Financial Accounting

Cash Payment

Introduction/Purpose:

Cash payments represent company expenditures, debt repayment, and promises made in physical currency or its equivalent. Precise tracking and control of these withdrawals is critical for financial reporting, spending management, and stability.

Dependency:

- Bank book: The system’s bank records must be integrated with the cash payment.Because the bank book serves as the foundation for cash payment.

- Chart of accounts: The chart of accounts is an organised list of all accounts used in an organisation’s accounting system that must be integrated with cash payment.

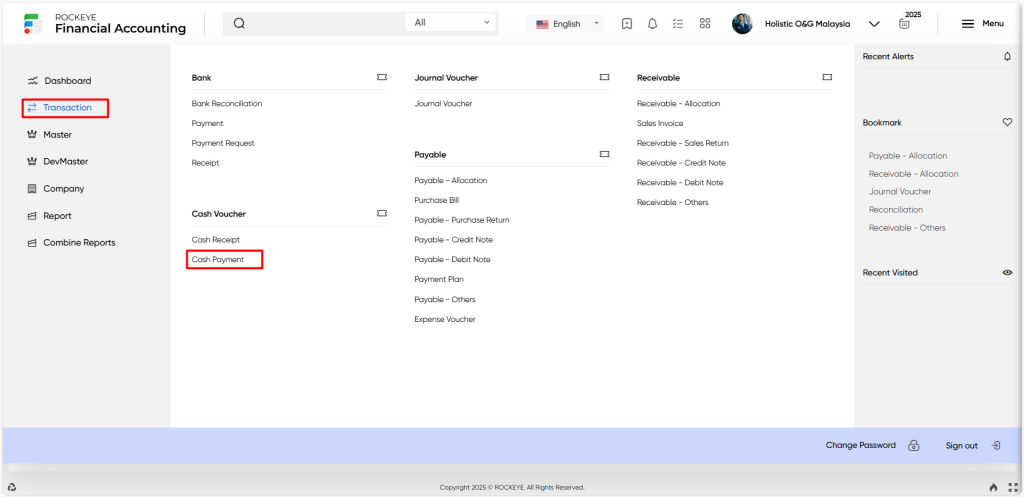

How To Navigate To Cash Payment:

The navigation includes the following steps for viewing the cash payment in the financial management system.

- Click on the transactions tab: The transactions can be accessed by clicking on the transactions tab on the side menu.

- Click on the cash payment: The cash payment can be accessed by clicking it from the cash voucher section.

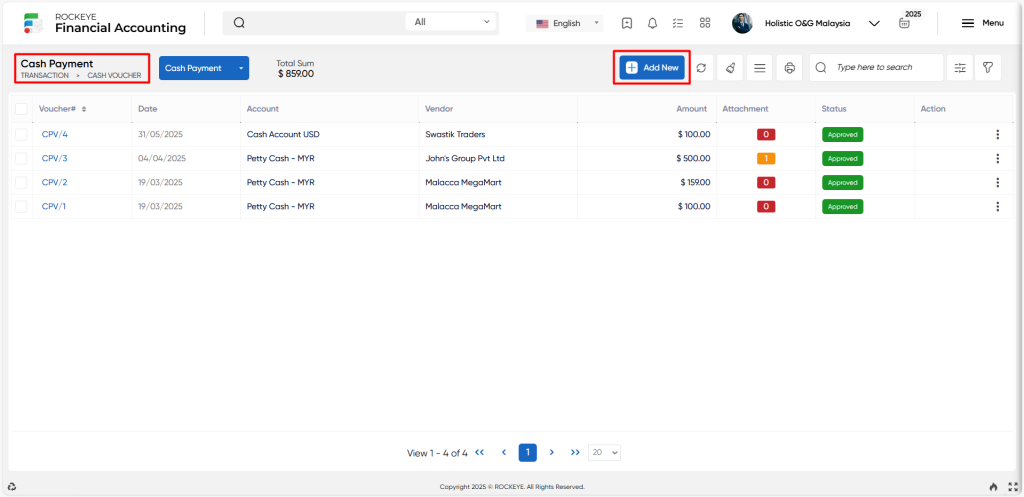

Listing:

A cash payment listing in a financial management system is a feature that provides a list of all cash payments.

- Users can view the following information in the cash payment listing

- Voucher

- Date

- Account name and type

- Account/Contact & currency

- Exchange rate, amount, amount LC

- Attachment

- Allocated and status

User can perform the following actions

- Add new: The “Add new” function allows you to create and add a new cash payment to the system.

- Show all listing records: The “show all listing” function is to display and update a list or collection of areas within a system or interface.

- More options: The “More options” function provides the user with more actions or functionalities.

- Print records: The “Print records” function allows users to print content by opening a print dialogue or displaying a preview of the content to be printed.

- Search: The “Search” function allows the user to look for a specific entry within the available data and presents the results that match the search parameters.

- Quick search: The ”Quick Search” function allows users to quickly search and locate specific cash payments within the system.

