cash account/bank account.

- Other action option: The “Other action option” function provides a dropdown menu with additional actions or functionalities that a user can perform within the bank account.

- Quick search: The “Quick Search” function refers to functionality that allows users to swiftly search and locate specific transactions or entries within the bank account/cash account based on certain criteria.

- Also listing screens having a smart tag when you move your mouse on a specific row system will show a small popup front where you can see activity related to a specific transaction.

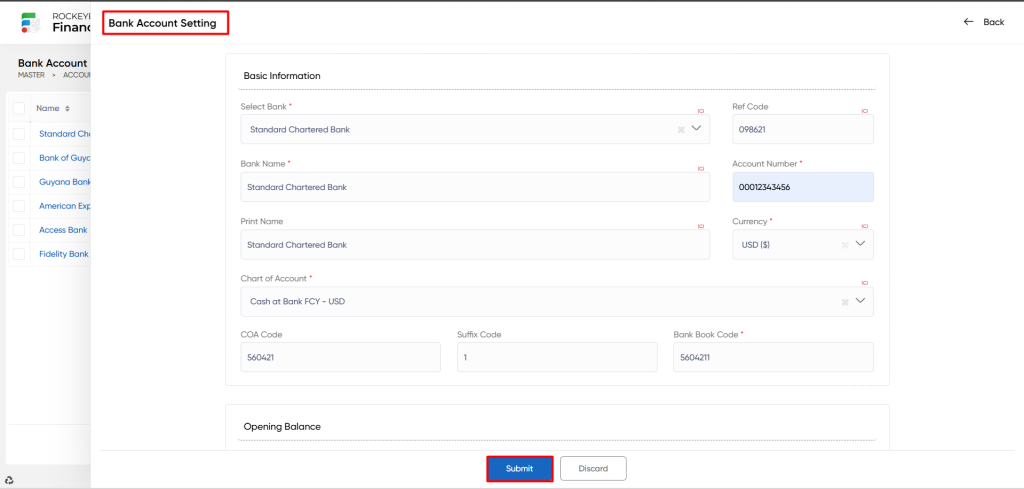

Recording & Update:

Add New Bank/Cash Account:

- Account name: The “account name” refers to the descriptive label placed on the cash account/bank account during the transaction.

- Print name: The “Print name” refers to a bank/cash book name as it appears in printed financial statements or reports.”

- Reference code: The “Reference code” refers to the field that allows you to add a unique identification or reference code to a bank/cash account entry.

- Currency: The “Currency” refers to the currency in which the bank or cash account entry is recorded. It indicates the monetary unit for the transaction.

- Chart of account: The “Chart of accounts (COA)” refers to a predefined list or directory that organizes and categorizes financial transactions in a bank or cash account.

- COA code: The “COA code” refers to the unique identifier or code assigned to each bank account/cash account based on a chart of accounts.

- Suffix code: The “Suffix code” refers to an optional field that can be used to provide additional identification or classification for the bank or cash account.

- Book/Cash Account code: The “Bank or Cash account code” refers to the code or identifier assigned to the bank account or cash account entry.

- Opening balance: The “Opening balance” refers to the initial balance of the bank or cash account at the beginning of a specific accounting period.

- Additional fields(In case of bank book creation):

- Select bank: This field allows users to select the specific bank from a list of available bank names (centralise at the organisation level)

- Branch address: The branch address field captures the physical address or location of the bank branch associated with the bank account entry.

- Select bank: This field allows users to select the specific bank from a list of available bank names (centralise at the organisation level)

- Account number: The account number field represents the unique number associated with the bank account for which the bank book entry is recorded.

- Country, LGA / District, State, City, Region, ZIP Code: These fields represent the geographical details related to the bank branch or account location.

- Account type: The “Account type” refers to the type of bank account associated with current, saving, overdraft etc.

- Branch number: The “Branch number” refers to the unique identification number assigned to the specific bank branch associated with the bank.

- Swift code: The “Swift code” refers to the Society for Worldwide Interbank Financial Telecommunication (SWIFT) code assigned to the bank.

- IBAN number: The “International bank account number (IBAN)” refers to the unique international bank account number associated with the bank account for the bank.

- Remark: The “Remark” refers to the field that allows users to enter any specific remarks or comments about the bank book entry.

Users can perform the following actions

- Submit: The “Submit” function allows the user to submit the required information while creating a new cash account/bank account.

- Discard: The “Discard” function allows the user to cancel the submission of information provided at the time of creating a new cash account/bank account.