Bank Receipt – Recurring

Introduction/Purpose:

Recurring bank receipts refer to automated, scheduled incoming payment transactions that repeat at defined intervals—such as weekly, monthly, or quarterly. These typically involve regular customer payments like subscriptions, rent, service fees, or installment-based collections.

In Rockeye ERP, recurring bank receipt functionality enables users to define and automate repetitive receipt entries, reducing manual data entry and minimizing errors. By configuring recurring receipt templates with fixed parameters—such as customer, amount, frequency, and account—users can automate timely fund postings, improving accuracy and efficiency

This automation enhances operational efficiency, supports accurate cash flow tracking, and promotes financial consistency across accounting periods.

Dependency:

To effectively configure and manage recurring bank receipts in Rockeye ERP, the following components must be in place:

- Customer Master Data: Customer records must be accurately maintained in the system, including banking details and customer codes, to associate receipts with the correct accounts.

- Bank Account Setup: The receiving bank account must be configured and active within the ERP system to ensure proper allocation of recurring funds.

- Defined Receipt Templates: Users must set up standardized receipt templates with relevant fields—such as frequency, amount, due date, and ledger accounts—to automate the generation of recurring entries.

- Posting Periods Open: The accounting periods for which receipts are to be scheduled must be open and available to allow seamless posting of transactions.

- Authorization and Approval: Ensure appropriate roles and workflows are defined for schedule creation and processing.

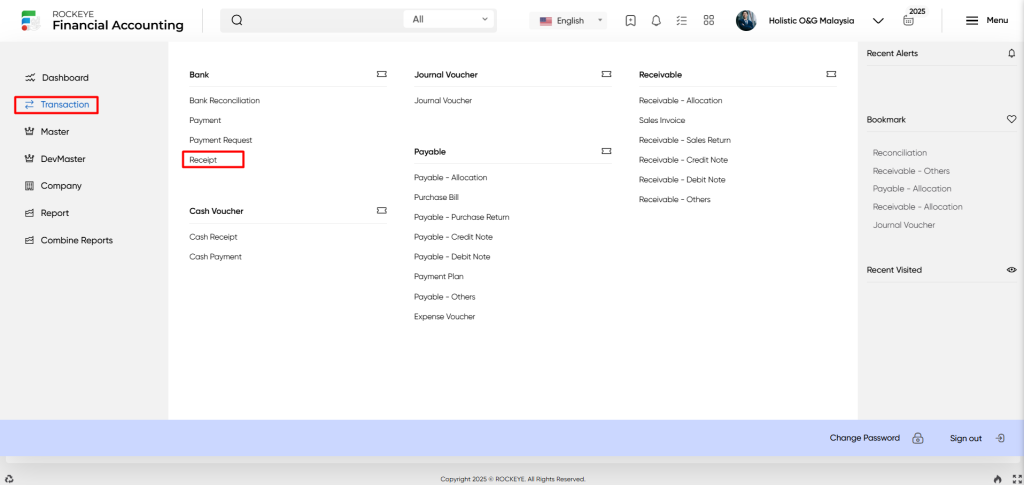

How to Navigate to Recurring Bank Receipts

The navigation to the recurring bank receipt typically involves the following steps:

- Go to the Transactions Tab: From the main side menu, click on the Transactions tab to access financial transaction options.

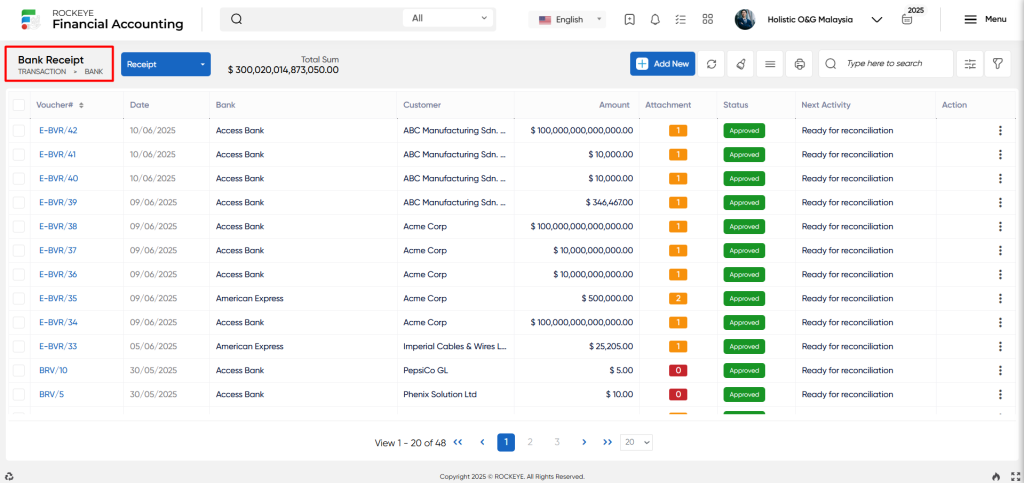

- Click on Bank Receipts: Under the Bank section, select Bank Receipts to open the receipt listing window.