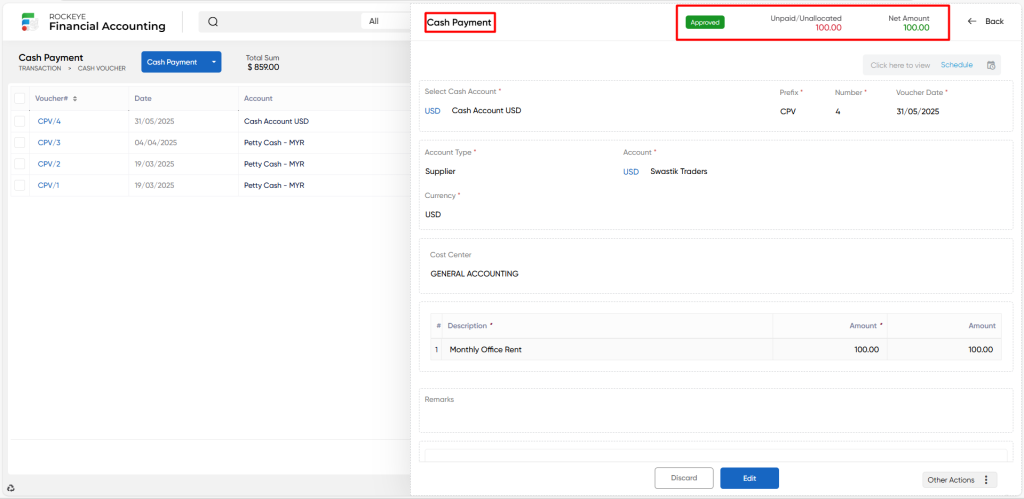

Recording & Update:

Manage Cash Payments:

- Pending: The “Pending” refers to cash payments that have been requested or started but are not yet finished or processed.

- Paid/Allocated: The Paid or “allocated” refers to cash payments that have been effectively completed and disbursed and are referred to as paid or allocated.

- Unpaid/Unallocated: The “Unpaid or unallocated” refers to cash payments that are due but have not yet been made or processed and are referred to as unpaid or unallocated.

- All: The “All” refers to the entire set or total quantity of cash payments. No matter their status or processing stage, it represents all cash payments that have been entered into the system.

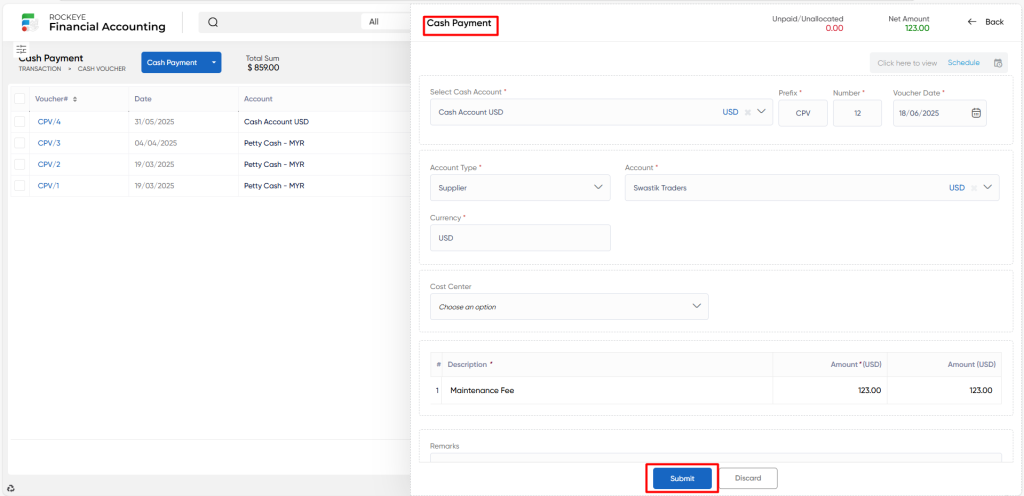

Add New Cash Payment:

- Post date: The “Post date” refers to the date on which the cash payment entry was published or saved in the database.

- Cash account: The “Cash account” refers to the particular cash account where the payment transaction will be recorded, such as hand-on cash or petty cash.

- Prefix: The “Prefix” refers to a prefix used for the cash payment entry’s identity or reference.

- Number: The “Number” refers to a special identification code or number given to the cash payment voucher for tracking and referencing purposes

- Voucher date: The “Voucher date” refers to the day that the cash payment voucher is prepared or distributed known as the voucher date.

- Account type: The “Account type” refers to the kind of account that the payment is associated with, such as a general account, a supplier account, or a specific account code.

- Account: The “Account” refers to the account to whom the payment is being made.

- Currency: The “Currency” refers to a specific currency used for the transaction while doing cash payments.

- Exchange date: The “Exchange date” refers to a day on which a particular exchange rate was used to convert one currency into another.

- Exchange rate: The “Exchange rate” refers to the rate at which one currency is exchanged for another and is represented by the exchange rate.

- Cost centre: The “Cost centre” refers to a specific division or cost centre responsible for the cash payment.

- Narration: The “Narration” refers to a brief description or justification of the motives for or characteristics of the payment.

- Amount: The “Amount” refers to the monetary worth of the cash payment.

- Remarks: The “Remarks” refers to a field that allows users to insert any relevant notes or comments concerning the cash payment.

- Attachments: The “Attachments” refers to a field that allows users to attach any pertinent files or supporting documentation linked to the payment.

Users can perform the following actions

- Submit: The “Submit” function allows the user to submit the required information while creating a new cash payment voucher.

- Discard: The “Discard” function allows the user to cancel the submission of information provided at the time of creating a new cash payment voucher.