Loan & Advance

Introduction/Purpose

The Loan and Advance feature in Employee Self-Service (ESS) is designed to facilitate the process of requesting and managing loans or advances for users within an organization. It provides a convenient and streamlined method for users to apply for financial assistance when they require immediate funds for various purposes.

The purpose of the Loan and Advance feature is to offer financial support to users who need it during critical situations or for personal reasons. By integrating this feature into ESS, organizations aim to simplify the loan or advance application process, automate approvals, and ensure transparency in financial transactions

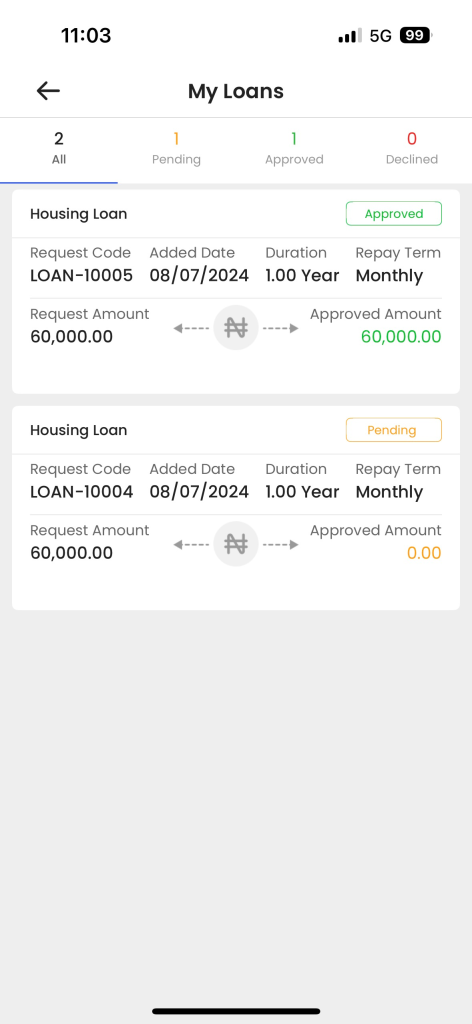

My loans

This filter enables the user to view loans specifically requested by themselves. By choosing this option, the user can view their own submitted loans requests, and users can filter their expenses requests based on the following categories:

- Pending: This filter enables users to display the list of loans that are currently under review by seniors. By selecting this filter, users can quickly identify which loans are still waiting for a decision.

- Approved: This filter allows users to view loans that have been successfully reviewed and approved. By selecting this option, users can easily access the details of approved loans, including the approved amount,loan duration,repayment term

- Declined: This filter helps users identify loans that have been rejected or declined. By selecting this filter, users can review the reasons for the declined loan and take appropriate action, such as making corrections, providing additional information, or resubmitting the loan for reconsideration.

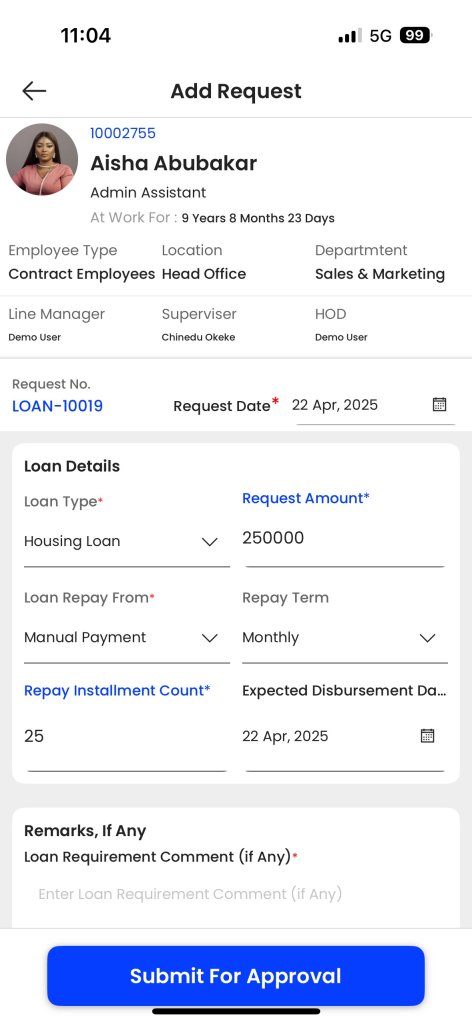

Add Loan Request

The loan and Advance requests of an employee self services are typically included:

- Loan Type : This field refers to the type of loan users are requesting, such as personal loan, home loan, car loan, business loan or HRA. Select the appropriate loan type from the provided options.

- Request Date : This field requires entering the current date when users are submitting the loan request.

- Request Amount : Enter the amount of money users are requesting as a loan. This should be the total sum you are looking to borrow from the lender.

- Expected Disbursement Date: Specify the date when users would like to receive the loan amount if it gets approved. This date should be a reasonable estimate based on users needs and the lender’s processing time.

- Repay Installment Count: This field indicates the number of installments or payments users will make to repay the loan.

- Loan Repay From: Specify the source from which users will make the loan repayments. This typically includes your gross salary, which refers to users total income before deductions, and manual payment, which means you will manually make payments towards the loan.

- Repay Term: Select the desired repayment term frequency from the provided options. The options include monthly, annually, quarterly, half-yearly, and weekly.

- Loan Guarantors type: Employees need to specify the loan guarantor whether it is external or internal.

And if it is internal then employees need to choose the colleague’s name. - Remark: This field helps the user to add some notes on the loan requirement.

- Submit for approval: The user will submit the information, and it will be sent for approval.

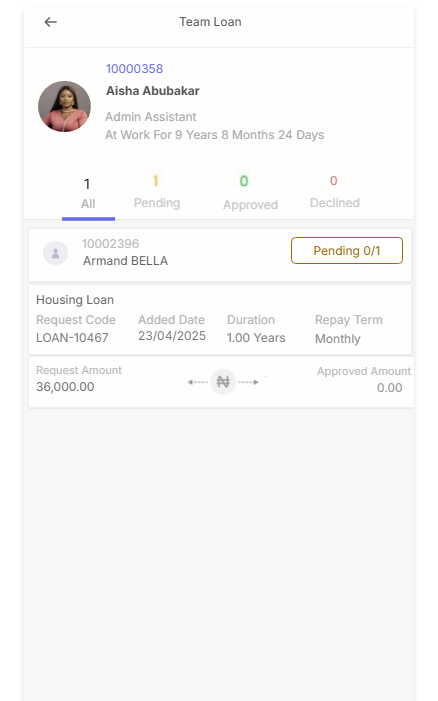

Team Request

The user can view the team member requests, and if it has approval rights, it can accept or reject the team member loan and advance requests. In a team request, the user can view the team request. The user can accept or reject the team requests, and the user can filter the team requests based on the following categories:

- All: It includes all the requests generated by the team members.

- Pending: The user can view their pending team request, which the user has to approve/reject.

- Approved: The user can view the approved team request.

- Declined: The user can view the declined team member request.

Loan Summary : This section provides an overview of employee status It gives a clear snapshot of the financial progress regarding the loan — showing what’s been given, what’s been repaid, and what remains

- Disbursement: A total of ₦60,000 has been disbursed to Aisha as a personal loan.

- Recovered: Out of the disbursed amount, ₦30,000 has already been repaid.

- Outstanding: The remaining loan balance yet to be paid is ₦30,000.

My Current Loan: This section gives a detailed view of employee existing personal loan.Loan Type,loan Code,Start Date Duration,Recovered.

Upcoming Installments:This section lists the upcoming repayment schedules with loan code,repay date and the amount