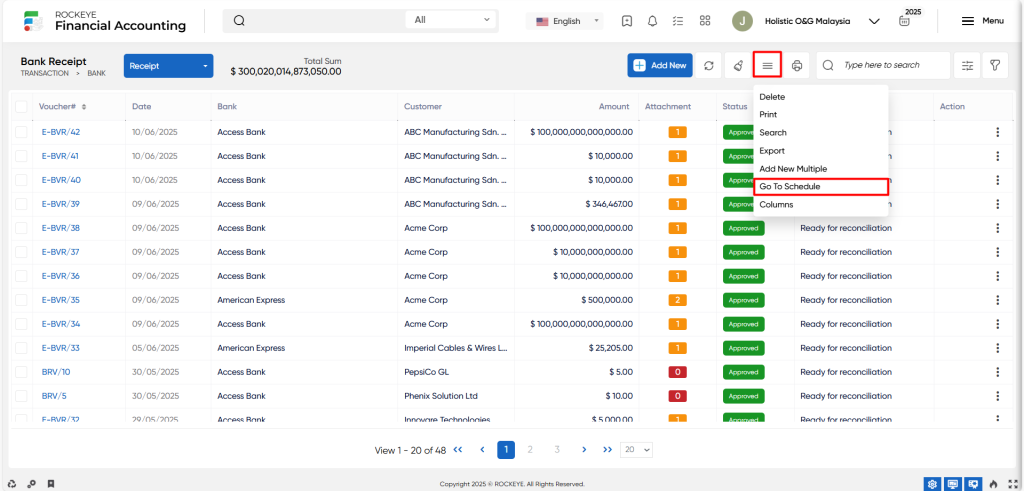

- Click the “More Options” Icon at the top right and navigate to “Go to Schedule.”

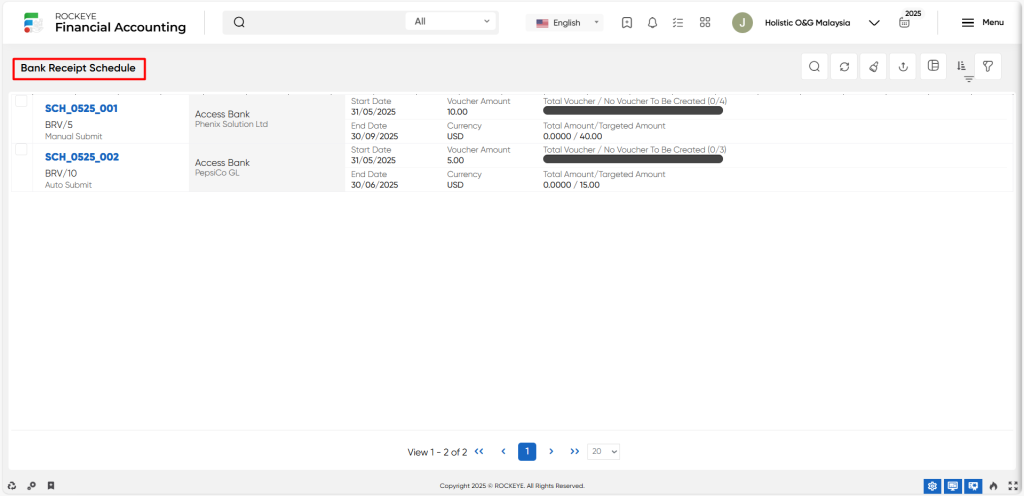

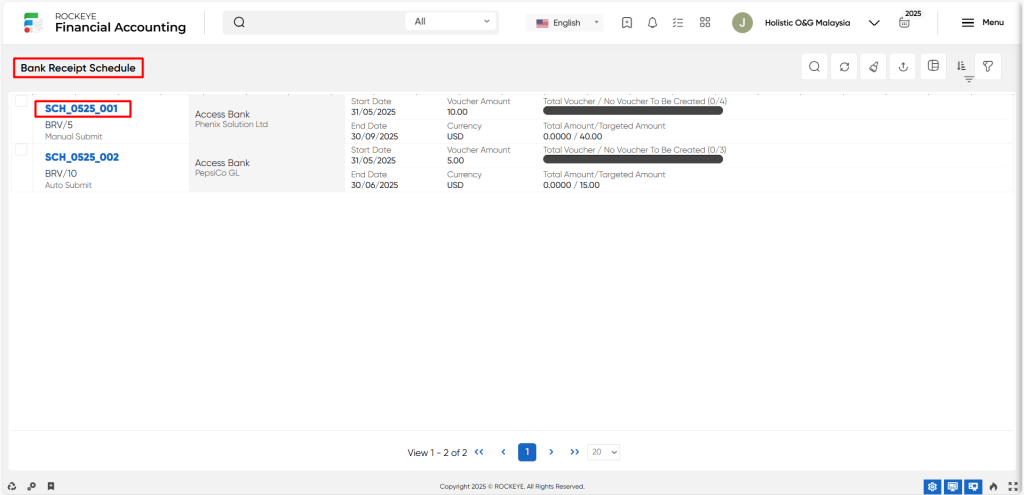

Recurring Banking Receipt Listing

The Recurring Banking Receipt Listing is a feature that displays all predefined recurring bank receipt entries configured in the financial system.

It provides a centralized view of scheduled receipt transactions, allowing users to easily track, manage, and update recurring payment setups for various customers.

The below key information can be viewed through the listing window:

- Schedule Number: A system-assigned unique identifier used to reference and manage each recurring receipt schedule.

- Related Base Bank Receipt Voucher: Shows the initial receipt entry that serves as the template for the recurring schedule, providing a link to the base transaction.

- Type of Execution: Specifies whether the schedule is set to run automatically on defined dates or requires manual user initiation.

- Bank Name: Indicates the receiving bank account where the recurring receipts are being posted.

- Customer Name: Displays the name of the customer associated with the recurring payment schedule.

- Start and End Date of the Schedule: Defines the duration over which the recurring receipts are to be generated, from the start date to the final execution date.

- Voucher Amount: The individual amount to be received for each recurring transaction based on the schedule setup.

- Currency: Reflects the currency in which the receipt transactions are recorded.

- Total Voucher /No. of Vouchers Created: Provides visibility into how many receipt vouchers have been generated so far versus the total number planned for the entire schedule.

- Total Amount / Targeted Amount: Shows the cumulative value of the receipts generated to date compared against the total targeted amount expected over the full schedule period.

Available Actions:

User can perform the following actions:

- Show all listing records: The “Show all listing” function is to display and update a list or collection of recurring bank receipts within a system or interface.

- Clear cache: The “Clear cache” refers to the process of deleting temporary files, data, or stored information that is stored in a cache.

- Export: The “Export” is for exporting the list of scheduled recurring receipts in various formats; Excel, CSV, PDF for reporting, analysis, or backup purposes.

- Change view: The “Change View” allows the user to switch between table view or list view formats for displaying schedule listings based on preference or usability needs.

- Advanced Search: The “Advanced Search” function allows the user to look for a specific entry within the available data and presents the results that match the search parameters.

- Quick search: The ”Quick Search” function allows users to quickly search and locate specific scheduled bank receipts within the system.

Recording & Update:

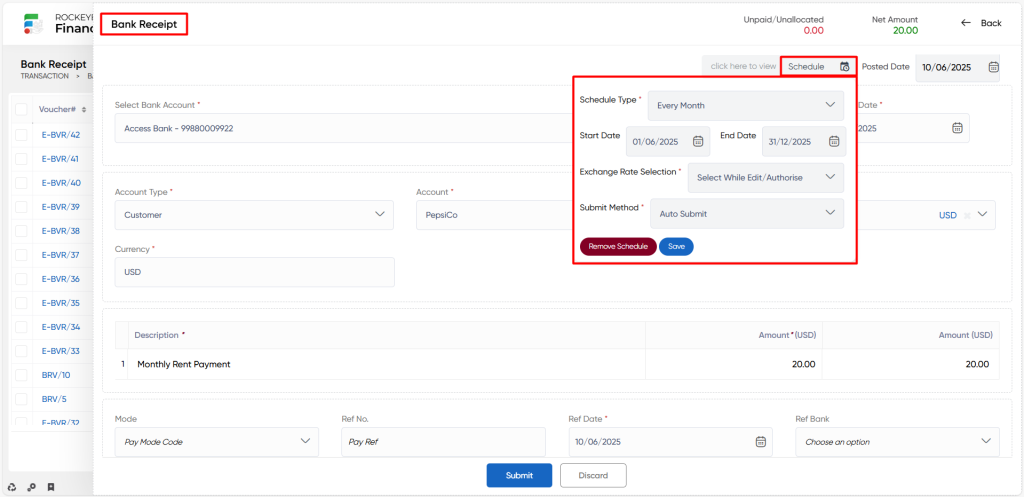

Creating A Recurring Bank Receipt:

- Schedule Type: Defines the frequency at which the recurring bank receipt is executed. Example: Monthly – Executes once every calendar month, Quarterly – Executes once every three months, Every 2 Weeks – Executes biweekly from the start date.

- Start Date: The initial date from which the recurring schedule becomes active and the first bank receipt is expected to be generated.

- End Date: The last valid date for the recurring schedule. No bank receipts will be created after this date.

- Exchange Rate Selection: Specifies how the exchange rate is applied when generating receipts for foreign currency transactions.

- Latest Exchange Rate – Applies the most recent exchange rate available in the system at the time of voucher generation.

- Current Voucher Exchange Rate – Uses the exchange rate that was set on the original base bank receipt.

- Select While Edit/Authorize – Prompts the user to manually input or confirm the exchange rate during the review or authorization stage of the recurring transaction.

- Submit Method: Determines how the scheduled recurring receipts are processed:

- Auto Submit: The system automatically generates the bank receipt on the scheduled dates without user intervention.

- Manual Submit: Requires the user to manually initiate the creation of the bank receipt based on the schedule.

- Remove Schedule: Allows the user to delete or deactivate the recurring schedule. This action halts all future voucher generation under that schedule and is typically used when a schedule is no longer needed or must be replaced.

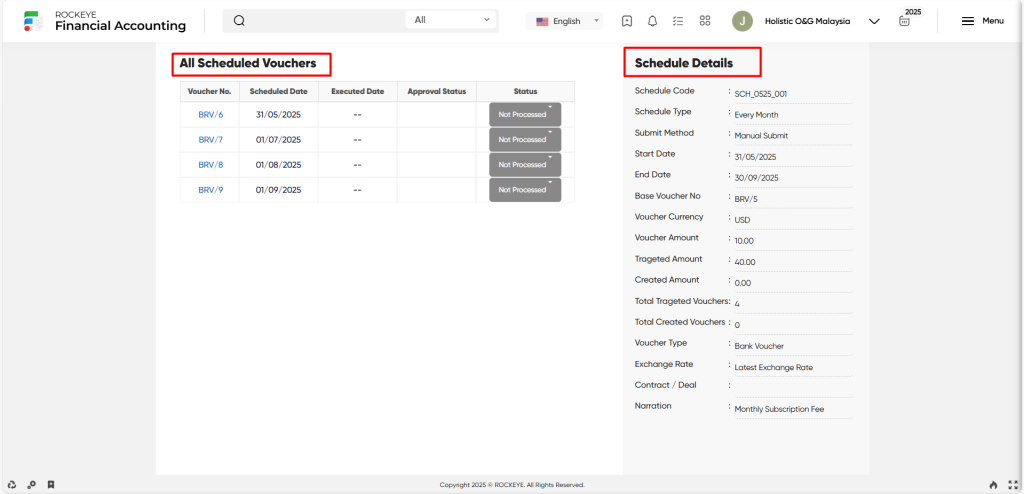

View Recurring Bank Receipt Schedule:

Left Panel: All Scheduled Voucher

- Voucher No.: Reference number for each individual voucher. These are clickable links to view voucher details.

- Scheduled Date: The date on which the system expects to process or submit the recurring bank receipt.

- Executed Date: Actual date on which the receipt was executed (blank means not yet processed).

- Approval Status: Shows whether the voucher has been approved or is pending.

- Status: Indicates the current processing status of each voucher. This helps track progress for execution of the recurring receipts.

Right Panel: Schedule Details

- Schedule Code: Unique identifier for the recurring schedule.

- Schedule Type: Frequency of recurrence.

- Submit Method: Specifies whether vouchers are submitted manually or automatically.

- Start Date: Beginning date of the recurring schedule.

- End Date: Final date for the schedule. No receipts will be generated beyond this date.

- Base Voucher No.: The original voucher used as a template for generating future recurring entries.

- Voucher Currency: The currency used for the voucher.

- Voucher Amount: Amount of each scheduled receipt.

- Targeted Amount: Total amount expected to be received over the schedule period.

- Created Amount: Amount already generated through processed vouchers.

- Total Targeted Vouchers: Expected number of vouchers to be created.

- Total Created Vouchers: Number of vouchers already generated.

- Voucher Type: Type of financial voucher being used.

- Exchange Rate: Method of applying the exchange rate.

- Contract / Deal: Reserved for linking the schedule to a specific contract or deal.

- Narration: Description or purpose of the scheduled receipt.